- United States

- /

- Diversified Financial

- /

- NYSE:MA

Here's Why Mastercard (NYSE:MA) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mastercard (NYSE:MA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Mastercard

How Fast Is Mastercard Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Mastercard has managed to grow EPS by 25% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

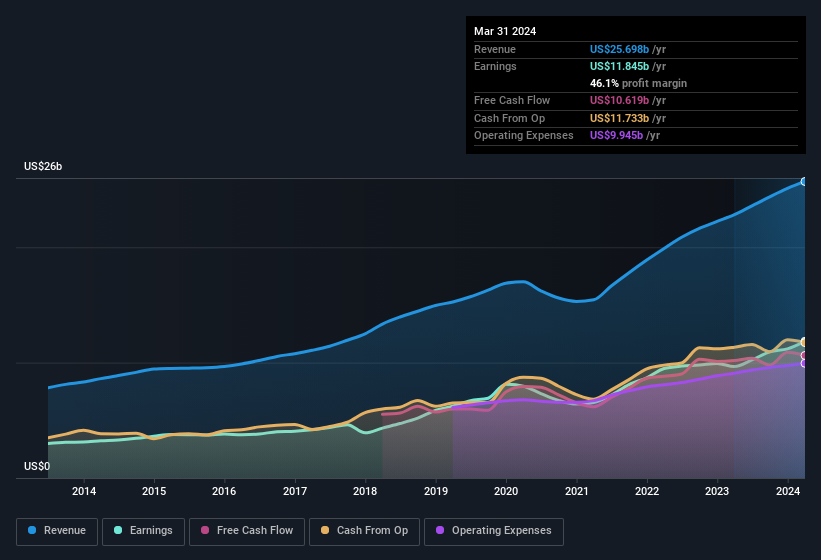

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Mastercard remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to US$26b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Mastercard.

Are Mastercard Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in Mastercard in the last 12 months. But the important part is that Independent Director Richard Davis spent US$391k buying stock, at an average price of US$391. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for Mastercard bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$175m. This comes in at 0.04% of shares in the company, which is a fair amount of a business of this size. This still shows shareholders there is a degree of alignment between management and themselves.

Does Mastercard Deserve A Spot On Your Watchlist?

You can't deny that Mastercard has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. What about risks? Every company has them, and we've spotted 1 warning sign for Mastercard you should know about.

Keen growth investors love to see insider activity. Thankfully, Mastercard isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives