- United States

- /

- Capital Markets

- /

- NYSE:JEF

Could Jefferies' (JEF) Debt Issuance Reveal More About Its Approach to Managing Disclosure Risk?

Reviewed by Sasha Jovanovic

- Earlier this week, Jefferies Financial Group Inc. completed two fixed-income offerings totaling approximately US$12.63 million, issuing 5.50% and 6.00% senior unsecured notes due in 2035 and 2045, respectively.

- This development comes amid a securities investigation into Jefferies and its trade finance arm concerning possible misstatements about their exposure to the recently bankrupt First Brands Group.

- We'll explore how potential legal and disclosure risks from the investigation could shape Jefferies' investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Jefferies Financial Group's Investment Narrative?

To invest in Jefferies Financial Group, you need to believe in its position as an experienced financial services operator, with a broad strategic footprint, particularly with recent moves like expanding its alliance with SMBC and steady dividend payments. However, the recent securities investigation tied to Jefferies’ exposure to First Brands Group’s bankruptcy could shape near-term sentiment and risk perception. While the company’s just-completed fixed-income offerings point to ongoing access to capital markets, this legal development introduces headline risk and could impact investor confidence, at least until more details emerge. That could put extra scrutiny on the board, which already draws some debate for its composition and oversight amid slowing revenue growth compared to peers. The biggest catalysts, potential incremental SMBC investment and operational integration, may now be viewed with greater caution until there’s clarity on potential legal liabilities.

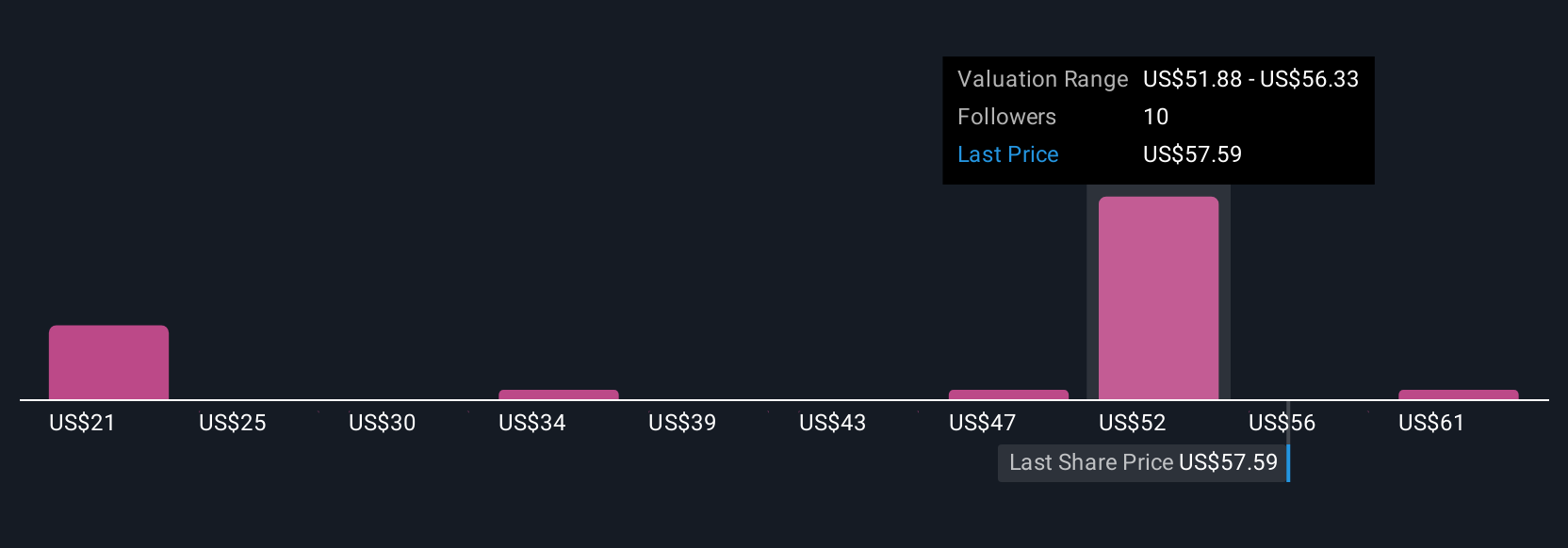

But with regulatory investigations making headlines, there are risks here investors shouldn't overlook. Jefferies Financial Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth as much as 15% more than the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success