- United States

- /

- Capital Markets

- /

- NYSE:MAIN

Is There Still Value in Main Street Capital After Its 32.8% Rally?

Reviewed by Bailey Pemberton

Let’s get right to the heart of the question many Main Street Capital watchers are asking themselves: is it time to buy, hold, or move on? Over the last year, Main Street Capital’s share price has surged by an impressive 32.8%. If we look further back, the returns paint an even more dramatic picture, with a staggering 141.6% gain over three years and nearly 200% over five. Even with a recent slip of 1.2% in the past week and a broader 4.1% dip over the last month, the year-to-date return still stands at a robust 6.2%.

Some of this long-term strength can be traced to continued optimism in the market for business development companies. Investors are reassessing risk and chasing yield in a low-rate environment. Whenever Main Street Capital’s name pops up, there is a sense that the company rides out market noise a bit more smoothly than some of its peers.

But when you dig into the valuation numbers, the story becomes less clear-cut. On a simple valuation screen, Main Street Capital scores just a 2 out of 6. This means it comes up as undervalued in only two areas out of the six key checks, which might tempt value hunters to pause. In the next sections, we’ll break down exactly how this score was built and stack up the commonly used methods for valuing Main Street Capital’s shares. Stay tuned, because by the end of this article, I’ll spotlight a smarter approach to valuation that goes beyond the usual checkboxes.

Main Street Capital scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Main Street Capital Excess Returns Analysis

The Excess Returns valuation model seeks to measure how effectively a business is putting its shareholders’ equity to work. It aims to quantify the real economic profit generated above the company’s cost of equity. Main Street Capital’s performance, in these terms, is based on several key indicators.

- Book Value: $32.30 per share

- Stable EPS: $4.31 per share (Source: Weighted future Return on Equity estimates from 6 analysts.)

- Cost of Equity: $3.30 per share

- Excess Return: $1.01 per share

- Average Return on Equity: 12.81%

- Stable Book Value: $33.62 per share (Source: Weighted future Book Value estimates from 2 analysts.)

By projecting these excess returns into the future, the model estimates an intrinsic value for Main Street Capital that is 29.5% lower than the current share price. This means the stock appears to be significantly overvalued based on its ability to generate returns above the cost of equity, despite otherwise solid fundamentals.

Result: OVERVALUED

Our Excess Returns analysis suggests Main Street Capital may be overvalued by 29.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Main Street Capital Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored tool for valuing profitable companies like Main Street Capital because it directly links the company’s share price with its ability to generate earnings. Unlike sales or book value, earnings reflect the bottom line, meaning real profits attributable to shareholders, which makes the PE ratio a widely used yardstick for businesses that deliver reliable income streams.

However, what makes a PE ratio “fair” depends on expectations for a company’s future growth and the risks it faces. High-growth firms, or those with especially stable earnings, tend to command higher PE ratios, while riskier or slower-growing companies trade at lower multiples. So context is crucial: Main Street Capital’s current PE ratio stands at 10.5x. For comparison, the industry average for the broader capital markets space is much higher at 27.1x, while its peer group averages 17.0x. On the surface, this suggests Main Street Capital is valued at a notable discount by these benchmarks.

But to get a more precise picture, Simply Wall St’s proprietary "Fair Ratio" comes into play. Unlike a raw peer or industry comparison, the Fair Ratio factors in Main Street Capital's own growth outlook, market cap, profit margins, and risk profile. This results in a fair PE ratio estimate of 10.4x for Main Street Capital, nearly identical to its current level. That alignment suggests the market is pricing the stock about right given its fundamentals and where it sits relative to the sector.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Main Street Capital Narrative

Earlier, we mentioned there is a better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, where you lay out your perspective on its future, including your take on Main Street Capital’s growth, earnings, margins, and what you believe is a fair value. Rather than just crunching numbers, Narratives connect the dots between the story you see unfolding and what that means for a credible forecast and price estimate, grounding your opinion in both financials and context. Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors track, refine, and share their investment stories.

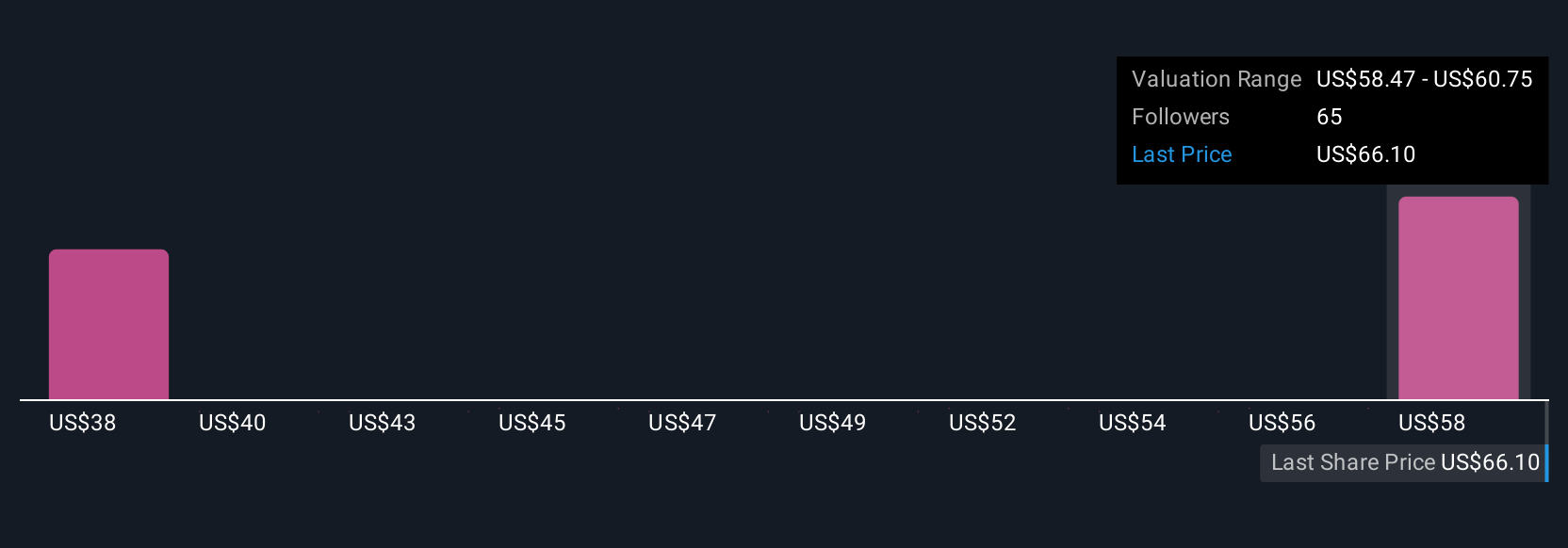

By comparing the fair value from your Narrative with today’s price, you can decide whether it’s time to buy, hold, or sell. As new information such as earnings or major news releases, Narratives automatically update so your thinking stays current. For instance, some Main Street Capital Narratives suggest a fair value as high as $62.00, based on optimism for rising net interest income and dividend growth. Others are more cautious, pointing to a fair value as low as $45.00 due to concerns about rising credit risks and shrinking profit margins. This range highlights how different perspectives and assumptions shape investment choices.

Do you think there's more to the story for Main Street Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAIN

Main Street Capital

A business development company and a small business investment company specializing in direct and indirect investments.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives