- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Ladder Capital (LADR): 18.4% Revenue Growth Forecast Challenges Margin Pressure Narrative

Reviewed by Simply Wall St

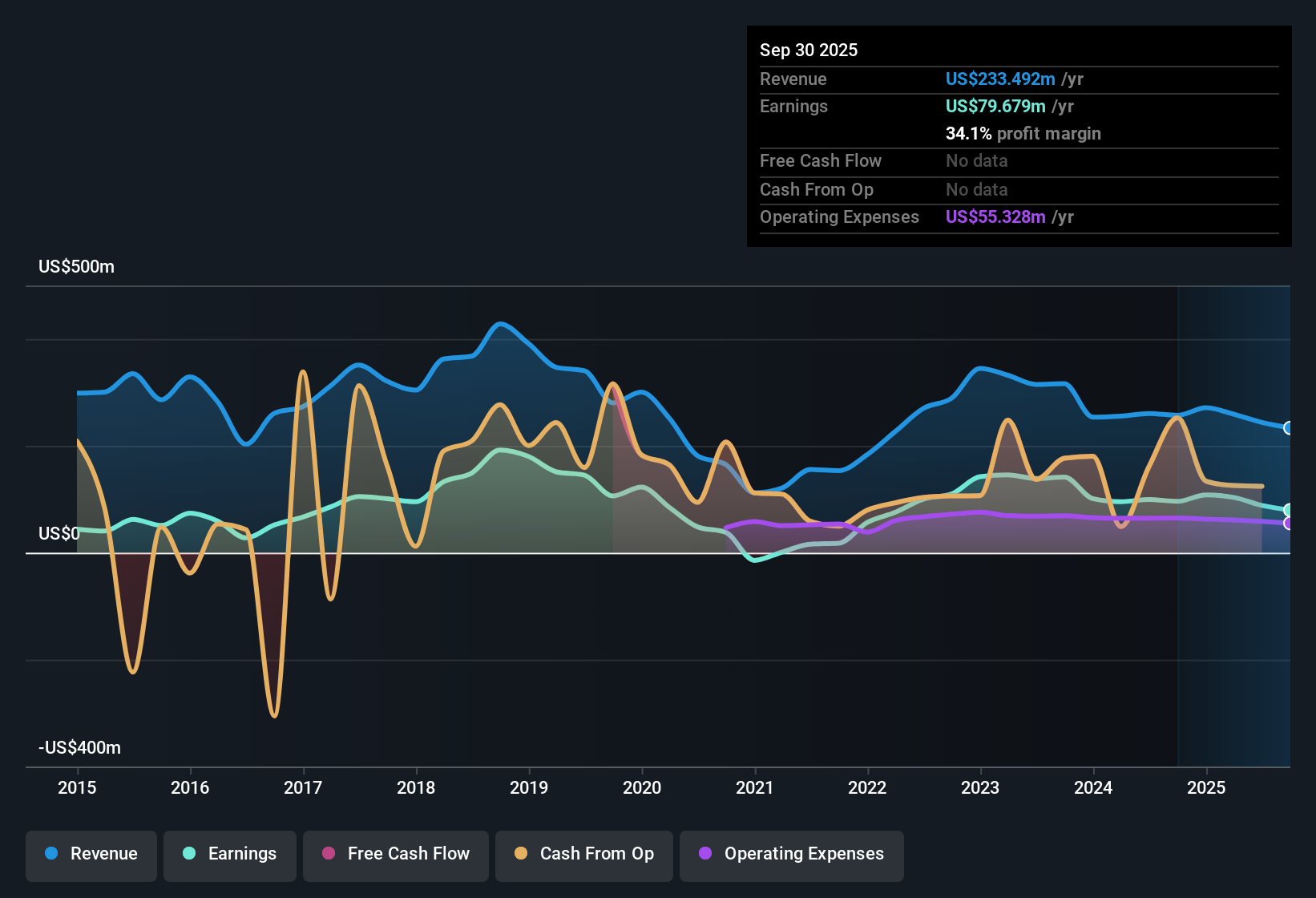

Ladder Capital (LADR) posted an 18.4% annual revenue growth forecast, well ahead of the 10% pace expected for the broader US market, even as net profit margins edged down from 38.2% to 36.3%. Over the past five years, the company’s earnings have grown by 26.1% per year, which stands out for consistency and quality. Despite shares currently trading at $11.03, below an estimated fair value of $15.57, LADR’s price-to-earnings ratio of 15.9x sits above both peer and industry averages, signaling an elevated valuation. Investors are watching closely as robust growth and long-term earnings quality meet headwinds from margin pressure and sector-relative pricing.

See our full analysis for Ladder Capital.Next up, we’ll see how these numbers measure up against the current narratives around LADR. Some expectations may hold, while others could be in for a reality check.

See what the community is saying about Ladder Capital

Credit Ratings Unlock Lower Debt Costs

- Recent credit ratings upgrades and successful unsecured bond deals have opened the door for Ladder to reduce its cost of debt, making it cheaper for the company to borrow and reinvest in higher-yielding property loans.

- Analysts' consensus view highlights that improved credit access enables Ladder to redeploy capital efficiently and support long-term earnings, but cautions remain ongoing as the company faces softening real estate fundamentals and continued credit risks.

- Lower borrowing costs give Ladder flexibility; however, the consensus holds that risks such as weaker occupancy trends and slower loan originations could still weigh on stability.

- The company’s diversified lending and portfolio approach helps offset risks, supporting steady revenue. Ongoing tightness in loan origination markets could constrain future net margin expansion.

- See how analysts’ consensus weighs these mixed signals for Ladder’s long-term outlook. Get the full narrative in one place. 📊 Read the full Ladder Capital Consensus Narrative.

Margin Compression Ahead Despite Growth

- Profit margins are forecast to fall from 36.3% now to 33.3% over the next three years, even as revenue is expected to grow at 11.8% per year. This reflects less profit for every dollar of new business.

- Analysts' consensus view points to this margin compression as a realistic headwind that tempers growth enthusiasm:

- Sustained commercial loan demand and urban real estate trends are providing a tailwind. However, the muted supply of new loan opportunities, credit risks, and higher capital costs are likely to reduce Ladder’s net operating leverage and keep profitability under pressure.

- Ongoing uncertainty in the commercial property market, especially in segments with overbuilding or slower rent growth, further challenges efforts to maintain previous profit levels.

Price Still Elevated Relative to Peers

- LADR’s price-to-earnings ratio of 15.9x remains above the peer average (11.7x) and industry average (13x) even with shares at $11.01. This indicates that, despite trading below DCF fair value ($15.27) and the analyst price target ($12.60), the market still assigns a premium relative to competitors.

- Analysts’ consensus view considers the narrow gap between current share price and target price as a sign that the stock is likely fairly priced, but warns that sector-relative valuation and Ladder’s weaker financial positioning make the margin for error slim:

- The pricing premium signals confidence in long-term growth and quality. Yet, ongoing concerns around dividend sustainability and balance sheet resilience could limit upside if operating conditions worsen.

- For new investors, caution is warranted given the relatively tight spread to consensus targets and challenges from sector headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ladder Capital on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Bring your insights to life in just a few minutes and share your unique perspective: Do it your way

A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ladder Capital faces headwinds from shrinking profit margins, elevated valuation, and concerns around balance sheet resilience compared to its peers.

For investors searching for stocks with stronger financial footing and less risk from balance sheet pressures, consider switching your focus to solid balance sheet and fundamentals stocks screener (1974 results) that could better weather challenging conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives