- United States

- /

- Consumer Finance

- /

- NYSE:LC

Is LendingClub’s Recent 27% Rally Justified After New Partnerships?

Reviewed by Bailey Pemberton

- Wondering if LendingClub is a hidden bargain or just another hot stock? You’re in the right place for a deeper look into the numbers behind the headline price.

- LendingClub’s share price has climbed 17.8% over the past month and is up a strong 27.7% for the year. This indicates renewed interest from investors and possibly a shift in sentiment around its growth potential.

- Recent announcements about strategic partnerships and new product offerings have put LendingClub in the spotlight. These updates have sparked both fresh enthusiasm and debate about its long-term prospects, helping explain some of the brisk price action seen lately.

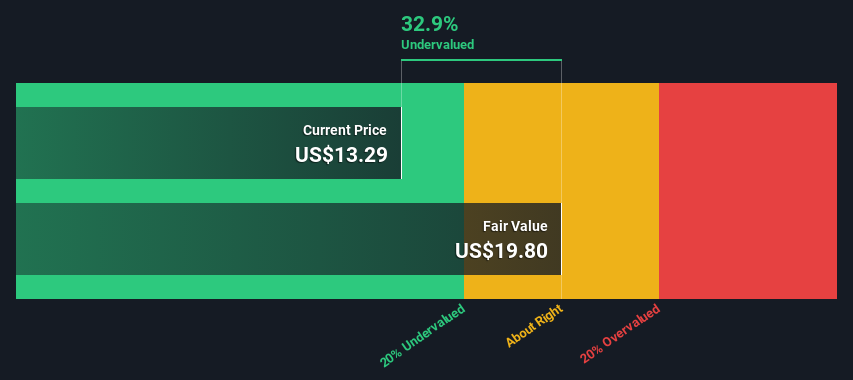

- On our valuation checks, LendingClub currently scores 3 out of 6. This suggests its value isn’t clear-cut and there’s more to unpack. Next, we’ll walk through the classic and alternative ways to assess if LendingClub is fairly priced. Stick around because we’ll also introduce a smarter approach later in the article.

Find out why LendingClub's 27.7% return over the last year is lagging behind its peers.

Approach 1: LendingClub Excess Returns Analysis

The Excess Returns model estimates the true value of a stock by comparing what management earns on shareholders’ equity with what shareholders could expect by investing that equity elsewhere at a standard cost of capital. It highlights how effectively LendingClub generates returns above the expected minimum for its investors.

Based on the latest data, LendingClub’s Book Value stands at $12.68 per share, and its Stable EPS is projected at $1.66 per share, as determined by a weighted average of future Return on Equity estimates from six analysts. The company’s Cost of Equity is $1.13 per share, leading to an Excess Return of $0.53 per share. The average Return on Equity over time is estimated at 11.55%, with Stable Book Value expected to reach $14.37 per share according to weighted future estimates from five analysts.

With this model, LendingClub’s intrinsic value is assessed at $25.40 per share. This figure is 31.5% higher than the current market price, suggesting the stock appears to be significantly undervalued using the Excess Returns approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests LendingClub is undervalued by 31.5%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: LendingClub Price vs Earnings

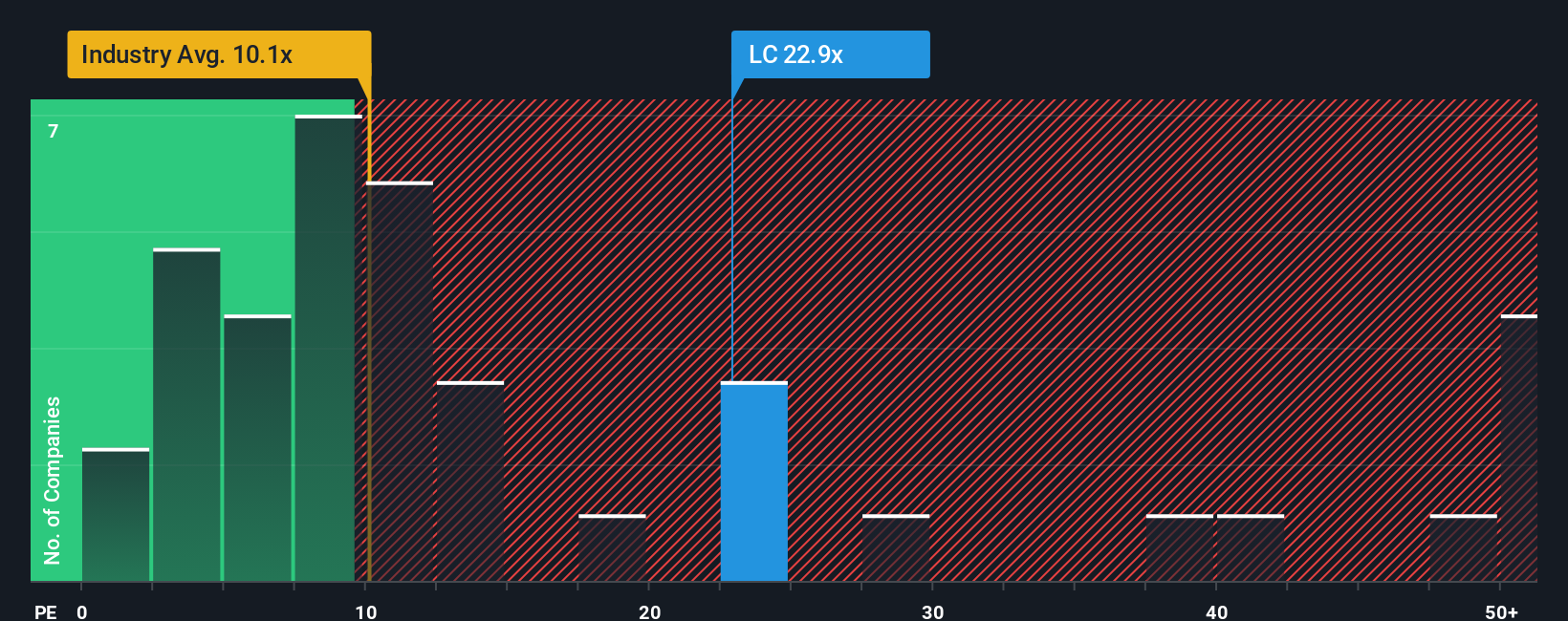

For companies like LendingClub that are solidly profitable, the Price-to-Earnings (PE) ratio is a tried-and-true valuation tool. This ratio works well because it connects a company’s current share price with what investors are willing to pay for each dollar of earnings, making it especially useful when profits are steady or growing.

It’s important to keep in mind that a "normal" or "fair" PE ratio isn’t the same for every company. Factors such as growth expectations, perceived risk, and profitability all play a role. Fast-growing or less risky firms can usually justify higher PE ratios, while companies facing uncertainty or limited growth potential might trade at lower levels.

LendingClub currently trades at a PE ratio of 19.3x. When compared to the Consumer Finance industry average of 10.4x and its peers’ average of 5.0x, LendingClub’s multiple is clearly higher. This signals that the market is pricing in a premium for future earnings or stability. However, the proprietary Fair Ratio from Simply Wall St, which blends factors like LendingClub’s earnings growth, industry, risk profile, margins, and market cap, comes in at 22.6x. This Fair Ratio is more tailored and insightful than basic peer or industry comparisons, since it accounts for the unique mix of attributes driving LendingClub’s valuation.

Comparing LendingClub’s actual PE ratio of 19.3x to its Fair Ratio of 22.6x, the shares appear undervalued at current levels based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LendingClub Narrative

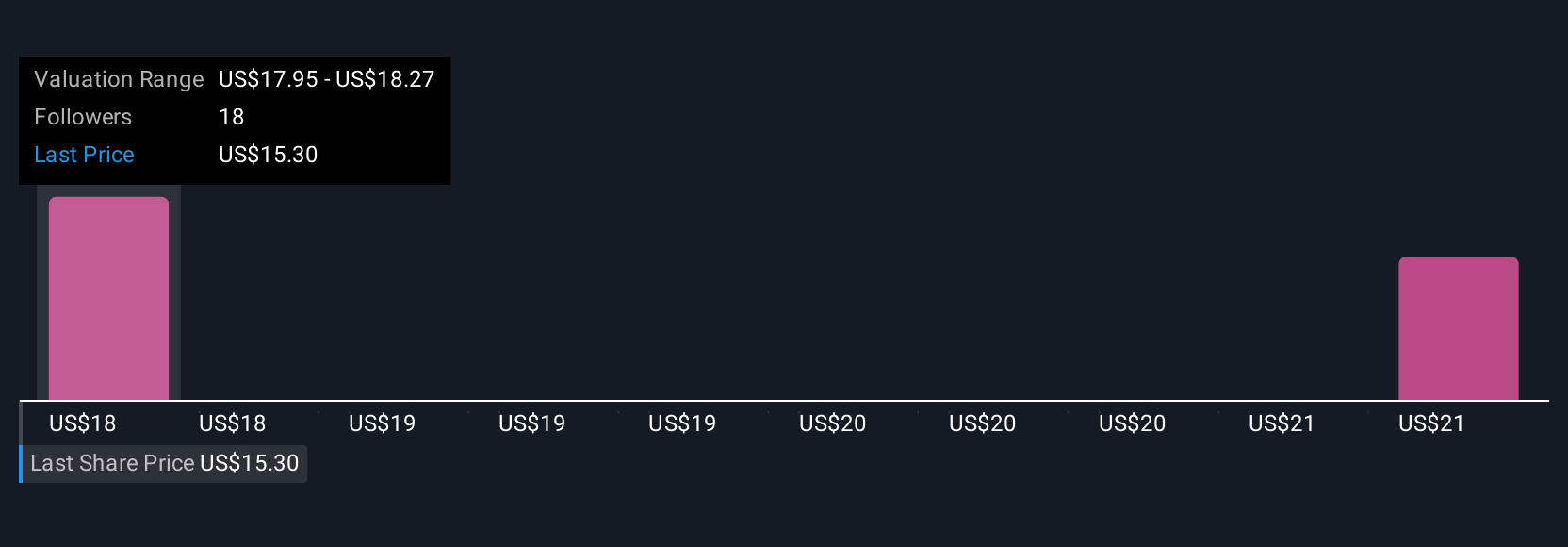

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story behind a company’s numbers; not just what you think about LendingClub’s fair value, but also why you believe its revenue, earnings, or margins will move a certain way in the future.

Unlike traditional valuation methods, Narratives help you connect the bigger picture and future outlook of LendingClub directly to a financial forecast and ultimately, a fair value. This approach is easy to use and available to everyone via the Community page on Simply Wall St, where millions of investors share and update their own Narratives.

With Narratives, you can compare your personalized Fair Value with LendingClub’s current share price to decide if it’s a buy, sell, or hold. Plus, Narratives automatically update as new information such as earnings or company news arrives, making sure your investment thesis evolves along with the market.

For example, some investors currently see LendingClub’s fair value as high as $21.00 due to optimism about its digital platform, while others see it as low as $15.50 because of concerns around competition and credit risk. The right Narrative gives you a clear, adaptive roadmap for investment decisions powered by your own research and logic.

Do you think there's more to the story for LendingClub? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives