- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Does Annaly’s Broad-Based Earnings Beat and Strong Revenue Growth Change The Bull Case For NLY?

Reviewed by Sasha Jovanovic

- In the recent past, Annaly Capital Management reported quarterly results showing revenue up very strongly year on year and ahead of analyst expectations, even as net interest income was mixed.

- Management highlighted that each of Annaly’s investment strategies contributed to strong economic returns year to date, underscoring the breadth of its diversified mortgage finance platform.

- Now we’ll examine how this earnings beat, underpinned by broad-based strategy performance, may influence Annaly Capital Management’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Annaly Capital Management Investment Narrative Recap

To own Annaly Capital Management, you need to believe in the resilience of its diversified mortgage finance platform and its ability to manage rate and spread volatility over time. The latest earnings beat, powered by strong revenue and broad-based strategy performance, reinforces that story but does not materially change the key near term catalyst, which remains execution in Agency MBS and credit, or the biggest risk, which is still elevated interest rate volatility pressuring spreads and hedging costs.

Among recent announcements, the declaration of Q4 2025 preferred dividends across the F, G, I and new J series stands out alongside the earnings news. It underlines Annaly’s ongoing funding needs and cost of capital at a time when mortgage spreads and hedging expenses are critical swing factors for returns, linking closely to both the upside from attractive Agency MBS spreads and the risk that prolonged volatility could erode margins.

Yet investors should be aware that if rate volatility persists, the pressure on hedging costs and mortgage spreads could...

Read the full narrative on Annaly Capital Management (it's free!)

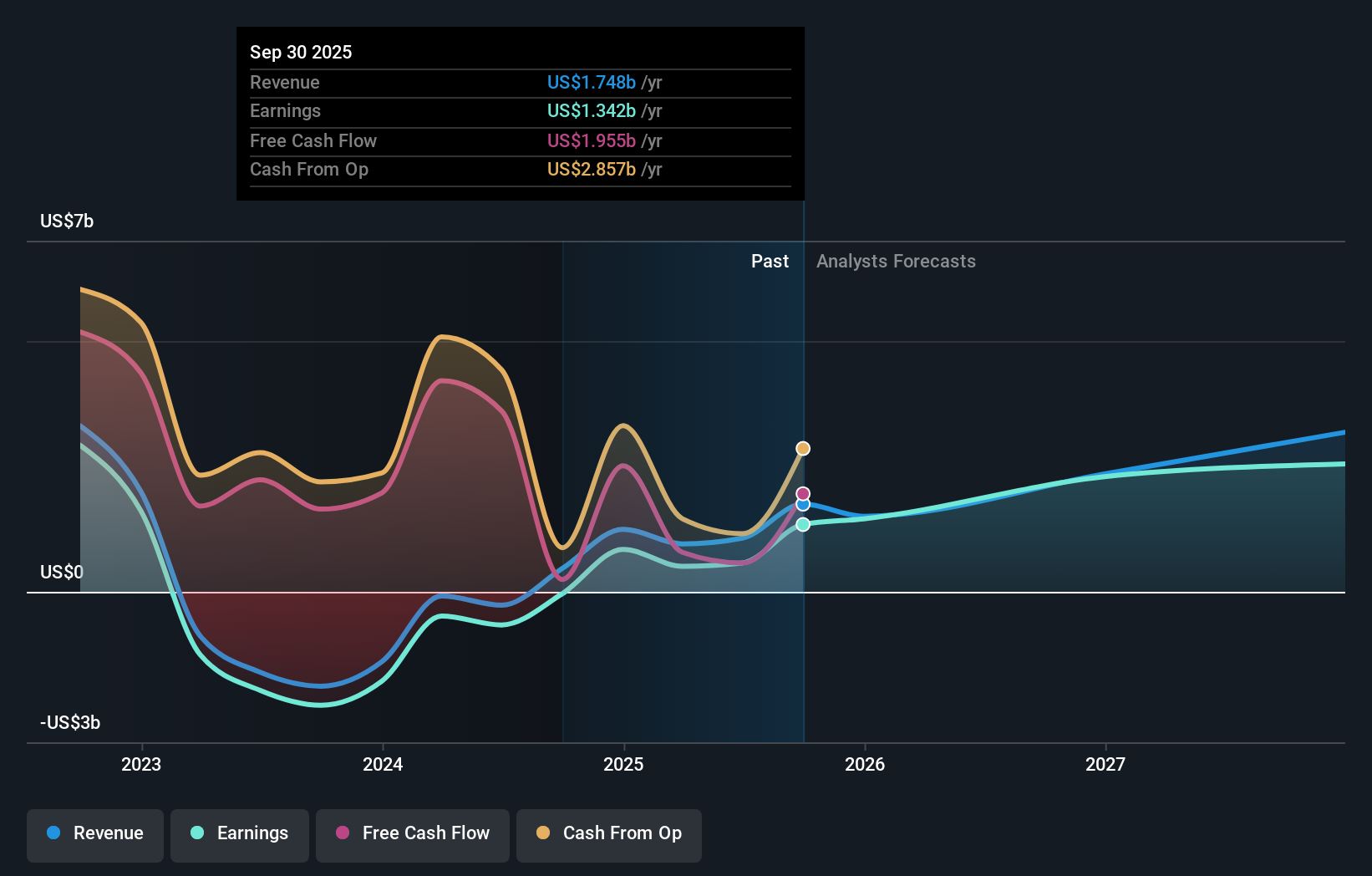

Annaly Capital Management's narrative projects $3.4 billion revenue and $3.2 billion earnings by 2028. This requires 46.9% yearly revenue growth and about a $2.6 billion earnings increase from $575.1 million today.

Uncover how Annaly Capital Management's forecasts yield a $22.10 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Twelve Simply Wall St Community fair value estimates for Annaly span roughly US$16 to about US$41.71, reflecting very different expectations for the stock. Against that backdrop, the recent revenue beat and broad-based economic returns sit beside an ongoing risk that sustained interest rate volatility could still weigh heavily on portfolio returns and future earnings.

Explore 12 other fair value estimates on Annaly Capital Management - why the stock might be worth as much as 83% more than the current price!

Build Your Own Annaly Capital Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Annaly Capital Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Annaly Capital Management's overall financial health at a glance.

No Opportunity In Annaly Capital Management?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026