- United States

- /

- Diversified Financial

- /

- NYSE:MA

What Mastercard (MA)'s AI-Powered Payment Partnerships Could Mean for the Digital Commerce Future

Reviewed by Simply Wall St

- In the past week, Mastercard announced a suite of AI-powered payment innovations, including advanced developer tools, new agent programs, and collaborations with Stripe, Google, and Ant International to set AI standards for secure payments globally. The company's rollout of agentic shopping and developer resources highlights its ambition to enable next-generation commerce experiences and expand its reach in digital payments infrastructure.

- We'll explore how Mastercard's focus on AI-driven payment security and developer enablement may influence its broader investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mastercard Investment Narrative Recap

To be a Mastercard shareholder, it comes down to believing in the company's ability to stay at the forefront of the global shift toward digital payments, while outpacing disruption from alternative real-time payment rails and navigating regulatory change. The recent AI-powered payments suite makes for a compelling headline but, in the short term, does not materially alter the main catalyst, ongoing adoption of digital payment solutions, nor does it directly address the persistent risk of market share pressure from domestic networks. Of the new announcements, Mastercard’s Agent Pay program stands out; its phased introduction across all US cardholders marks another move to embed intelligent agents in everyday transactions. This reinforces Mastercard's emphasis on user-centric security and innovation as payments increasingly go digital, connecting directly to current growth drivers in e-commerce and value-added services. Yet, despite rapid tech innovation, investors should be mindful that digital disruptors in fast-growing markets may...

Read the full narrative on Mastercard (it's free!)

Mastercard's outlook anticipates $42.6 billion in revenue and $19.9 billion in earnings by 2028. This is based on a projected 12.1% annual revenue growth and a $6.3 billion increase in earnings from the current $13.6 billion.

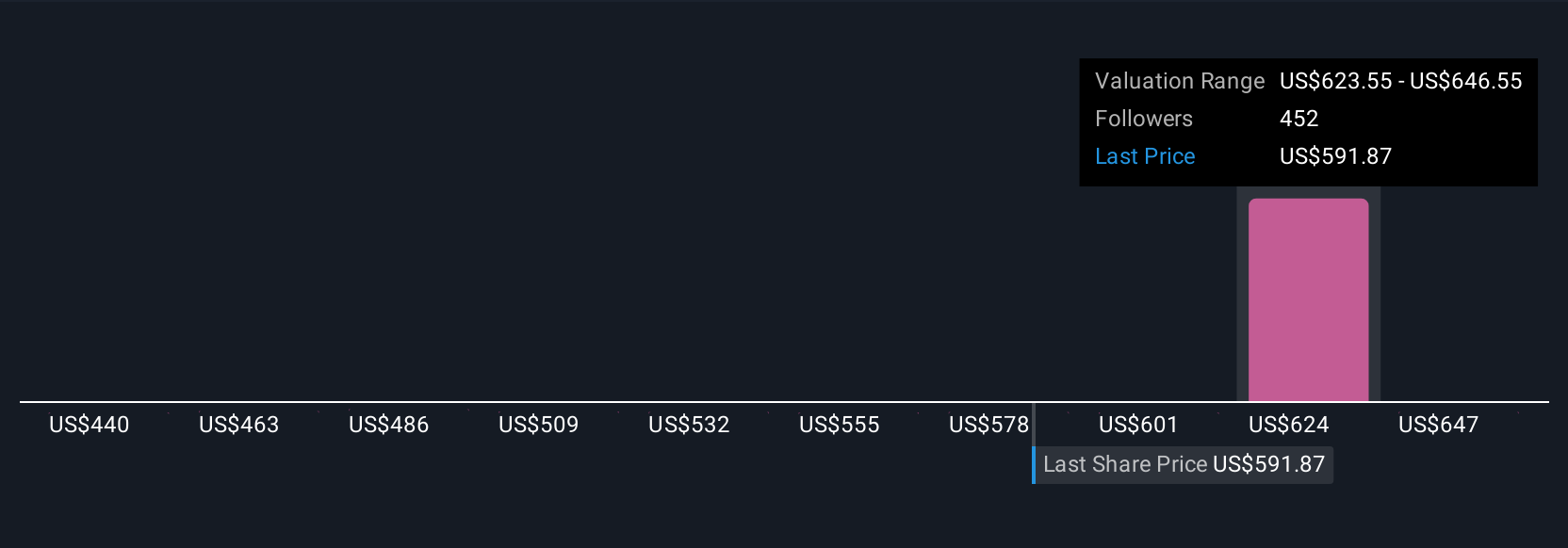

Uncover how Mastercard's forecasts yield a $644.55 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have modeled fair values from US$439.59 to US$669.54, reflecting 23 distinct viewpoints. Product innovation continues, but competition from local payment systems remains a key factor influencing longer-term outcomes, so consider a range of outlooks.

Explore 23 other fair value estimates on Mastercard - why the stock might be worth as much as 15% more than the current price!

Build Your Own Mastercard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mastercard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mastercard's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives