- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Did Ladder Capital's (LADR) Earnings Miss Signal a Shift in Its Growth Outlook?

Reviewed by Sasha Jovanovic

- Ladder Capital Corp reported its third quarter 2025 results on October 23, 2025, posting sales of US$26.67 million and net income of US$19.19 million, with diluted earnings per share of US$0.15.

- These results came in below consensus analyst estimates for both revenue and earnings, missing the projected earnings per share of US$0.23 and expected revenue of US$59.8 million.

- We'll assess how Ladder Capital's lower-than-expected quarterly revenue and earnings could influence its future lending growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ladder Capital Investment Narrative Recap

To be a shareholder in Ladder Capital today, you’d need to believe in the firm’s ability to grow its commercial real estate lending business despite ongoing headwinds, most notably, muted transaction activity and tight conditions in the lending markets. The latest quarterly results, which missed expectations for both revenue and earnings, could weigh on short-term confidence but do not appear to materially change the major risk: ongoing challenges in originations and net interest margin compression due to higher capital costs.

Among Ladder’s recent announcements, the upsized revolving credit facility to US$850 million stands out, especially amid volatility in earnings. This increased liquidity not only signals financial flexibility for navigating uncertain lending demand, but also directly supports the primary catalyst for the stock: the ability to reinvest at higher yields when market opportunities arise.

But on the other hand, investors should pay close attention to signs of persistent overbuilding and softness in key multifamily markets, as these could...

Read the full narrative on Ladder Capital (it's free!)

Ladder Capital's narrative projects $340.9 million in revenue and $113.5 million in earnings by 2028. This requires 11.8% yearly revenue growth and a $25.1 million increase in earnings from $88.4 million today.

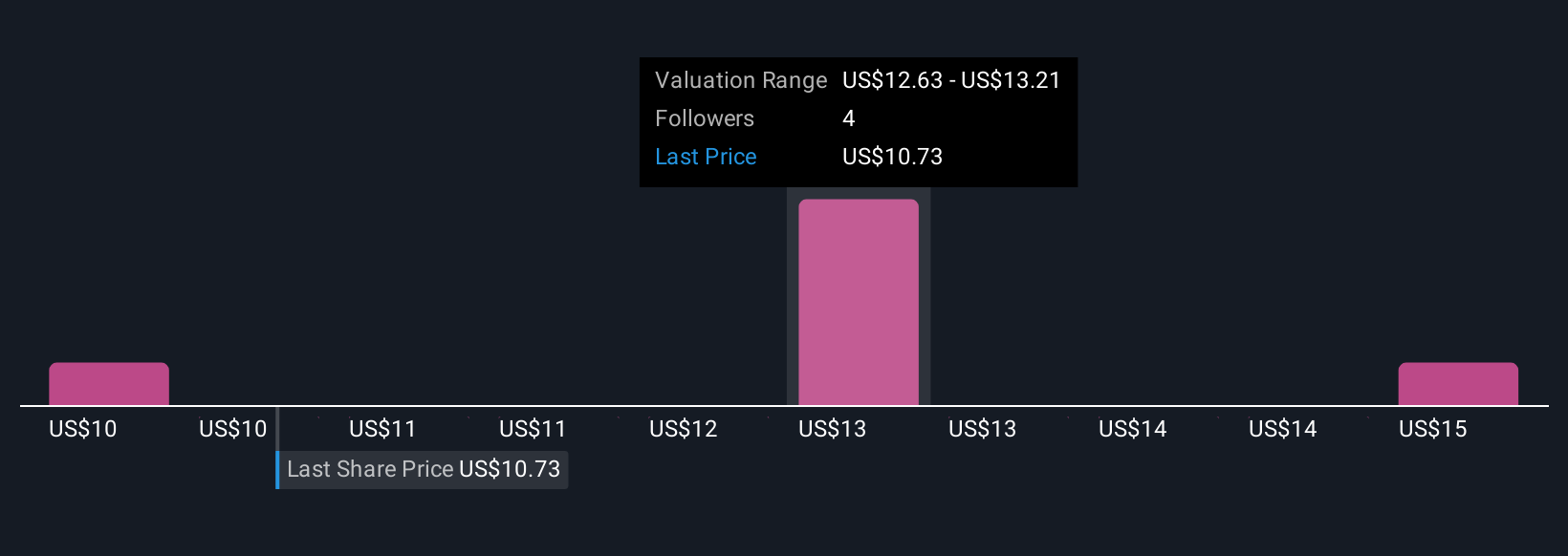

Uncover how Ladder Capital's forecasts yield a $12.83 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three unique fair value estimates for Ladder Capital, ranging from US$9.77 to US$15.67 per share. While this insight highlights broad differences in growth outlooks, the company’s muted loan origination pipeline and tight net interest margins remain key factors shaping performance, so consider a mix of views before deciding where opportunity or risk lies.

Explore 3 other fair value estimates on Ladder Capital - why the stock might be worth as much as 43% more than the current price!

Build Your Own Ladder Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ladder Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ladder Capital's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Low risk with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion