- United States

- /

- Diversified Financial

- /

- NYSE:KLAR

Klarna (NYSE:KLAR): Evaluating Valuation as Shares Slide and Revenue Grows

Reviewed by Simply Wall St

Klarna Group (NYSE:KLAR) shares have been under quiet pressure this month, dipping nearly 14% over the past month. Investors are watching how the company's path to profitability evolves as annual revenue rises, even as net losses persist.

See our latest analysis for Klarna Group.

While Klarna Group’s share price has slid 13.8% over the past month, recent movements come after a tough year-to-date period that has seen a 19.1% drop in share price return. The persistent pressure suggests that markets are waiting for clarity on sustainable profitability and growth, even as the company continues posting higher annual revenues.

If you’re keeping an eye on these shifts, it could be a great moment to broaden your investing perspective and discover fast growing stocks with high insider ownership

But with annual revenues climbing and net losses narrowing, does Klarna Group currently trade at a discount that could reward patient investors? Or is the market already reflecting future growth prospects in the share price?

Price-to-Sales Ratio of 4.6x: Is it Justified?

Klarna Group’s current price-to-sales ratio stands at 4.6x, with shares trading at $37.07 per share. This level signals the market is pricing in lofty expectations compared to both peers and the broader industry.

The price-to-sales (P/S) ratio measures how much investors are paying per dollar of the company’s revenue. For high-growth fintech and diversified financials, this ratio can often be elevated, as the market anticipates accelerated revenue expansion or a future shift to strong profitability. However, it is also important to consider that an above-average P/S ratio may expose investors to downside if such rapid growth or margins do not materialize.

Klarna’s P/S ratio of 4.6x stands markedly above the US Diversified Financial industry average of 2.6x, as well as the average among its direct peers at 4.5x. This signals that, in the current market view, Klarna is pricing in even more ambitious growth and margin improvements than its competitors. Investors could be paying a premium here relative to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales Ratio of 4.6x (OVERVALUED)

However, slowing revenue growth or persistent net losses could put further pressure on valuations, especially if market expectations for rapid profitability remain unmet.

Find out about the key risks to this Klarna Group narrative.

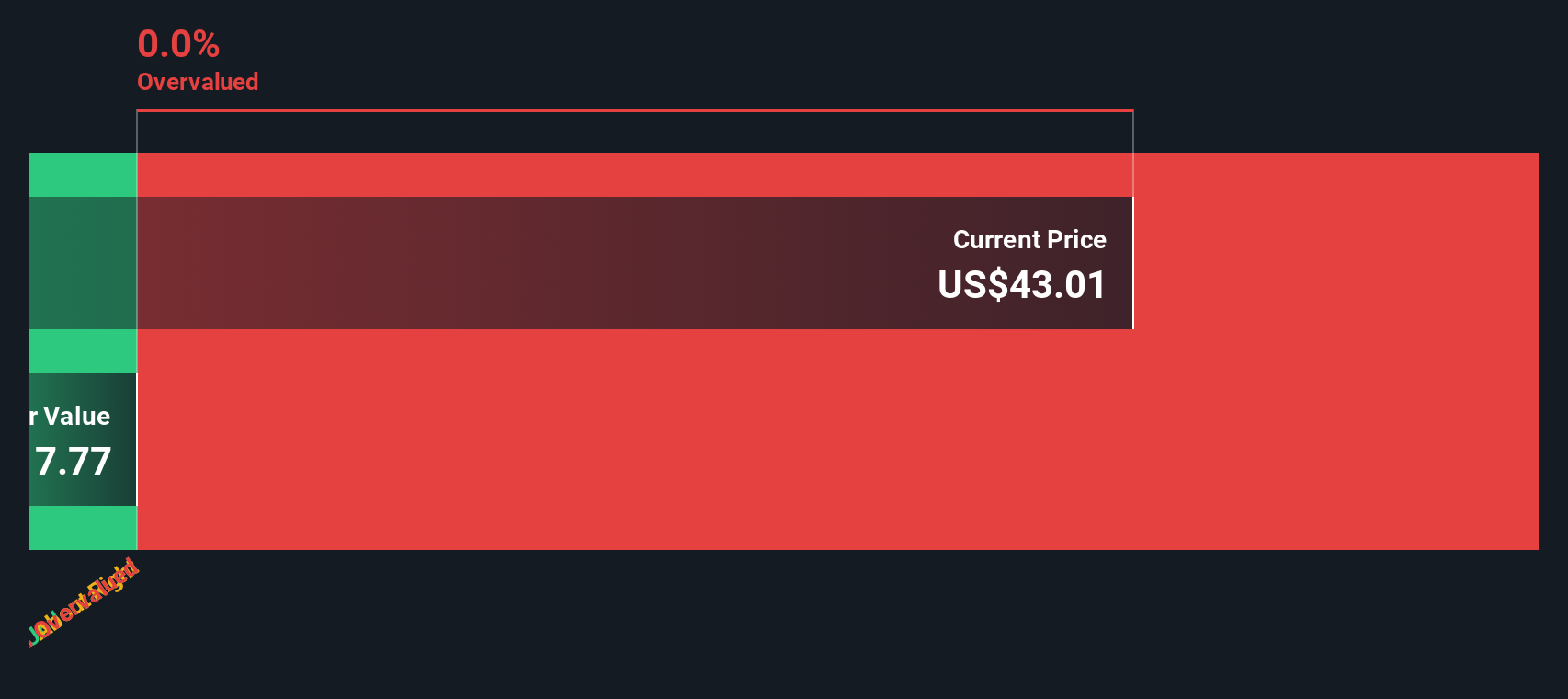

Another View: SWS DCF Model Suggests Significant Overvaluation

Looking through a different lens, the SWS DCF model offers a starkly contrasting perspective. It estimates Klarna Group's fair value at just $3.23 per share compared to the current price of $37.07. This result suggests the shares could be dramatically overvalued based on long-term cash flow forecasts. Does this mean the market is overly optimistic, or is there more to the Klarna story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klarna Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klarna Group Narrative

If you see things differently or want to dig deeper into the numbers, you can quickly craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Klarna Group.

Looking for more smart investment angles?

Don’t limit your insights to just one stock. Open up a world of market possibilities with top opportunities waiting for your attention right now.

- Capture potential with steady payouts and ongoing growth by viewing these 17 dividend stocks with yields > 3% that deliver attractive yields above 3% and strengthen your portfolio’s income stream.

- Uncover tomorrow’s industry disruptors by spotting these 24 AI penny stocks transforming entire sectors through artificial intelligence and groundbreaking automation.

- Stay ahead of the curve with picks poised for powerful rebounds by investigating these 879 undervalued stocks based on cash flows primed by strong fundamentals but overlooked by the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klarna Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KLAR

Klarna Group

Operates as a technology-driven payments company in the United Kingdom, the United States, Germany, Sweden, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives