- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Assessing Ladder Capital (LADR) Valuation Following Recent Share Price Fluctuations

Reviewed by Simply Wall St

Ladder Capital (LADR) stock has seen some mild fluctuations lately, slipping just under 4% over the past month but still up 6% over the past year. Investors may be watching for underlying performance drivers as broader financial markets digest recent moves.

See our latest analysis for Ladder Capital.

Ladder Capital’s share price has cooled off slightly in recent weeks following a period of solid total shareholder returns. This reflects a market that may be pausing to reassess growth prospects against ongoing shifts in financial stocks. Momentum has moderated, but over the past year, shareholders have still come out ahead with overall gains. The 116% five-year total return highlights robust long-term performance.

If you’re curious about what other companies with strong momentum and insider conviction are doing, it’s a great time to discover fast growing stocks with high insider ownership

With the stock trading near analyst targets after years of solid returns, the question remains: is Ladder Capital undervalued with more room to run, or has the market already factored in its future growth?

Most Popular Narrative: 14.2% Undervalued

With the latest close at $11.01 and the most widely followed narrative's fair value pinned at $12.83, analyst consensus places the stock notably below their projection. The potential disconnect between current trading levels and anticipated growth is at the heart of this viewpoint.

The structural retreat of banks from commercial real estate lending is presenting attractive lending opportunities for non-bank REITs like Ladder. Greater loan demand and limited competition are expected to boost origination volumes and fee income, powering revenue and distributable earnings growth.

Wondering what ambitious assumptions drive this bullish outlook? The narrative is built on a series of optimistic forecasts for revenue, earnings, and margins that could push valuation multiples well above sector norms. Think you know what’s fueling this premium? See the full narrative for the details behind these bold projections.

Result: Fair Value of $12.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or a decline in multifamily rents could quickly challenge the optimistic growth outlook for Ladder Capital.

Find out about the key risks to this Ladder Capital narrative.

Another View: Multiples Raise Caution

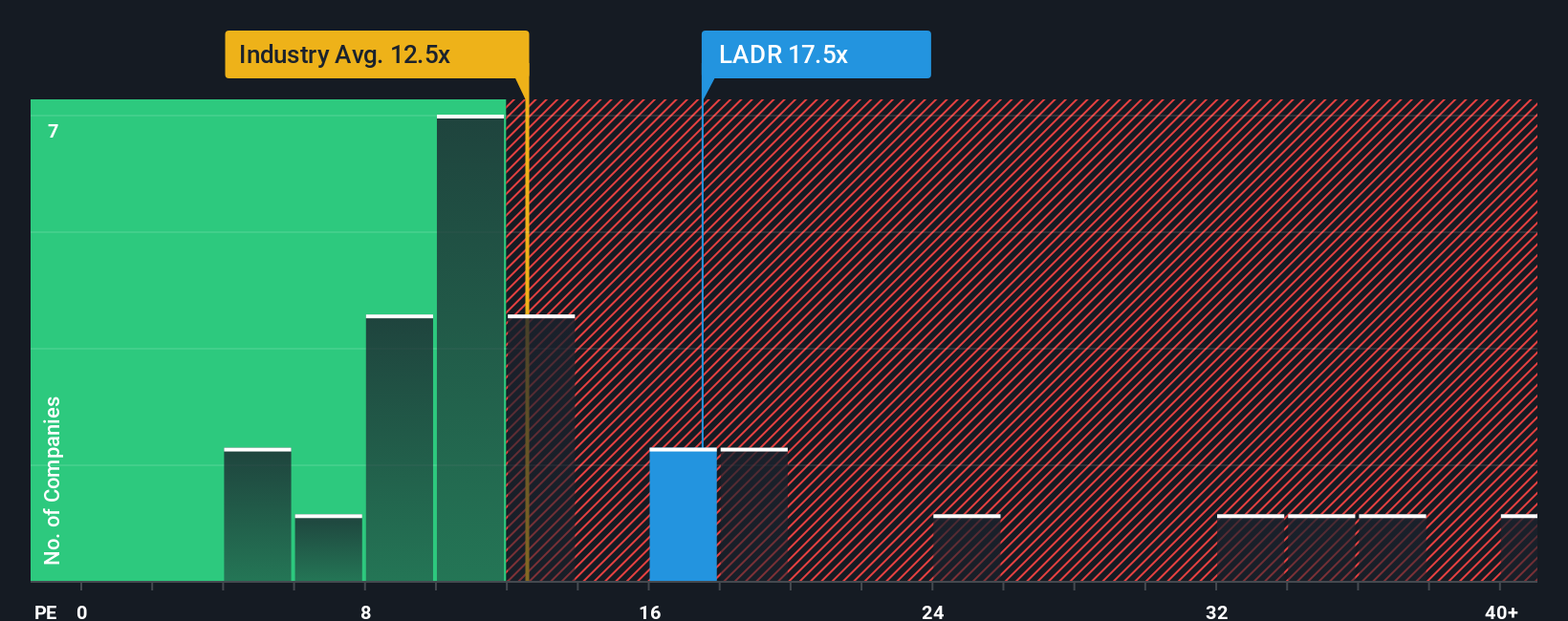

Taking a closer look at how Ladder Capital trades versus its peers, its price-to-earnings ratio stands at 17.6x, which is steeper than both the industry average (12.5x) and its peer group (12.3x). Even compared to its fair ratio of 12.5x, the current valuation looks relatively rich. This could mean the stock is pricing in strong future results. However, does that leave less room for upside or more risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ladder Capital Narrative

If you see things differently or want to investigate the numbers firsthand, you can piece together your own Ladder Capital story in just minutes. Do it your way

A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market and give yourself a smarter head start by acting now. These hand-picked stock ideas could be your next big win.

- Capitalize on the trend toward breakthrough automation and intelligence by tapping into these 27 AI penny stocks positioned at the forefront of innovation.

- Strengthen your portfolio with income opportunities. Target reliable companies offering yields above 3% by checking out these 17 dividend stocks with yields > 3%.

- Seize the potential in digital transformation as you browse these 80 cryptocurrency and blockchain stocks making waves in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives