- United States

- /

- Capital Markets

- /

- NYSE:MCO

Should Moody’s (MCO) Analytics Leadership Change Prompt a Fresh Look as Private Credit Demand Surges?

Reviewed by Simply Wall St

- Moody’s Corporation announced that Stephen Tulenko, President of Moody’s Analytics, has resigned effective September 2, 2025, with Andy Frepp, the Chief Operating Officer, immediately appointed as Interim President following Tulenko’s departure.

- This leadership transition comes as Moody’s experiences increasing demand from the rapidly growing private credit markets, emphasizing the important link between internal management shifts and evolving market trends.

- We’ll explore how Moody’s executive change in its analytics division could influence its outlook amid surging private credit market demand.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Moody's Investment Narrative Recap

To be a Moody’s shareholder, you need confidence in its ability to capture value from the expansion of private credit markets and ongoing innovation in analytics. The recent leadership change in Moody's Analytics, Andy Frepp stepping in as Interim President, does not materially affect the central outlook; investor focus remains fixed on how well Moody's turns surging private credit demand into sustainable revenue, while keeping an eye on rising competition from AI-driven analytics, the biggest immediate risk.

Moody’s strategic partnership with MSCI, announced in April 2025, is especially relevant given the current executive transition. By combining Moody’s analytical expertise with MSCI’s insights, the company aims to provide more robust risk assessments for private credit, a move that could help address customer expectations and reinforce Moody’s competitive edge, provided the Analytics segment continues to execute well through leadership change.

By contrast, investors should be aware that competitive threats from alternative data and AI-enabled analytics remain a key risk if Moody’s fails to...

Read the full narrative on Moody's (it's free!)

Moody's narrative projects $9.0 billion revenue and $3.0 billion earnings by 2028. This requires 7.2% yearly revenue growth and an increase of $0.9 billion in earnings from $2.1 billion today.

Uncover how Moody's forecasts yield a $540.75 fair value, a 5% upside to its current price.

Exploring Other Perspectives

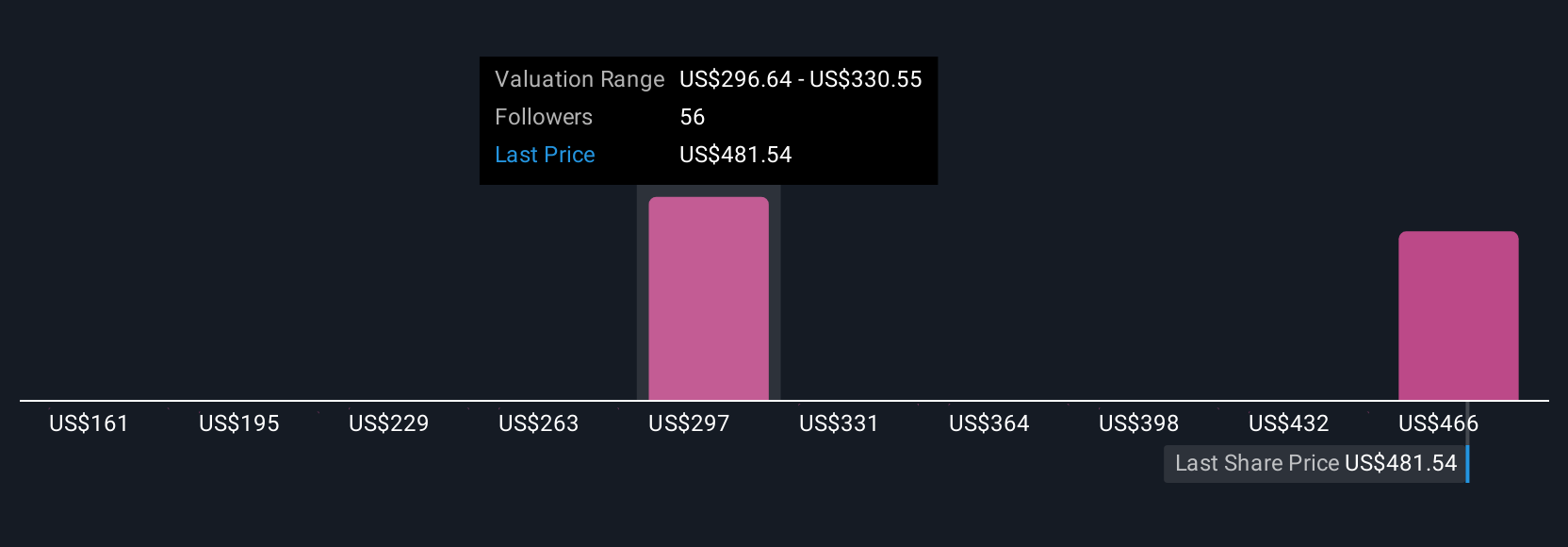

Simply Wall St Community members estimate Moody’s fair value from US$251 to US$541, spanning 12 independent forecasts. Private investors see wide possibilities while AI competitors may test Moody’s future pricing power and relevance, explore these varied viewpoints for a fuller picture.

Explore 12 other fair value estimates on Moody's - why the stock might be worth as much as $540.75!

Build Your Own Moody's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moody's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moody's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives