- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Is Nelnet’s (NNI) Launch of AI Platform Propelr Altering Its Investment Case?

Reviewed by Simply Wall St

- Earlier this week, Nelnet Business Services launched Propelr, an AI-powered learning platform designed to help human resources and compliance leaders deliver scalable, engaging training for workforce development and retention.

- By leveraging Nelnet’s long-standing expertise in education technology, Propelr aims to address the increasing demand for digital onboarding, compliance training, and professional development solutions in today’s evolving workplace.

- We’ll explore how Nelnet’s entry into AI-driven training solutions could reshape its long-term investment narrative by opening new growth avenues.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nelnet's Investment Narrative?

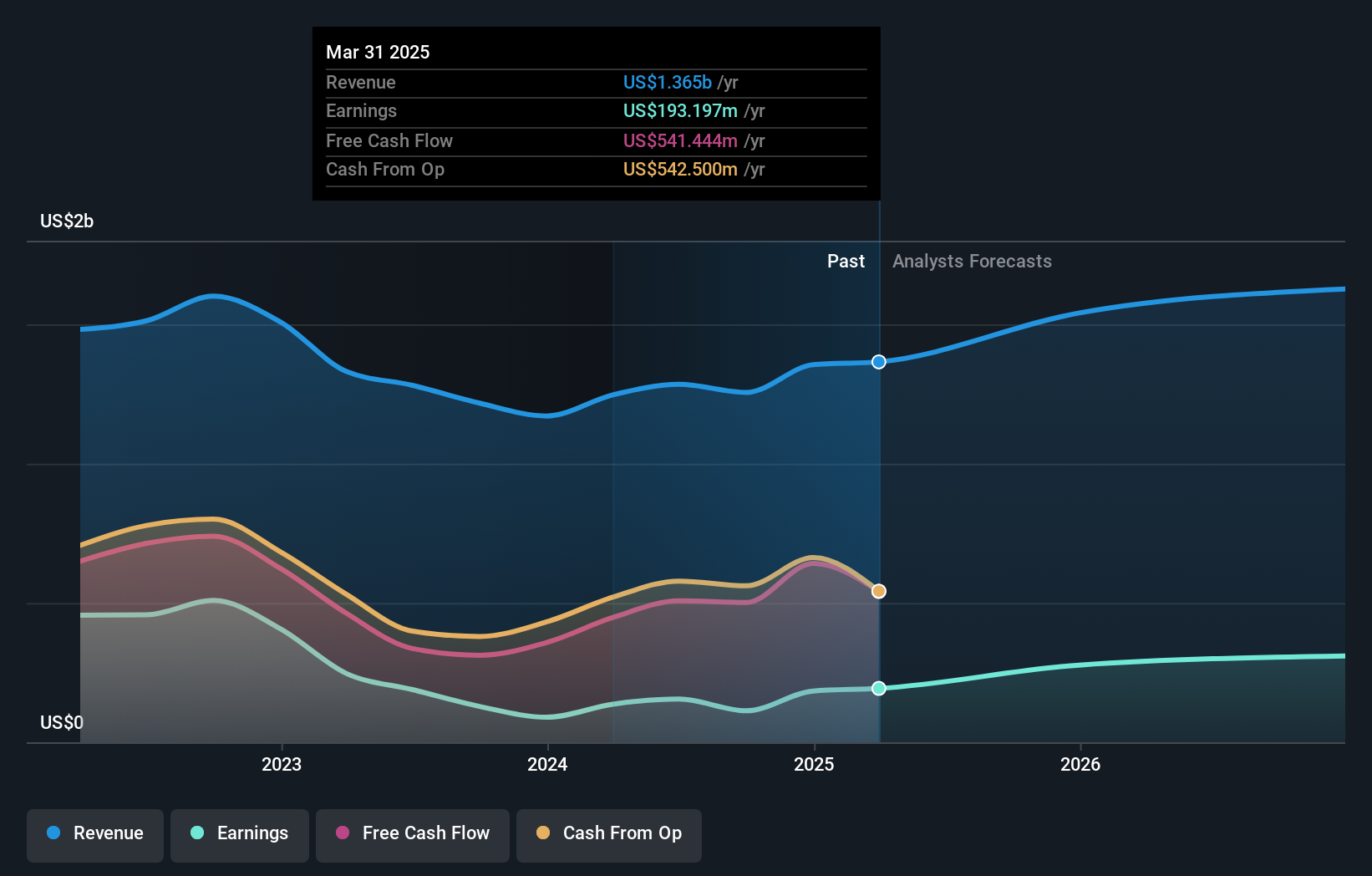

To be a shareholder in Nelnet right now, you’d want to believe in its ability to balance strong core operations with forward-looking innovation. The launch of Propelr signals a push into AI-driven learning, aiming to expand Nelnet’s reach beyond traditional education finance and further penetrate the fast-growing market for workplace training and compliance. While this move could help diversify revenue streams and attract new enterprise clients, it’s unlikely to be a material short-term catalyst, given the platform’s early-stage adoption and the size of Nelnet’s existing business. Instead, investor focus will likely remain on two main fronts: execution on large-scale contracts like the USDS federal servicing deal, and the ongoing challenge of justifying Nelnet’s premium valuation relative to peers. Propelr adds an interesting growth angle, but doesn’t immediately change the biggest risks, such as high debt coverage concerns or the need for sustained profit growth. Yet, questions persist about whether Nelnet’s premium valuation can be justified by earnings growth.

Nelnet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth as much as $130.00!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives