- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR (KKR) Is Up 9% In A Week After NIQ Global Files for US IPO – What's Changed

- NIQ Global, a consumer insights company backed by KKR and Advent International, has filed for an initial public offering in the United States, reflecting renewed activity in the US IPO market for private equity-backed firms as equities regain stability.

- This IPO filing signals that KKR and similar private equity owners are testing public markets again, indicating increased confidence in the environment for monetizing investments.

- We'll explore how KKR's opportunity to exit investments through IPOs like NIQ Global could reinforce its future earnings and monetization outlook.

KKR Investment Narrative Recap

To be a shareholder in KKR, you need to believe in the firm’s ability to grow earnings by monetizing investments despite volatility in global markets and a challenging macro environment. The recent filing for an IPO by NIQ Global, a company backed by KKR, points to the potential for renewed exit activity. While this signals incremental progress towards unlocking performance income, it does not meaningfully shift the most important short-term catalyst, which remains the pace and success of KKR’s broader monetization pipeline. The biggest risk is still market volatility delaying these monetizations.

Among KKR’s recent announcements, the news that Torrent Pharmaceuticals is in advanced negotiations to acquire J.B. Chemicals & Pharmaceuticals, where KKR holds a large stake, stands out. This potential transaction directly ties into KKR’s short-term catalyst of realizing performance income from portfolio exits, especially as the firm looks to demonstrate its ability to crystallize value in a stabilizing market.

Yet, investors should pay close attention to the continued risk that, even as IPO or M&A windows reopen, unexpected global market volatility could still delay KKR’s plans and...

Read the full narrative on KKR (it's free!)

KKR's forecast indicates revenue of $12.3 billion and earnings of $5.3 billion by 2028.

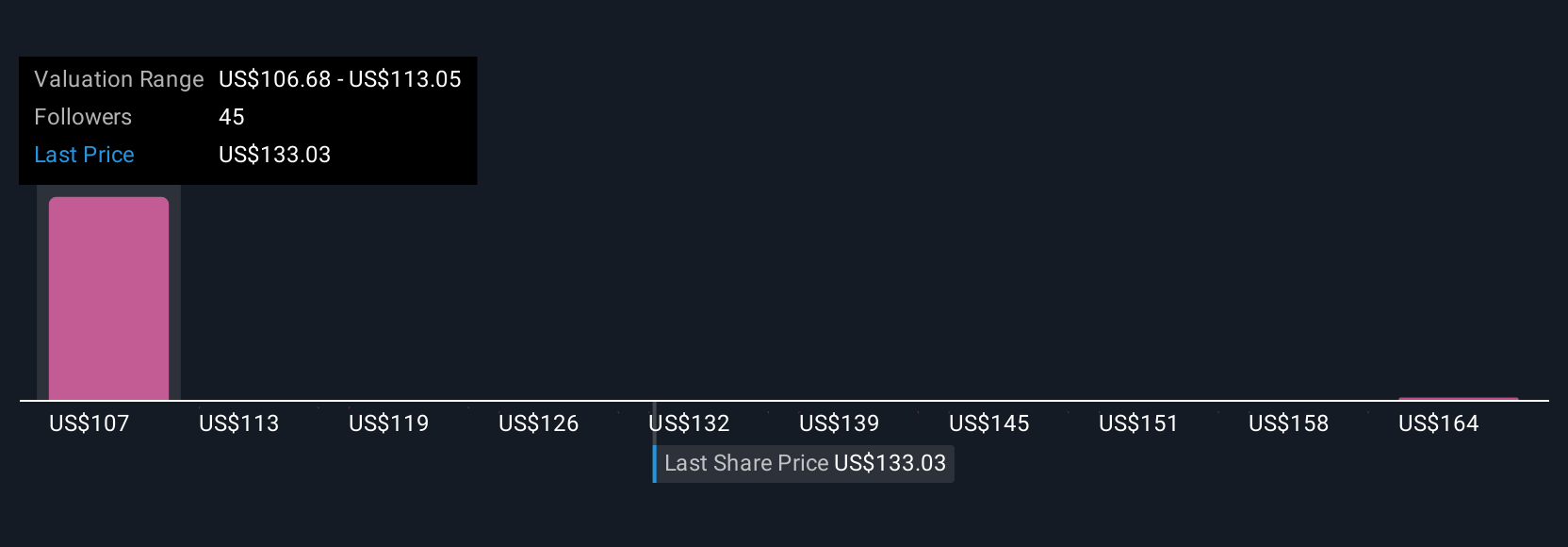

Uncover how KKR's forecasts yield a $106.68 fair value, a 21% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members placed fair value estimates on KKR between US$106.68 and US$170.36, reflecting significant variety across five independent views. At the same time, the company’s monetization pipeline remains central to near-term performance, making it worthwhile to compare these perspectives against potential market delays and liquidity events.

Build Your Own KKR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KKR research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free KKR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KKR's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives