- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC): Evaluating Valuation Following 20% One-Month Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for LendingClub.

Momentum appears to be building for LendingClub, with a 1-month share price return of 20% pushing its shares up to $17.76. This recent surge follows a period of choppy trading. Zooming out, investors have enjoyed a total shareholder return of nearly 27% over the past year and more than 225% over five years.

If you’re searching for the next standout mover, now is a perfect moment to broaden your radar and discover fast growing stocks with high insider ownership

With LendingClub shares still trading at a 14% discount to analyst price targets, the key question is whether the current rally leaves room for further gains or if the market has already priced in the company’s growth prospects.

Most Popular Narrative: 12.3% Undervalued

LendingClub's fair value, according to the most widely followed narrative, stands notably higher than its last closing price. This gap reflects optimism around projected earnings growth, margin expansion, and new digital initiatives.

LendingClub is well positioned to capture accelerating consumer demand for digital and mobile-first banking solutions, as evidenced by the rapid adoption and engagement with its new products (LevelUp Savings, LevelUp Checking, forthcoming DebtIQ). Sustained digital product innovation is expected to broaden the addressable market and drive long-term growth in both originations and customer lifetime value, positively impacting revenue and net margins.

Want to uncover the engine behind this valuation? The underlying projections lean on bold digital transformation, ambitious profit expansion, and a major leap in LendingClub’s core operating metrics. Ready to see which assumptions drive this target price? Find out what makes the math add up for bulls.

Result: Fair Value of $20.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and LendingClub’s deep exposure to personal loans could pressure growth expectations if market dynamics shift or if consumer credit cycles turn.

Find out about the key risks to this LendingClub narrative.

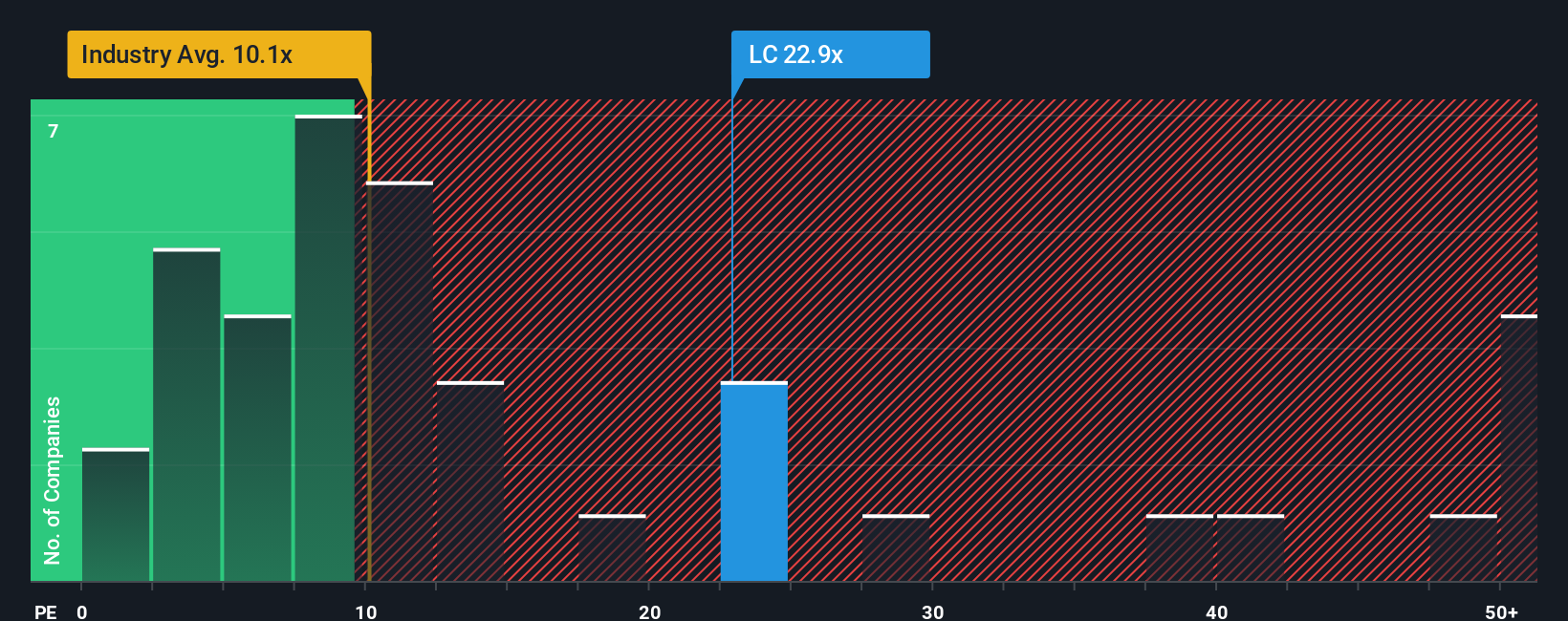

Another View: Multiples Raise a Caution Flag

While LendingClub appears undervalued using fair value estimates, comparing its current price-to-earnings ratio of 19.7x to the peer average of just 4.9x and the industry’s 10.4x level signals it is expensive relative to its sector. The fair ratio sits even higher at 22.6x, but are investors willing to pay up for anticipated growth? This premium could add risk if the outlook shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you want to dig into the numbers and look from a fresh perspective, you can shape your own take on LendingClub in just a few minutes. Do it your way

A great starting point for your LendingClub research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity. Set yourself up for smarter gains by checking out these compelling investment options before the market gets there first.

- Tap into technology’s biggest disruptors with these 27 AI penny stocks as artificial intelligence continues to fuel innovation and fresh growth stories.

- Boost your portfolio’s income potential by targeting steady yield opportunities in these 20 dividend stocks with yields > 3%. This is ideal for anyone seeking healthy returns without chasing volatility.

- Catch surging trends early by uncovering future stars among these 3614 penny stocks with strong financials, where overlooked businesses can transform into tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives