- United States

- /

- Capital Markets

- /

- NYSE:MS

Should You Revisit Morgan Stanley’s Valuation After 31% Share Price Surge and Leadership Shakeup?

Reviewed by Bailey Pemberton

- Wondering if Morgan Stanley is a bargain or overpriced right now? You're not alone, and it's a great question for anyone thinking about adding the stock to their portfolio.

- The share price has climbed impressively this year, up 31.4% year-to-date and 43.1% over the past 12 months. This signals strong momentum and shifting market sentiment.

- Recent headlines about the company's strategic expansion in wealth management and leadership changes have added a fresh spark to investor interest. These developments help explain both the recent surge in the stock and the buzz around the company in financial circles.

- On our value scorecard, Morgan Stanley scores a 3 out of 6 for undervaluation. This tells part of the story but not the whole picture. We'll explore traditional valuation methods in just a moment, so stick around for an even smarter approach to understanding what this number really means.

Approach 1: Morgan Stanley Excess Returns Analysis

The Excess Returns model evaluates how effectively a company creates value over and above what investors require as compensation for using their capital. In Morgan Stanley’s case, this means looking at how much more profit the bank generates compared to its cost of equity.

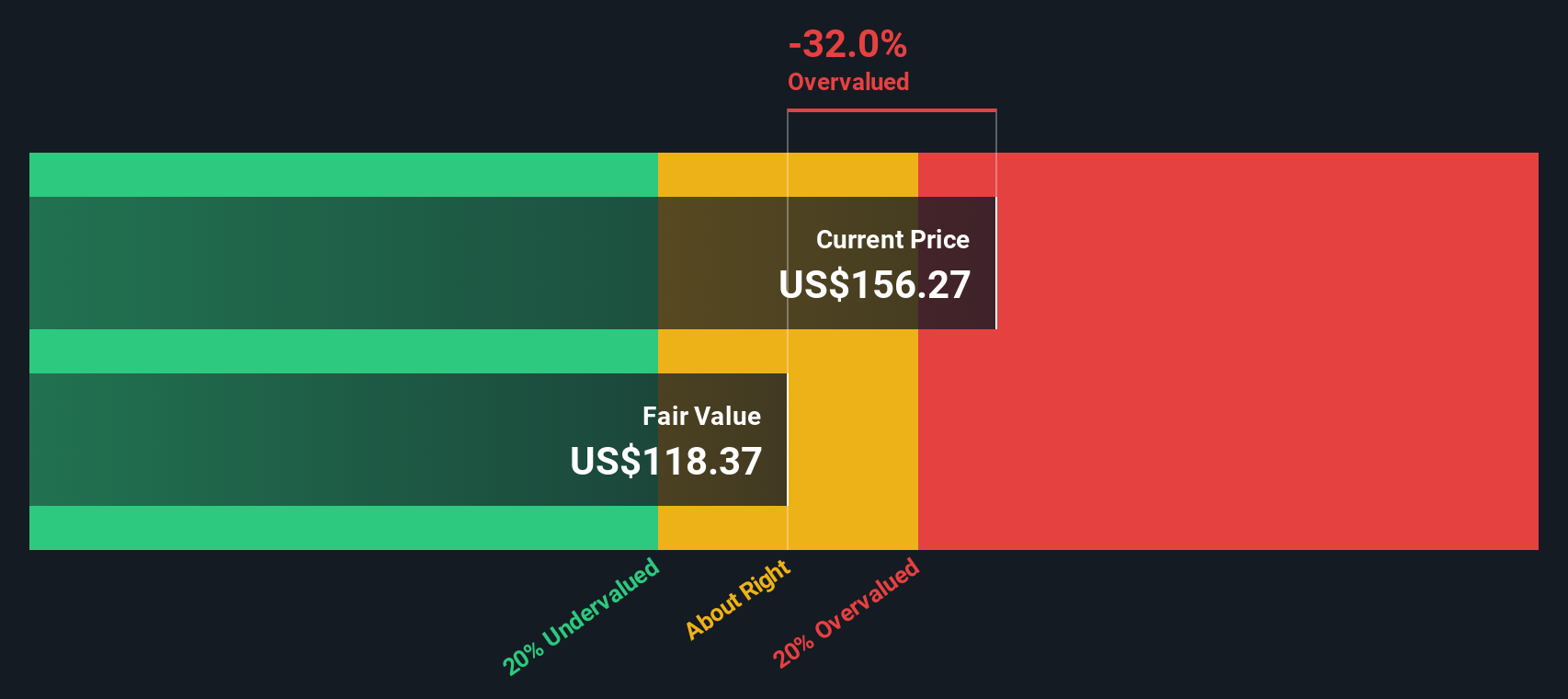

Currently, Morgan Stanley has a Book Value of $62.98 per share and a Stable EPS of $11.10 per share, based on weighted future Return on Equity estimates from 13 analysts. The company’s Cost of Equity stands at $6.62 per share, while its calculated Excess Return is $4.48 per share. On average, the firm achieves a Return on Equity of 16.3%, which outpaces its cost of capital. Additionally, analysts expect the Stable Book Value to be $68.09 per share, drawing from projections by 14 analysts.

Using this data, the Excess Returns model estimates Morgan Stanley's intrinsic value at $135.51 per share. Because the current market price is about 21.0% higher than this intrinsic value, the stock appears overvalued by this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Morgan Stanley may be overvalued by 21.0%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Morgan Stanley Price vs Earnings

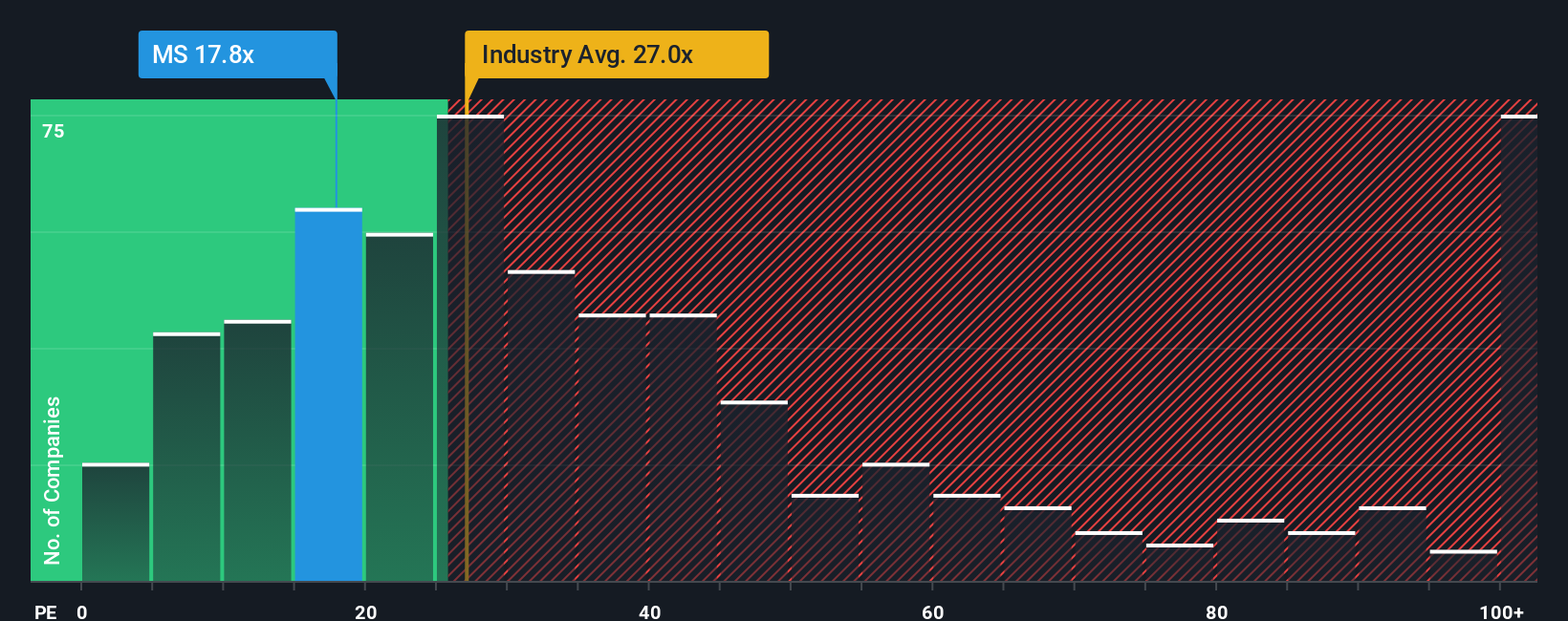

For profitable companies like Morgan Stanley, the Price-to-Earnings (PE) ratio is a time-tested way to gauge valuation. Since the company consistently delivers earnings, the PE ratio reflects both its profitability and how the market expects it to grow moving forward. Investors should remember that a higher PE often signals stronger growth expectations or lower perceived risk, while a lower PE may indicate more modest prospects or higher uncertainty.

Morgan Stanley currently trades at a PE ratio of 16.7x. For context, this is below the Capital Markets industry average of 23.7x and also under the peer group average of 35.0x. These benchmarks show the company is priced less aggressively than much of its sector, at least on a headline basis.

Instead of relying only on peer or industry averages, which may not account for company-specific factors, Simply Wall St uses a “Fair Ratio.” This proprietary multiple blends elements like expected earnings growth, profit margin trends, industry positioning, market capitalization, and risk profile for a more tailored benchmark. Morgan Stanley’s Fair PE Ratio stands at 19.1x, which is only moderately higher than the current PE.

Because the difference between Morgan Stanley’s Fair Ratio and its actual PE is less than 0.10, the stock appears to be valued about right by this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

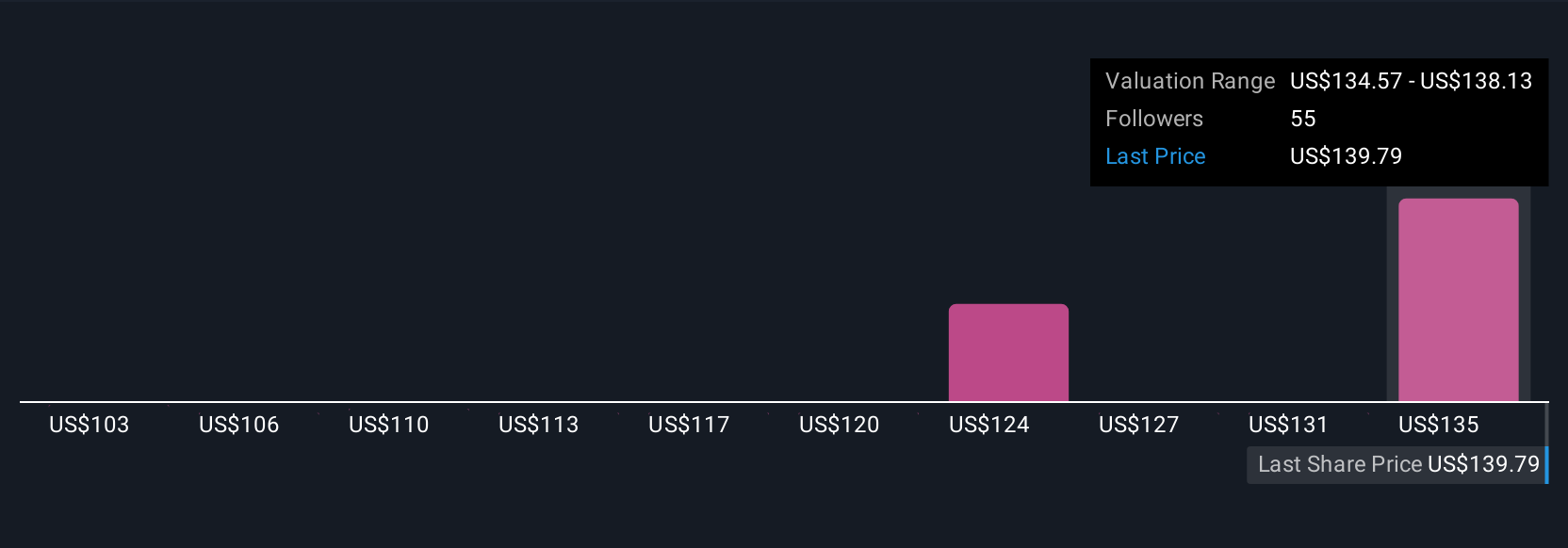

Upgrade Your Decision Making: Choose your Morgan Stanley Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let’s introduce you to Narratives, a dynamic, story-driven approach that connects the “why” behind Morgan Stanley’s numbers to the financial outcome you believe in. A Narrative is simply your perspective on the company’s future, translated into your own forecast of revenue, earnings, and margins, which leads straight to your view of fair value. Narratives make investing more personal and informed by letting you shape your own financial forecast, and on Simply Wall St’s Community page, millions of investors share and explore these perspectives every day.

With Narratives, you can easily compare the fair value of Morgan Stanley, according to your own assumptions, to today’s share price. This helps you decide not just if the stock is “cheap” or “expensive,” but if it fits your specific investing story. They also update automatically when new news or earnings are released, keeping your analysis current. For example, some investors see Morgan Stanley’s international expansion and rising recurring revenues and set bold price targets up to $160, while others focus on regulatory risks and competitive threats to justify a more cautious target of $122. Narratives allow all of these viewpoints to be clearly illustrated and tested, so you always know exactly what is driving your investment decisions.

Do you think there's more to the story for Morgan Stanley? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives