- United States

- /

- Capital Markets

- /

- NYSE:MAIN

Does MAIN’s Latest Southeast Investment Reflect a New Phase in Its Capital Deployment Strategy?

Reviewed by Sasha Jovanovic

- Main Street Capital recently announced the completion of an US$81 million portfolio investment to support the minority recapitalization of a musculoskeletal care management services organization in the Southeastern U.S., alongside preliminary third-quarter 2025 results showing record net asset value per share and robust return on equity.

- This combination of a sizable new investment and ongoing financial performance highlights Main Street Capital's continued deployment of capital into growth sectors while reinforcing its reputation for consistent returns.

- We will consider how the third quarter’s record net asset value per share update shapes Main Street Capital’s investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Main Street Capital Investment Narrative Recap

Main Street Capital appeals to shareholders who believe in stable income and robust asset growth from diversified lower middle market investments. The recent US$81 million investment and updated earnings guidance, pointing to record net asset value per share and solid return on equity, are positive but do not materially shift the most pressing catalyst: continued growth and quality within the expanding lower middle market portfolio. The biggest immediate risk remains the potential impact on asset quality and income stability as the company increases its exposure in this segment.

One recent announcement closely connected to this catalyst is Main Street’s preliminary third-quarter 2025 guidance, which estimated distributable net investment income of US$1.01 to US$1.05 per share and highlighted ongoing growth in its lower middle market and private loan portfolios. These results support the narrative of reliable income but also touch on heightened expectations for effective management as the company’s investment activity ramps up.

However, investors should also be mindful of the less-discussed concern, that as Main Street accelerates lower middle market investments...

Read the full narrative on Main Street Capital (it's free!)

Main Street Capital is forecast to generate $611.1 million in revenue and $227.4 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 4.9% and reflects a decrease in earnings of $245.5 million from current earnings of $472.9 million.

Uncover how Main Street Capital's forecasts yield a $62.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

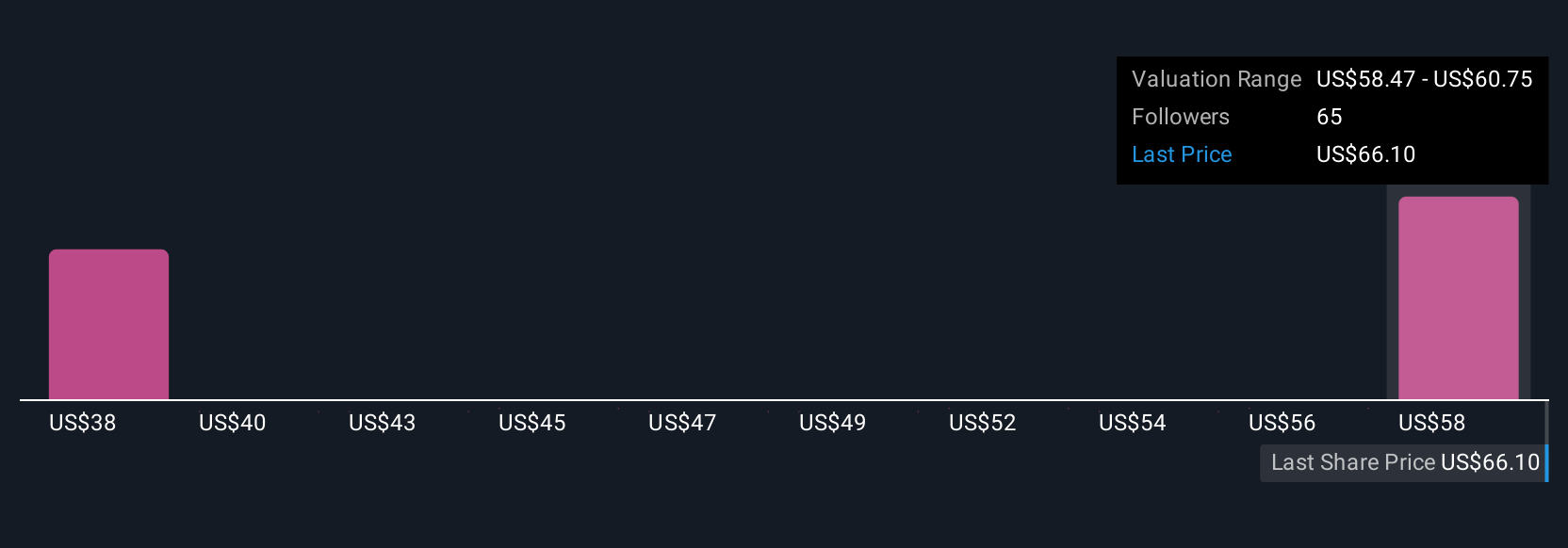

Seven members of the Simply Wall St Community estimated Main Street Capital’s fair value between US$37.97 and US$62. This wide spread reflects varied outlooks, especially as analysts point to the challenge of maintaining asset quality amid portfolio growth.

Explore 7 other fair value estimates on Main Street Capital - why the stock might be worth as much as 7% more than the current price!

Build Your Own Main Street Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Main Street Capital research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Main Street Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Main Street Capital's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAIN

Main Street Capital

A business development company and a small business investment company specializing in direct and indirect investments.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives