- United States

- /

- Capital Markets

- /

- NYSE:MC

Moelis (MC) Profit Margin Surge Challenges Cautious Narratives This Earnings Season

Reviewed by Simply Wall St

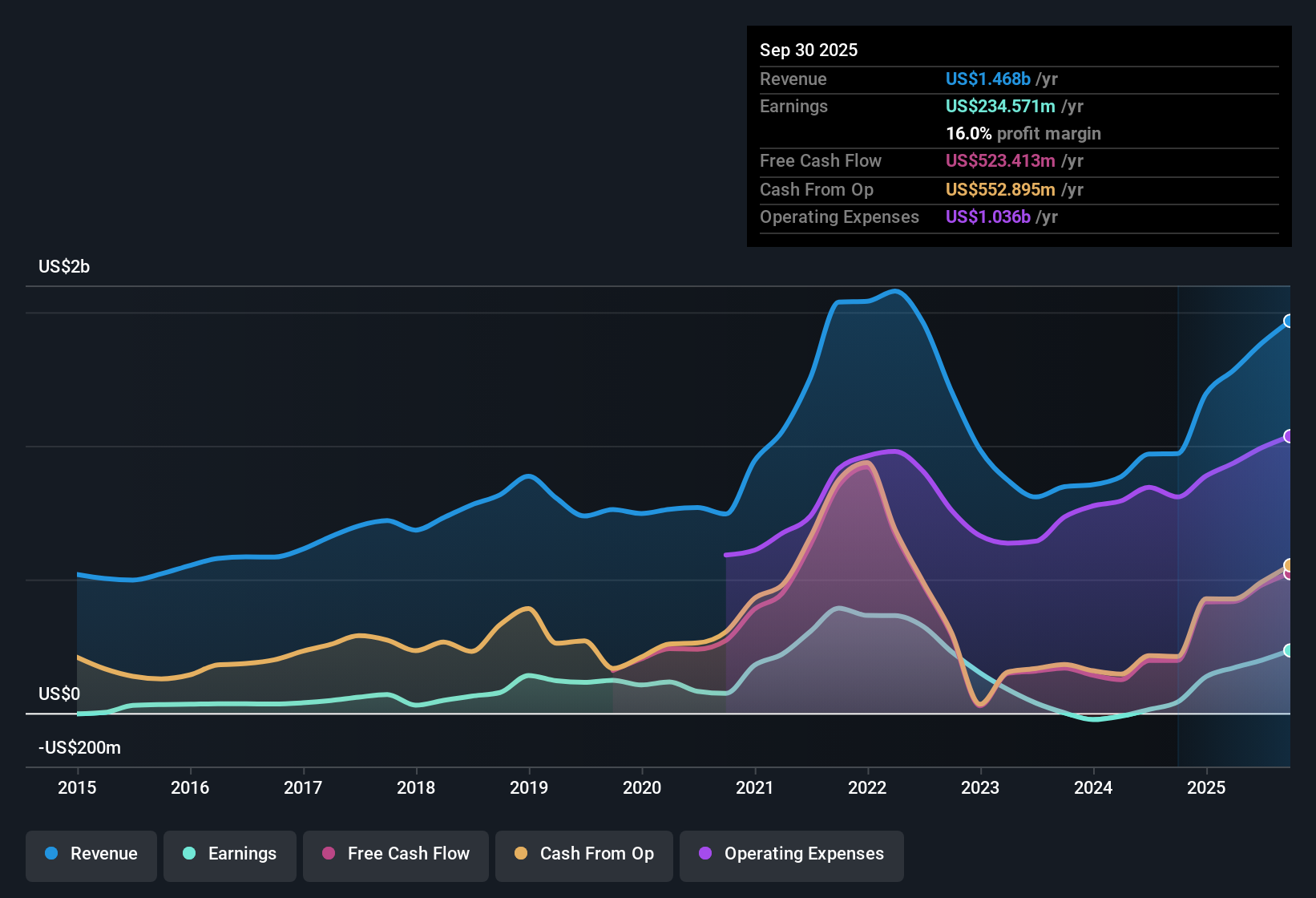

Moelis (MC) posted net profit margins of 16%, a marked jump from 4.2% the previous year, with annual earnings growth surging 472.7%, far ahead of its five-year average trend. Despite robust profit and revenue growth forecasts that outpace broader US market expectations, the current share price of $64.27 sits well above the $28.45 fair value estimate, raising questions about valuation. The company’s high quality earnings, strong margins, and appealing price-to-earnings ratio relative to industry peers form the backdrop for investor sentiment this earnings season.

See our full analysis for Moelis.Next, we'll compare these headline results against the most widely followed narratives in the market to uncover where the numbers reinforce the story and where they might challenge conventional wisdom.

See what the community is saying about Moelis

Pace of Margin Expansion Surpasses Industry

- Analysts project Moelis's profit margins will grow from 14.3% today to 18.0% in three years, a wider expansion than the US Capital Markets industry is forecasting for itself.

- According to the analysts' consensus view, Moelis’s push into recurring and retained advisory assignments, particularly within capital structure and creditor-side franchises, is expected to deliver steadier fee income and higher quality earnings.

- This strength in margin outlook is attributed to both the firm's globally integrated M&A platform and its focus on premium fee mandates. This positions Moelis strongly even against larger, more diversified competitors.

- Consensus notes that further margin upside depends on maintaining topline growth while controlling compensation and technology costs. This balance is being tested as expansion accelerates.

- Results like these prompt consensus analysts to see Moelis as a leader in margin improvement, but they caution the road to stable, higher margins requires consistently strong deal flow. See what the consensus story says about where these margins could go next. 📊 Read the full Moelis Consensus Narrative.

Forecasted Revenue Growth Outpaces Peers

- Moelis is forecasted to grow revenue at 14.4% per year, which is ahead of the US market forecast of 10.3% per year and directly supports analysts' assumption of top-line expansion driving future profitability.

- The consensus narrative highlights that the company’s deeper push into private capital advisory and technology sectors is expected to diversify clients, expand the deal pipeline, and drive sustained above-market growth.

- This pipeline builds on Moelis's strategic hiring and sector focus. The aim is for more predictable, less volatile earnings streams that could lead to a valuation re-rating if sustained.

- However, consensus also observes that this aggressive expansion could add expense risk and make profit growth more sensitive to the pace of new deals. This is a factor worth tracking as forecasts are ambitious relative to peers.

Valuation Gap Versus DCF Fair Value and Industry

- Moelis trades at a Price-to-Earnings ratio of 20.3x, which is less than the US Capital Markets industry average (25.2x) but higher than the peer average (18.4x). Its $64.27 share price remains well above the DCF fair value estimate of $28.45.

- The consensus narrative sees most analysts converging on a price target of $76.86, just 19.6% above the current share price. This suggests the market largely views Moelis as fairly valued on forward potential, though the premium to DCF fair value reflects optimism about quality and future growth.

- This tight pricing range is rare in advisory stocks and indicates confidence in Moelis’s execution and resilience, especially given the fast five-year turnaround in profitability trends.

- Still, with consensus estimates resting on both continued margin gains and robust revenue expansion, any shortfall in deal flow or spike in compensation could bring this premium into question quickly.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Moelis on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Shape your own view and share your perspective in just a few minutes. Do it your way

A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Moelis’s premium price over fair value depends on ambitious growth and margin forecasts, which could quickly falter if deal flow or cost control slip.

If you want more reasonable valuations with upside potential, check out these 848 undervalued stocks based on cash flows to spot companies trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MC

Moelis

Operates as an investment banking advisory company in North and South America, Europe, the Middle East, Asia, and Australia.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives