- United States

- /

- Diversified Financial

- /

- NYSE:NATL

Is There Still Room for NCR Atleos After 40% Rally and Positive Digital Payment Trends?

Reviewed by Bailey Pemberton

If you have NCR Atleos stock on your watchlist, you are not alone. This payment technology player has delivered a big pop in the past year, with shares climbing an impressive 40.8%. Even just in the past seven days, the stock has edged up another 1.9%, outpacing broader markets. With the year-to-date return at 15.5%, it is no wonder investors are debating whether this momentum has room to run, or if it's time to cash in.

What’s behind these moves? Most of the recent excitement traces back to ongoing shifts in the digital payments landscape, as well as investor optimism around NCR Atleos’s focus on growth markets. While not every headline news item has translated directly into a big share price change, sentiment has clearly swung in favor of digital transaction companies. This trend has supported the steady climb in valuation.

But here is where things get interesting. Despite all this excitement, if you look at the company’s value score, a metric that checks whether a stock is undervalued using six different methods, NCR Atleos clocks in at a 0 out of 6. Put plainly, according to these valuation checks, the stock does not show signs of being undervalued at all right now.

So what does that mean for current and potential shareholders? Let’s break down how these valuation methods work to separate the noise from the numbers. And before we wrap things up, I’ll also share an even sharper way to judge value that seasoned investors swear by.

NCR Atleos scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NCR Atleos Excess Returns Analysis

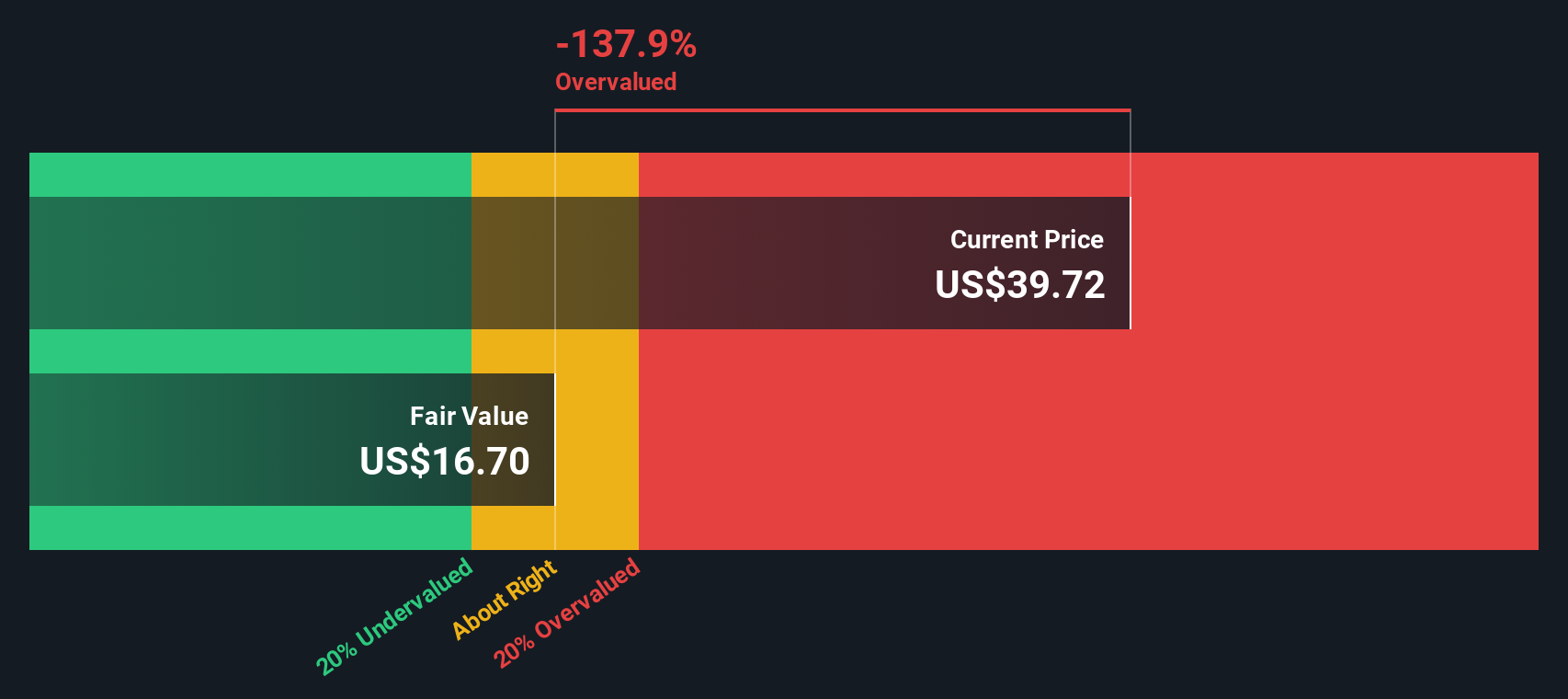

The Excess Returns model evaluates a company's ability to earn returns above its cost of equity. For NCR Atleos, this method focuses on the capital invested by shareholders and how efficiently that capital is being transformed into profit. Essentially, it asks whether the business is consistently producing more earnings than what it costs to raise and reinvest those funds.

Here are key figures for NCR Atleos:

- Book Value: $4.76 per share

- Stable EPS: $1.20 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $0.36 per share

- Excess Return: $0.84 per share

- Average Return on Equity: 32.06%

- Stable Book Value: $3.75 per share (Source: Median Book Value from the past 5 years.)

This valuation approach estimates an intrinsic value well below the current share price, indicating that NCR Atleos is about 137.3% overvalued according to this model. In summary, while the company shows strong returns on equity, the current market price far exceeds what the fundamental numbers imply is reasonable.

Result: OVERVALUED

Our Excess Returns analysis suggests NCR Atleos may be overvalued by 137.3%. Find undervalued stocks or create your own screener to find better value opportunities.

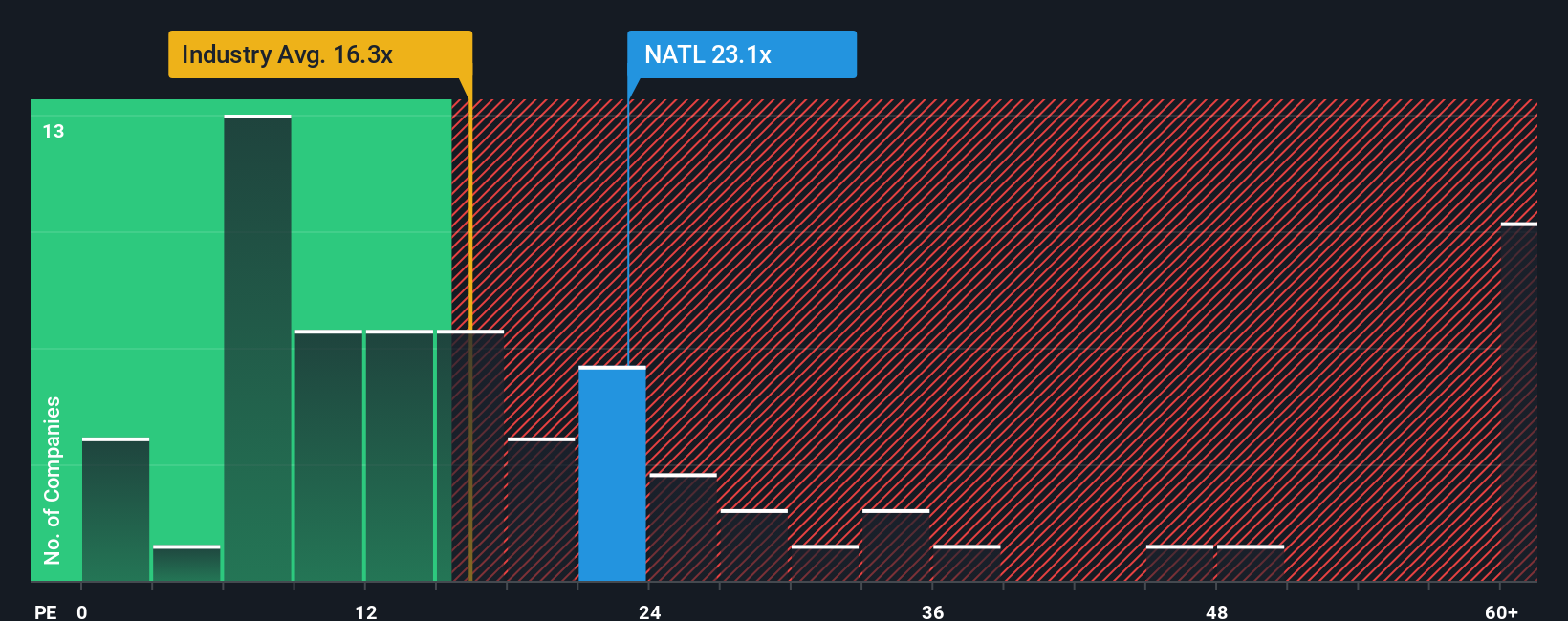

Approach 2: NCR Atleos Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like NCR Atleos because it directly relates a company’s share price to its earnings per share. This makes it useful for assessing how much investors are willing to pay today for a slice of the company’s future earnings.

Growth expectations and risk both play a critical role in setting what is considered a “fair” PE ratio. Generally, companies expected to grow earnings faster or operate with lower perceived risk can command higher PE multiples, whereas slower-growing or riskier firms tend to trade at lower ratios.

Currently, NCR Atleos trades at a PE multiple of 22.6x. When compared to the Diversified Financial industry average of 16.5x and its peer group average of 11.8x, the company is priced well above both benchmarks. This might suggest investors have high confidence in NCR Atleos’s prospects. However, metrics like the industry average do not capture the whole picture, especially if a company differs from peers in terms of growth, margins, or risk.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio accounts for several key factors, including expected earnings growth, profit margins, risk profile, the company’s specific industry, and its market capitalization. This approach aims to provide a more context-aware benchmark than a simple industry or peer comparison.

For NCR Atleos, the Fair Ratio recommended by Simply Wall St is 19.5x. Since the actual PE ratio of 22.6x is meaningfully higher than this fair value, it suggests the stock may be priced a bit aggressively right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your NCR Atleos Narrative

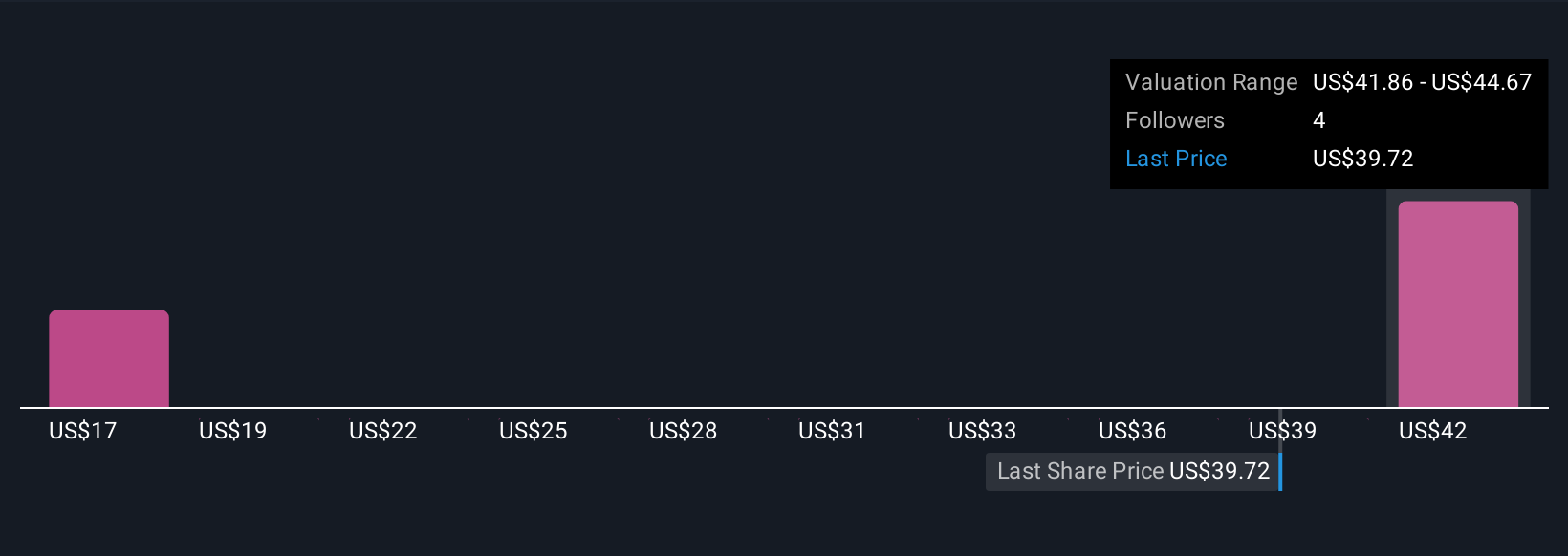

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story you believe about a company, how it will grow, what challenges it will face, and how these realities will impact its value. This is quantified through your assumptions for future revenue, earnings, margins, and a fair value estimate. Narratives connect the company’s story to a forward-looking forecast and, ultimately, a realistic fair value that guides buy or sell decisions.

On Simply Wall St’s Community page, Narratives are easy to use, giving millions of investors a space to shape their own view or learn from others. Each Narrative clearly lays out its financial assumptions so you can see exactly how the story translates into numbers. By comparing the Fair Value calculated from any Narrative to the latest share price, you can decide if the stock looks attractive or expensive based on your personal view. Narratives update automatically as new data, news, or earnings releases come in, so your analysis stays relevant.

For example, some investors see NCR Atleos benefiting from booming ATM-as-a-Service demand and project fair values as high as $60. Others focus on risks tied to digital banking and set their fair value closer to $34.

Do you think there's more to the story for NCR Atleos? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives