- United States

- /

- Capital Markets

- /

- NYSE:MSCI

A Fresh Look at MSCI’s Valuation Following $1.25 Billion Notes Offering and New Analyst Coverage

Reviewed by Kshitija Bhandaru

MSCI (MSCI) has made headlines after launching a $1.25 billion senior notes offering. This move has fueled speculation on how the additional capital could impact debt repayment, future investments, and share repurchases ahead of its upcoming Q3 results.

See our latest analysis for MSCI.

Anticipation is swirling ahead of MSCI’s Q3 results, with both the recent $1.25 billion senior notes offering and new analyst coverage putting a spotlight on the company’s next moves. Despite a steady run for much of the year, MSCI’s 1-year total shareholder return is slightly negative, but its returns over 3- and 5-year periods remain robust. This points to enduring long-term momentum even as near-term sentiment shifts.

If MSCI's recent capital moves have you curious about other dynamic opportunities, now could be a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading about 11 percent below the average analyst price target and recent coverage reaffirming MSCI’s strengths, the big question is whether there is hidden value here or if future growth is already priced in.

Most Popular Narrative: 10.1% Undervalued

With MSCI's most widely followed narrative setting a fair value of $623.81, the latest close at $560.77 suggests room for upside as expectations hinge on robust recurring revenue and margin expansion.

Accelerated development and cross-selling of proprietary data, analytics, and private capital solutions (including recently launched products and business lines like private equity benchmarks and risk tools) will tap into new client bases and increase wallet share among institutional clients. This is anticipated to drive durable multi-year compounded revenue growth.

Curious what powers this ambitious take? The valuation is based on bold assumptions about steady expansion, relentless innovation, and future margins that could rival technology industry leaders. Want to know which numbers influence the consensus? Unlock the full narrative to see which financial forecasts put MSCI’s price target in the spotlight.

Result: Fair Value of $623.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected subscription growth or persistent fee compression could quickly challenge even the most optimistic case for MSCI's long-term valuation.

Find out about the key risks to this MSCI narrative.

Another View: Valuation by Market Multiples

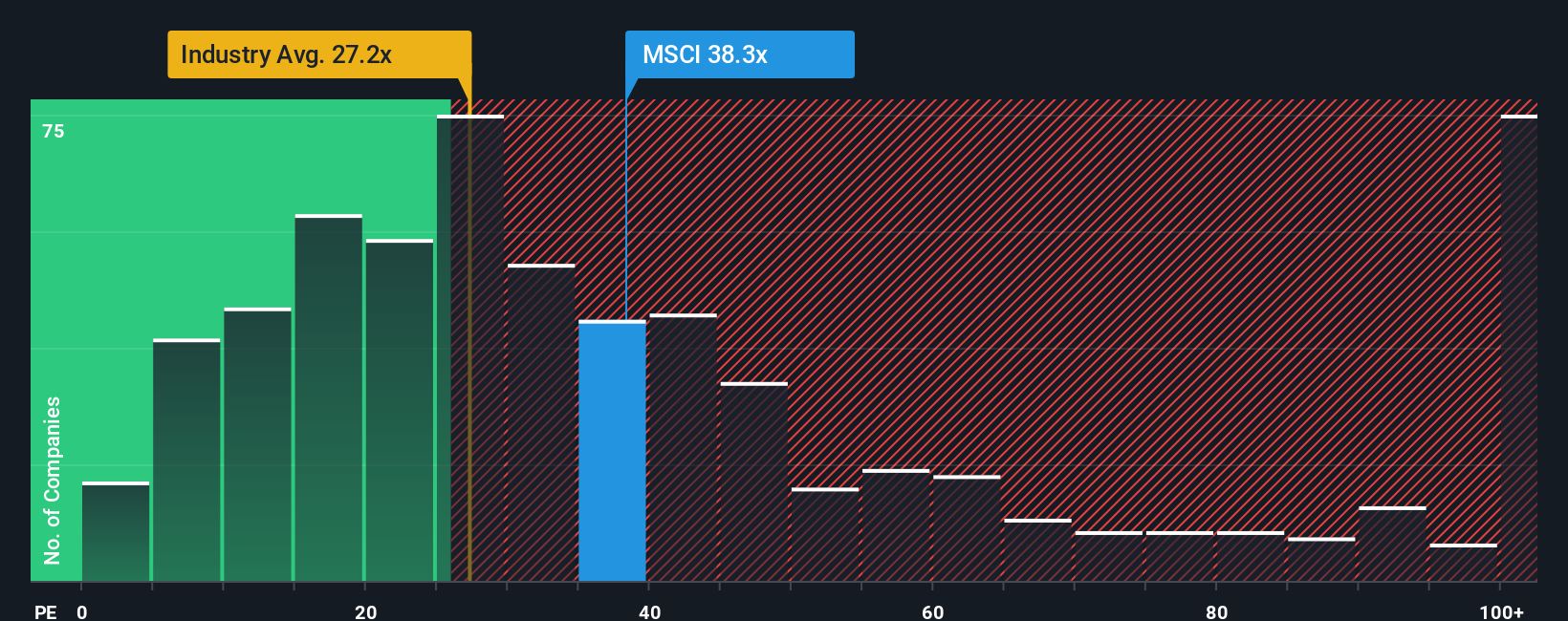

Looking at valuation from the perspective of the price-to-earnings ratio, MSCI stands out as expensive. Its P/E of 36.8x is higher than both the industry average of 26.2x and its direct peers at 35.8x. Notably, it trades at more than double its fair ratio of 18.1x. This suggests elevated valuation risk if market sentiment changes. Does this premium truly reflect future growth, or could it signal caution ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you see MSCI’s story differently or want to dive into the numbers on your own terms, you can shape your own narrative in just a few minutes, and Do it your way.

A great starting point for your MSCI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great investment opportunities slip by. Get ahead of the curve and spot standout stocks that fit your goals using our powerful screeners:

- Target high yields to boost your portfolio income by checking out these 19 dividend stocks with yields > 3%, which features strong cash flows and reliable payouts.

- Ride the growth wave in medicine and tech advancements by searching these 31 healthcare AI stocks as the healthcare landscape rapidly evolves.

- Capitalize on undervalued gems with strong fundamentals by evaluating these 910 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives