- United States

- /

- Diversified Financial

- /

- NYSE:JXN

Is Jackson Financial’s Rally Justified After Solid Three-Year Return and Insurance Sector Momentum?

Reviewed by Bailey Pemberton

If you are keeping an eye on Jackson Financial and wondering whether now is the time to make a move, you are definitely not alone. In a market where financials see both enthusiasm and skepticism, Jackson stands out for its roller-coaster performance and intriguing fundamentals. The stock sits just above $96, showing modest movement in the past week with a 1.4% uptick, though it was down slightly at 0.5% for the past month. Taking a broader view, the year-to-date return is 9.7%, and over the past three years, the return is an impressive 230.9%.

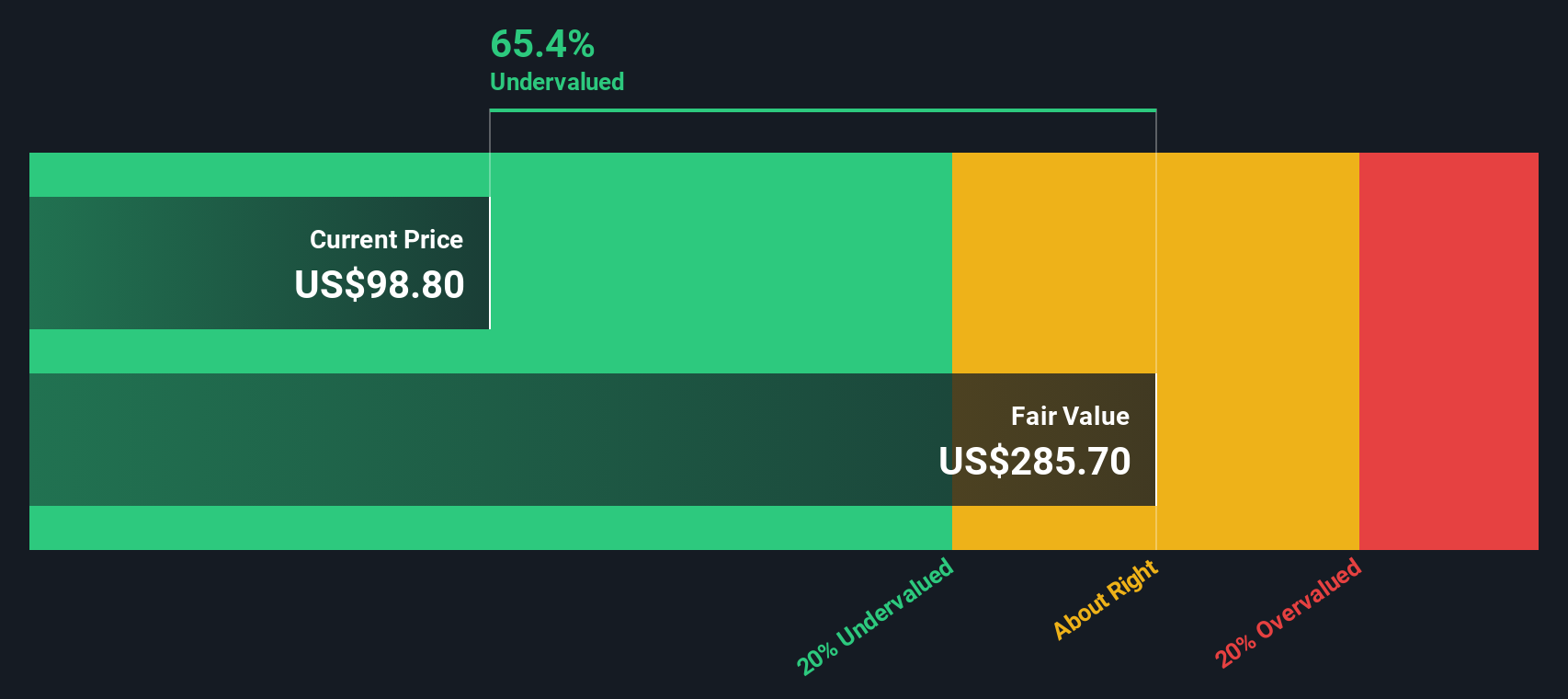

That kind of growth is bound to spark questions. Is the rally sustainable, or is risk increasing as well? Recent positive sentiment in markets toward insurance providers like Jackson may be helping boost investor confidence, especially with rising awareness about retirement planning and the role of annuities. There is growing debate over whether these tailwinds truly reflect the company’s value. It is also hard to ignore Jackson’s strong valuation score; an impressive 5 out of 6 checks suggest this stock is undervalued by several key measures.

So, is Jackson Financial a bargain hiding in plain sight, or is the crowd seeing something you are missing? Let us examine the different ways the market and analysts measure what this company is really worth, and consider a smarter approach to valuation that may provide clearer insight by the end of the article.

Why Jackson Financial is lagging behind its peers

Approach 1: Jackson Financial Excess Returns Analysis

The Excess Returns valuation method focuses on how much more Jackson Financial earns on its equity than it pays out in cost of capital, highlighting the company’s ability to create value for shareholders. This model emphasizes the return on invested capital, sustainable earnings, and long-term growth prospects rather than just current profits.

Jackson Financial shows a strong financial profile with a book value of $140.38 per share and a stable earnings per share (EPS) of $23.20. These numbers are based on the median return on equity from the past five years, demonstrating consistent profitability. The cost of equity stands at $13.51 per share, leading to an annual excess return of $9.69 per share. The average return on equity is a robust 13.19%, and future estimates suggest the stable book value could reach $175.93 per share according to weighted projections from two analysts.

Using this model, Jackson Financial’s intrinsic value is calculated at $386.65 per share. With the current market price sitting just above $96, the stock appears about 75.1% undervalued according to the Excess Returns approach. This substantial discount may attract investors who see potential in the company’s ability to maintain its outperformance over time.

Result: UNDERVALUED

Our Excess Returns analysis suggests Jackson Financial is undervalued by 75.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Jackson Financial Price vs Sales

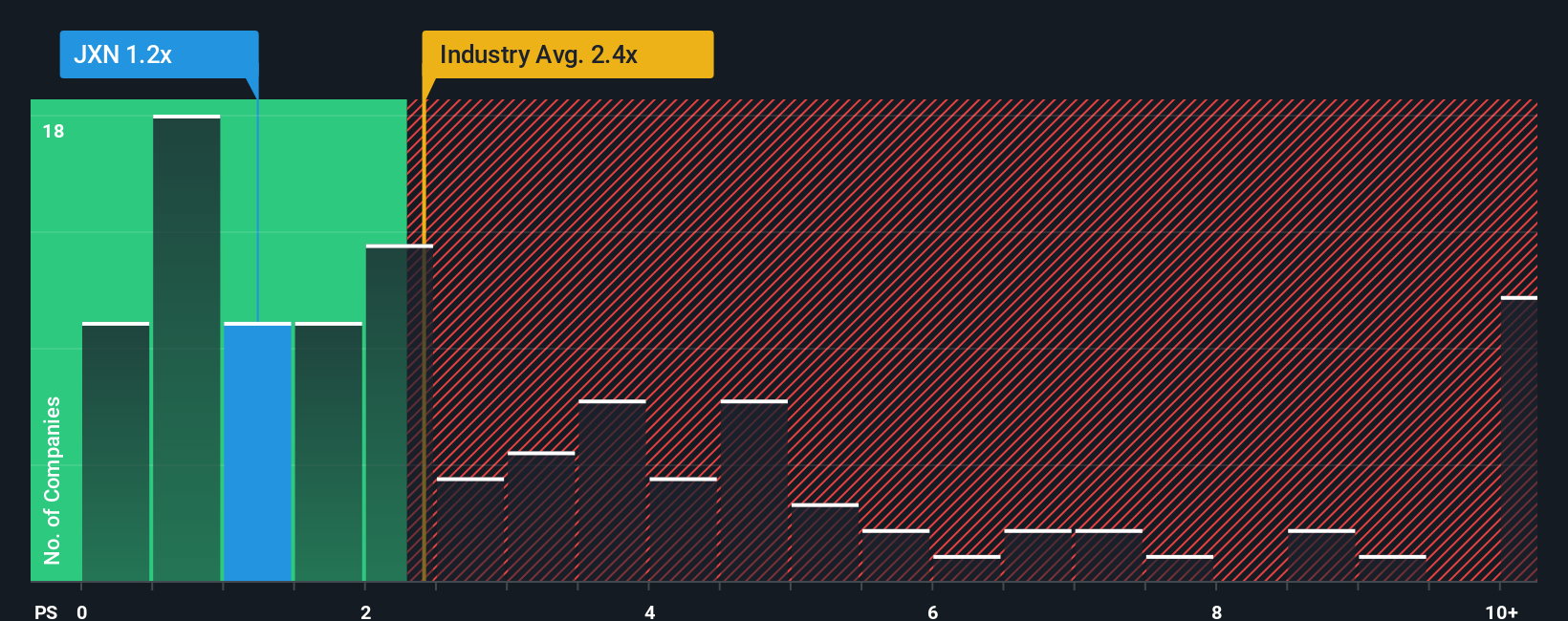

The Price-to-Sales (P/S) ratio is often considered a reliable yardstick for valuing profitable companies, especially in the financial sector where revenues are less affected by accounting differences than earnings. It helps investors compare companies of varying profitability or spot undervalued opportunities among insurers with similar business models but differing growth trajectories.

Interpreting the P/S ratio requires an understanding of expectations for growth and overall industry risk. Generally, companies poised for higher revenue growth or with more stable outlooks will trade at higher multiples. Conversely, increased risks or lower sales momentum may justify a lower P/S ratio as “normal.”

Currently, Jackson Financial trades at a P/S ratio of 1.18x. This is slightly below both the peer average of 1.27x and the broader Diversified Financial industry average of 2.49x. However, simply benchmarking these numbers against the industry or similar companies might not tell the full story.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio builds on traditional comparisons by factoring in Jackson’s profit margin, growth outlook, industry context, and market cap, providing a more tailored baseline than industry averages or peer multiples. For Jackson, the Fair Ratio is calculated at 2.48x, which is well above its current 1.18x. This suggests that the stock’s valuation is conservative given its circumstances.

Looking at these figures together, Jackson Financial’s current price appears to undervalue its future prospects and operational strengths when using the P/S ratio.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jackson Financial Narrative

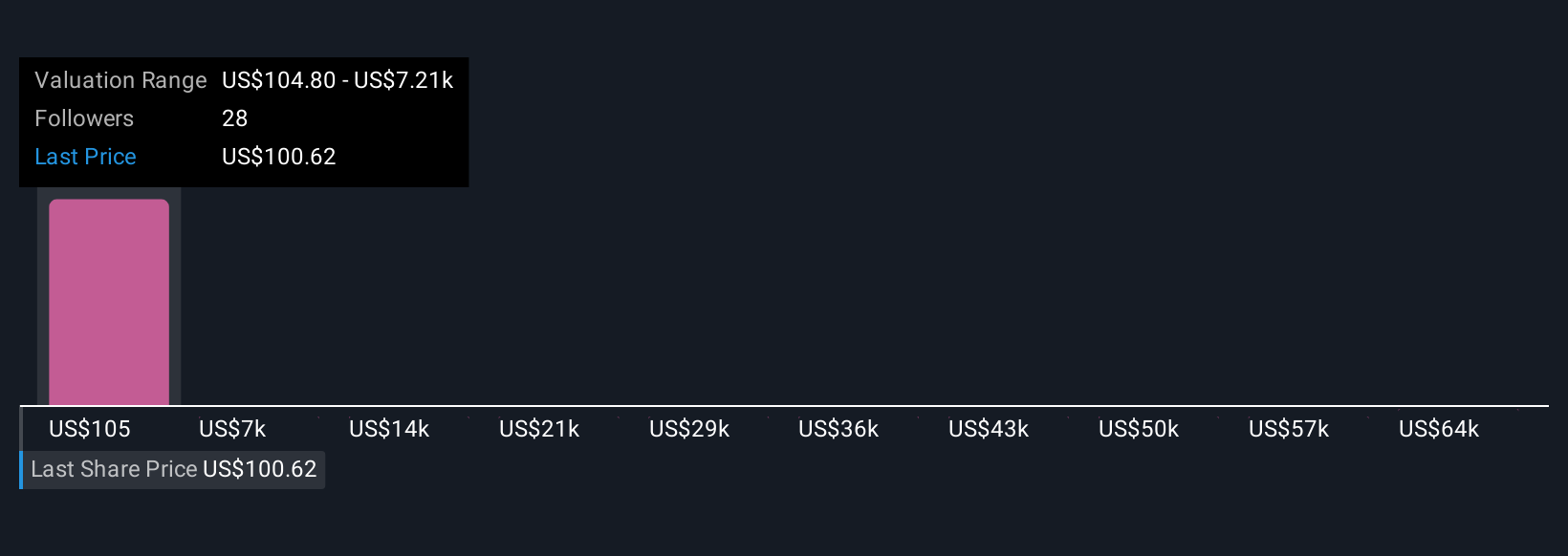

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a powerful yet simple tool that connects your personal outlook on a company with financial forecasts and an estimated fair value in a clear, story-driven format.

A Narrative is more than just a set of numbers; it is your story and expectations for Jackson Financial, guiding you through future revenue, earnings, and margin estimates with your unique perspective in mind. By explicitly linking what you believe about a company’s business drivers to quantifiable forecasts, Narratives help turn your outlook into actionable insights.

Narratives are available on Simply Wall St’s Community page and are used by millions of investors looking for a smarter, accessible way to invest. They help you decide when to buy or sell by dynamically comparing your Narrative’s Fair Value to the current share price, and automatically update these insights when new news or earnings data arrives, keeping you in step with market developments in real time.

For example, some Jackson Financial Narratives in the community reflect strong optimism with a fair value of $118, based on accelerating annuity sales and digital expansion. Others take a more cautious view, expressing concerns about fee pressure and regulatory risk to arrive at a fair value closer to $95. This illustrates how different stories can lead to different investment conclusions.

Do you think there's more to the story for Jackson Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JXN

Jackson Financial

Through its subsidiaries, provides suite of annuities to retail investors in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives