- United States

- /

- Diversified Financial

- /

- NYSE:MA

Mastercard (MA): Reassessing Valuation After Recent AI-Powered Payment Innovations and Strategic Partnerships

Reviewed by Kshitija Bhandaru

If you’ve been weighing your options on Mastercard (MA), its latest burst of AI-powered payment innovations might have tipped the scales. In recent days, Mastercard revealed a suite of developer tools and high-profile partnerships designed to make intelligent, secure payments the rule rather than the exception. These moves suggest the company is not just pacing the digital commerce race, but actively setting the course for how AI transforms the way we pay.

The buzz around these announcements has added some momentum for Mastercard, whose stock is up 19% over the past year and has more than tripled in the last three years. Short-term moves this month have been mixed as investors assess the implications of rapid product rollouts alongside continued steady financial performance. As Mastercard evolves its technology and cements relationships with digital and financial heavyweights, investors may be sensing an inflection point in both risk and reward.

The central question is whether Mastercard’s current price fully reflects its growth potential in AI-powered payments, or if there is still room for upside as these initiatives scale up. Is now the time to get in, or has the market already recognized what is next?

Most Popular Narrative: 9.4% Undervalued

The most followed narrative on Mastercard suggests the stock is currently trading below its estimated fair value, highlighting ongoing growth opportunities and strong business momentum.

Mastercard's expanded value-added services in cybersecurity, data analytics, and consulting—highlighted by the acquisition of Recorded Future and investments in AI-driven fraud solutions—support higher-margin, recurring revenue streams and net margin expansion.

Curious how this value story is built? The analysts behind this price target are betting on accelerating growth and ambitious profit assumptions, with a bold call on where margins could be heading. What financial levers are they pulling, and how high do they expect earnings to climb? Dig into the narrative to reveal the growth drivers and the math behind this undervaluation.

Result: Fair Value of $644.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Mastercard faces tough regulatory scrutiny and the rapid rise of alternative payment rails, both of which could challenge the company’s future growth assumptions.

Find out about the key risks to this Mastercard narrative.Another View: Market Ratio Perspective

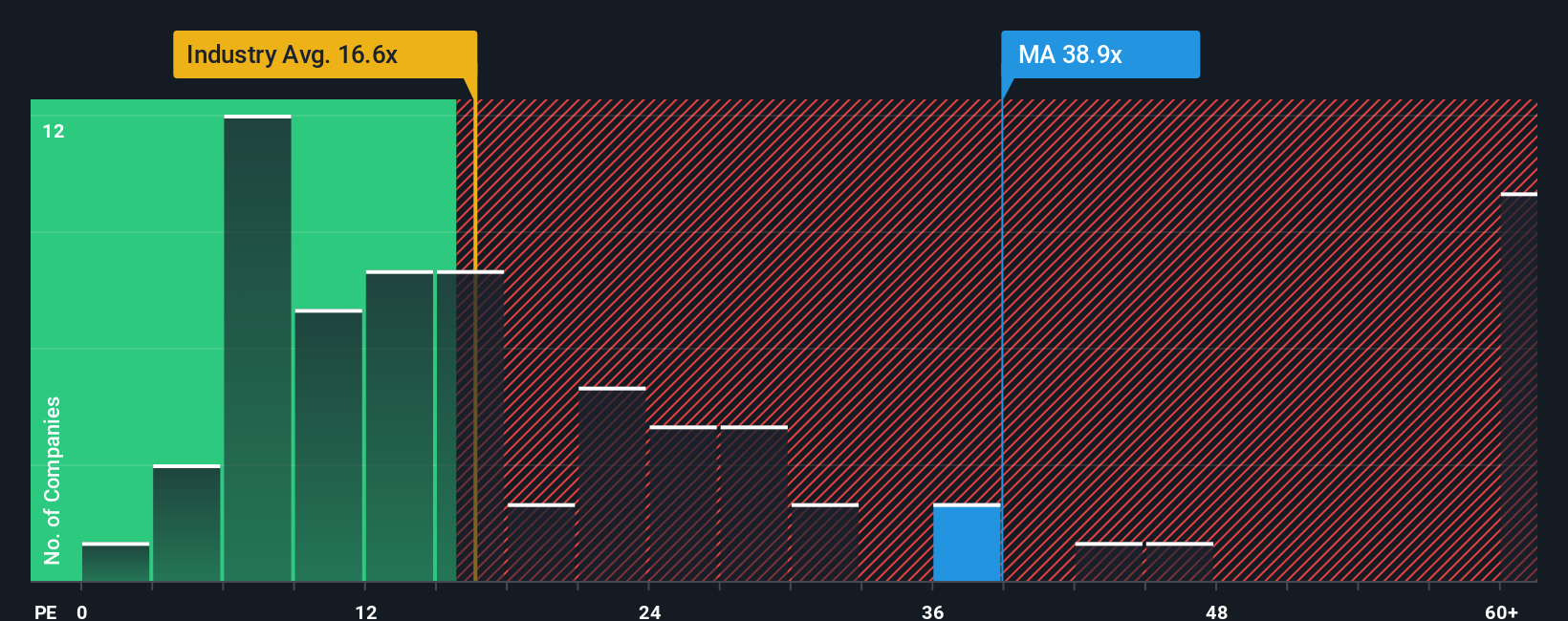

A different take uses a simple price-to-earnings ratio, comparing Mastercard with the industry average. This perspective makes the stock appear expensive today and challenges the argument for undervaluation discussed earlier. Could the premium be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Mastercard to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Mastercard Narrative

If you see the story differently or want to dig into the numbers your own way, you can quickly build a custom narrative in just a few minutes using Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing out on the next market breakout could mean overlooked gains. Give yourself an edge by harnessing these unique stock ideas tailored for forward-thinking investors.

- Capitalize on untapped growth with companies showing strong financials. Get inspired by our penny stocks with strong financials for high-potential opportunities others might miss.

- Lock in steady returns even when markets are wild by tapping into dividend stocks with yields > 3% offering generous yields over 3%. This is ideal for income-focused portfolios.

- Harness the power of innovation with leaders shaping tomorrow’s world. See who’s at the forefront of computational breakthroughs in our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives