- United States

- /

- Capital Markets

- /

- NYSE:MSCI

MSCI (MSCI) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

MSCI (MSCI) has quietly slipped about 8% over the past month and nearly 12% over the past year, even as its long term track record and double digit earnings growth remain intact.

See our latest analysis for MSCI.

That slide lines up with a softer 1 year total shareholder return of around negative 12%, suggesting momentum has cooled for now, even though the 5 year total return near 34% still reflects a solid long term compounding story.

If MSCI’s recent pullback has you rethinking your watchlist, this is a useful moment to explore fast growing stocks with high insider ownership that could be setting up their next leg of growth.

With revenue and earnings still growing near double digits and the stock trading roughly 22% below consensus targets, is MSCI quietly slipping into undervalued territory, or is the market already factoring in every ounce of future growth?

Most Popular Narrative Narrative: 18.1% Undervalued

With MSCI last closing at $538.26 against a narrative fair value of about $657.56, the story frames current pricing as leaving notable upside on the table.

The analysts have a consensus price target of $619.071 for MSCI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $700.0, and the most bearish reporting a price target of just $520.0.

Want to see what kind of revenue runway, margin lift, and future earnings power justify that valuation gap? The underlying growth math might surprise you.

Result: Fair Value of $657.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer sustainability demand and intensifying competition in data and indexing could chip away at MSCI’s margin story and temper that upside narrative.

Find out about the key risks to this MSCI narrative.

Another Angle on Valuation

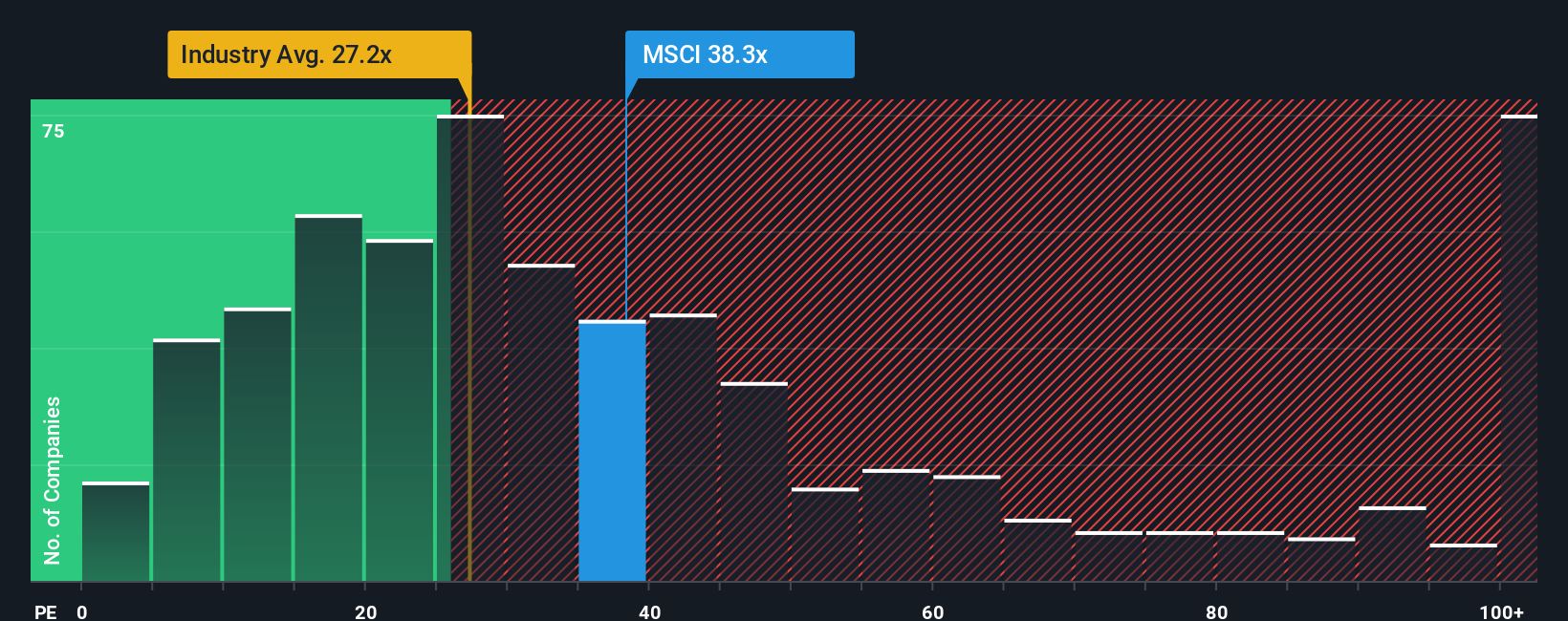

While the narrative fair value suggests MSCI is about 18% undervalued, a simple earnings multiple paints a very different picture. The stock trades on roughly 33 times earnings, versus around 25 times for the wider US capital markets group and a fair ratio near 16.6 times.

That premium versus both industry and fair ratio implies investors are already paying up for quality and stability, leaving less room for error if growth slows or margins disappoint. Is this a quality compounder at a fair price, or a strong business with limited upside from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your MSCI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St Screener to uncover focused stock ideas tailored to different strategies and themes.

- Target steady income by reviewing these 15 dividend stocks with yields > 3% that aim to balance yield potential with business quality and long term sustainability.

- Tap into structural growth by scanning these 30 healthcare AI stocks at the intersection of medical innovation and advanced analytics.

- Pursue high risk, high reward potential through these 81 cryptocurrency and blockchain stocks positioned at the frontier of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026