- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Nelnet (NNI): Assessing Current Valuation After Steady 21% Year-to-Date Gain

Reviewed by Simply Wall St

Nelnet (NNI) shares have seen some movement recently, and investors are keeping an eye out for what might come next. With a year-to-date return above 21%, the stock’s steady climb raises questions about current valuation and future prospects.

See our latest analysis for Nelnet.

While the past week saw a modest dip, Nelnet’s share price has climbed steadily this year and is now up over 21% year-to-date. Stronger momentum earlier in the year has translated into a 1-year total shareholder return of 13%. Investors are watching to see whether signs of growth outweigh shifting risk perceptions.

If strong moves from companies like Nelnet have you curious about the broader landscape, this could be a great moment to discover fast growing stocks with high insider ownership

With Nelnet’s shares climbing swiftly and trading near analyst price targets, the big question is whether the current price still offers value for new investors or if future growth has already been factored in by the market.

Price-to-Earnings of 14.1x: Is it justified?

Nelnet trades on a price-to-earnings (P/E) ratio of 14.1x, putting the current share price at a premium to both its direct peers and the wider consumer finance sector.

The price-to-earnings multiple compares a company's share price to its per-share earnings and is a classic tool for valuing financials. For a business like Nelnet, investors often use the P/E to gauge expectations of future profitability and relative value in the sector.

With the US consumer finance industry averaging 10.2x and Nelnet’s peer group at an even lower 8.5x, the market is demanding a meaningful premium for Nelnet stock. However, the company’s P/E is also higher than our estimated fair price-to-earnings ratio of 13x. This signals that the market may have bid the shares well above what fundamentals alone would justify.

Explore the SWS fair ratio for Nelnet

Result: Price-to-Earnings of 14.1x (OVERVALUED)

However, modest annual growth in both revenue and net income, along with recently slowing returns, could challenge Nelnet's current premium valuation.

Find out about the key risks to this Nelnet narrative.

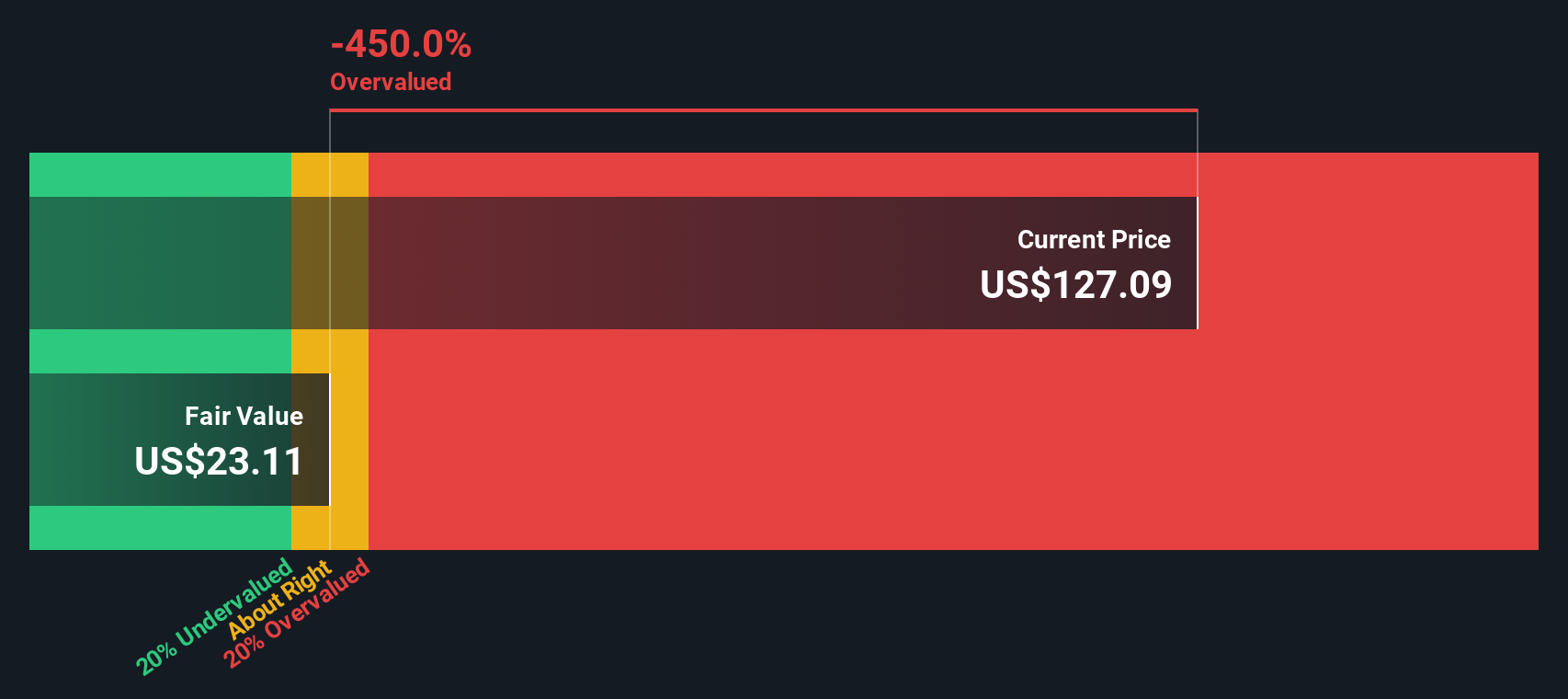

Another View: The SWS DCF Model Suggests Overvaluation

Looking at Nelnet through the SWS DCF model, the picture is even starker than with traditional valuation ratios. Our DCF model estimates a fair value of just $23.03 per share, far below the current price of $128.22. This deep gap points to significant downside risk if the market eventually aligns with this estimate. But does the market know something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nelnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 852 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nelnet Narrative

If you see the story differently or want to dig into the numbers yourself, it’s quick and simple to build your own view. Do it your way

A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Market opportunities move fast, but your next smart investment could be within reach. Make sure you’re not overlooking potential winners outside your current watchlist.

- Boost your income stream and identify steady performers when you check out these 21 dividend stocks with yields > 3% with impressive yields and long-term payout records.

- Tap into the cutting-edge frontier and get ahead with these 26 AI penny stocks focused on artificial intelligence innovation across multiple sectors.

- Seize the chance for value gains by browsing these 852 undervalued stocks based on cash flows that the market may be missing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives