- United States

- /

- Capital Markets

- /

- NYSE:MAIN

The Bull Case For Main Street Capital (MAIN) Could Change Following Fresh Analyst Valuation Upgrade

Reviewed by Sasha Jovanovic

- Recently, Main Street Capital Corporation received a valuation upgrade from analysts following renewed focus on its resilient business model and differentiation from its business development company peers.

- This update highlights the company's ongoing book value growth, consistent dividend increases, and strong institutional interest, which sets it apart within the sector.

- We will examine how the new attractive valuation grade and emphasis on dividend growth influence Main Street Capital’s investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Main Street Capital Investment Narrative Recap

To be a shareholder in Main Street Capital, you need confidence in its resilient business model, consistent dividend growth, and ability to deliver returns through disciplined investment across lower middle market companies. The recent valuation upgrade does not change the key short-term catalysts or biggest risks, including income stability as the portfolio shifts, but it does reinforce investor attention on dividend performance and book value growth as decision factors.

The most pertinent recent announcement is Main Street's decision to increase regular monthly dividends by 2 percent for Q1 2026, alongside a supplemental special dividend for December 2025. This supports the dividend-focused investment narrative and reinforces the company’s emphasis on returning capital to shareholders, which remains a central catalyst as market sentiment reacts to adjustments in distribution policy.

Yet, investors should also stay alert to the impact of increased nonaccrual rates, especially as credit risks in consumer discretionary exposure could become more significant...

Read the full narrative on Main Street Capital (it's free!)

Main Street Capital's outlook anticipates $611.1 million in revenue and $227.4 million in earnings by 2028. This scenario assumes a 4.9% annual revenue growth rate and a $245.5 million decline in earnings from the current level of $472.9 million.

Uncover how Main Street Capital's forecasts yield a $60.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

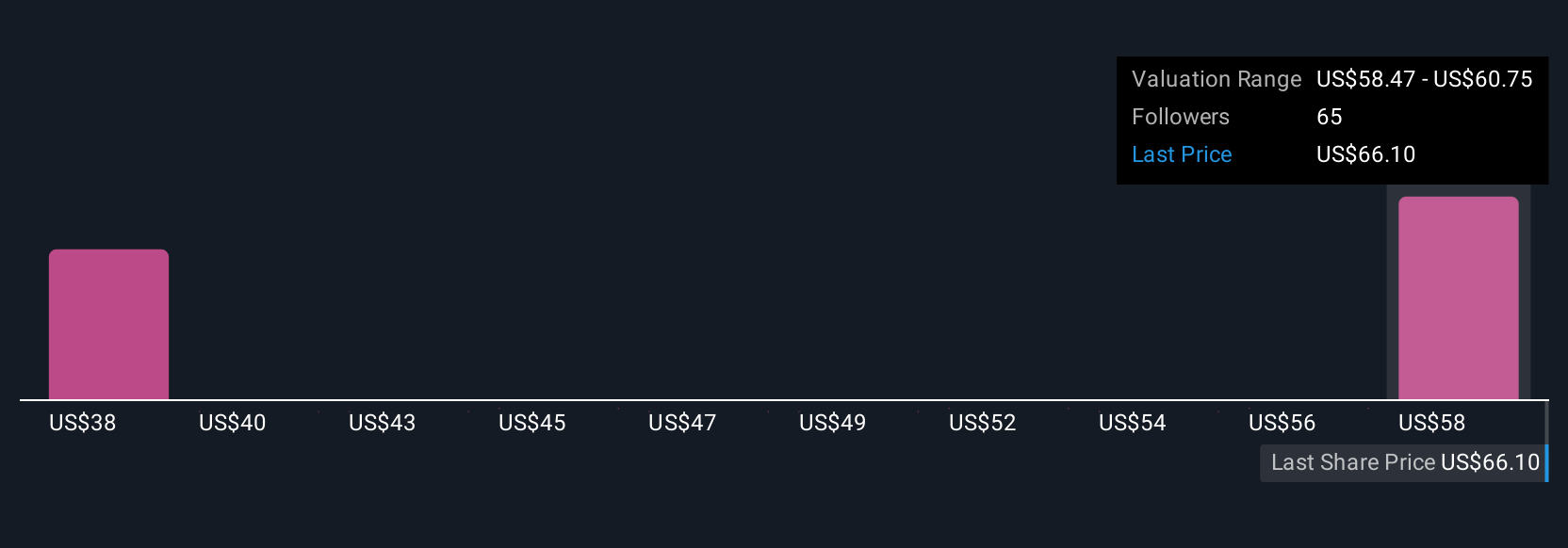

Simply Wall St Community members submitted eight fair value estimates ranging from US$37 to US$60.67 per share. With income risks still emerging, your view could differ from the consensus and drive your next move; explore diverse viewpoints to challenge your assumptions.

Explore 8 other fair value estimates on Main Street Capital - why the stock might be worth as much as 5% more than the current price!

Build Your Own Main Street Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Main Street Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Main Street Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Main Street Capital's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAIN

Main Street Capital

A business development company and a small business investment company specializing in direct and indirect investments.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.