- United States

- /

- Diversified Financial

- /

- NYSE:MTG

MGIC Investment (MTG): Reassessing Valuation as Easing Mortgage Rates and Share Buybacks Drive Interest

Reviewed by Simply Wall St

MGIC Investment (MTG) is catching investor attention as mortgage rates continue to ease and housing inventory improves. At the same time, the company’s recent share repurchases indicate that management remains optimistic about future performance and shareholder value.

See our latest analysis for MGIC Investment.

MGIC Investment’s 1-month share price return of 7.7% stands out in the current environment, as investors warm up to easing mortgage rates and stronger housing fundamentals. Momentum has been building, highlighted by a notable three-year total shareholder return of 129% which reinforces the stock’s long-term appeal.

If MGIC’s recent strength piqued your interest, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with MGIC Investment surging on momentum and returning excess capital to shareholders, the question remains: is the current share price still undervalued, or has the market already factored in the company's brighter outlook and growth prospects?

Most Popular Narrative: 2.6% Overvalued

The most widely followed narrative sets MGIC Investment's fair value slightly below the recent closing price, suggesting the stock might be priced a bit above analyst expectations for future performance. This difference frames the debate on whether the current momentum is sustainable based on future fundamentals.

Conservative capital management, including ongoing share buybacks and dividend increases, reduces outstanding share count and enhances EPS. This approach directly benefits shareholder returns and supports long-term earnings per share growth. Strong investment in operational efficiency and technology-driven cost controls, combined with stable operating expenses, signals potential for margin expansion and greater bottom-line profitability in future periods.

Want to know what powerful forecasts underpin this viewpoint? The future path hinges on key metrics changing, such as revenues and margins, but there is a twist in the narrative that could surprise even industry watchers. Click through to see which assumptions drive the fair value, and why they matter more than you might think.

Result: Fair Value of $27.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently flat insurance growth and rising delinquency rates could challenge MGIC’s long-term earnings outlook and put pressure on margins if market conditions deteriorate.

Find out about the key risks to this MGIC Investment narrative.

Another View: What Does the SWS DCF Model Say?

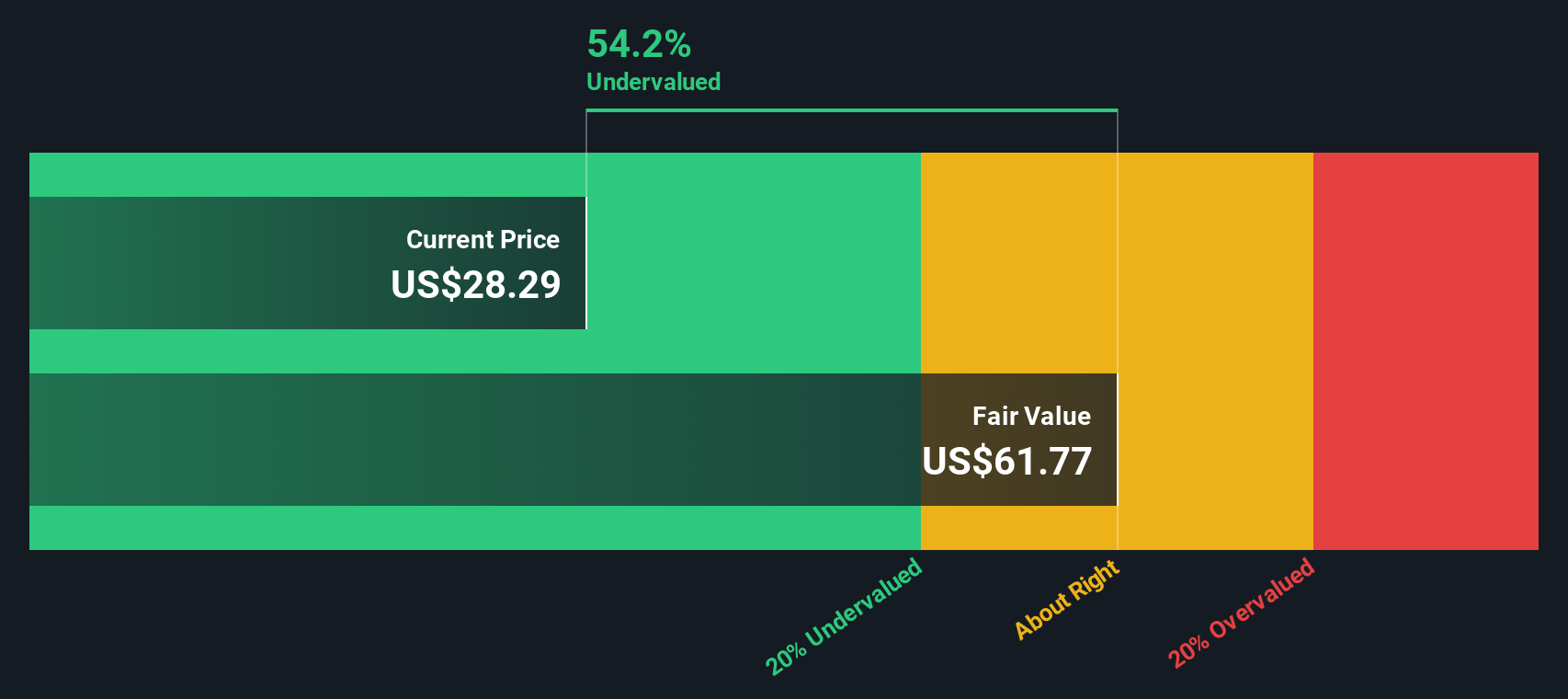

While analysts see MGIC Investment as slightly overvalued by multiples, our DCF model tells a very different story. The SWS DCF model places MGIC's fair value at $62.51 per share, which is well above its current price. Could the market be overlooking deeper long-term value in this case?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MGIC Investment Narrative

If you see things differently or would rather follow your own research path, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your MGIC Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity when there’s a world of innovative stocks to consider. Use these exclusive stock ideas to put your portfolio ahead of the crowd.

- Unlock growth potential with these 923 undervalued stocks based on cash flows, where companies trade below their estimated worth and could deliver attractive long-term returns.

- Secure consistent income streams by checking out these 15 dividend stocks with yields > 3%, your route to stocks yielding more than 3% to boost your cash flow.

- Catch the tech wave and get ahead of market trends with these 25 AI penny stocks, stacked with promising AI-driven companies reshaping tomorrow’s industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTG

MGIC Investment

Through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services in the United States, the District of Columbia, Puerto Rico, and Guam.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.