- United States

- /

- Capital Markets

- /

- NYSE:ICE

New ICE (ICE) Mortgage-Backed Indices: Will Transparency Drive Institutional Growth or Intensify Competition?

Reviewed by Sasha Jovanovic

- Earlier this month, AGNC Investment Corp. announced the launch of new fixed income indices developed in partnership with Intercontinental Exchange, tracking the performance of current coupon Agency mortgage-backed securities across various maturities and issuing agencies.

- This collaboration expands ICE's reach within the fixed income market, potentially attracting institutional clients seeking transparent benchmarks for agency mortgage-backed securities.

- We'll assess how the introduction of these fixed income indices may enhance ICE's investment narrative and long-term market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Intercontinental Exchange Investment Narrative Recap

To be a shareholder in Intercontinental Exchange, you have to believe in the ongoing value of its expansive trading platforms, data services, and indices as markets evolve toward digital, data-driven solutions. The recent partnership with AGNC to launch fixed income indices adds to ICE’s product breadth, catering to institutional demand for transparent benchmarks; however, this development does not materially affect ICE’s most important near-term catalyst, which continues to be the growth in electronic trading and robust transaction volumes. Key risks still center on mortgage technology headwinds and integration challenges from acquisitions, which remain unchanged by this news.

Among recent announcements, ICE’s launch of the NYSE Elite Tech 100 Index in July 2025 stands out for its relevance. Like the AGNC partnership, this expands ICE’s indexing capabilities, a segment increasingly important as clients seek diverse benchmarking solutions supporting recurring data revenue. These moves collectively play into ICE’s growth catalysts but do not shift the central dependency on transaction volume expansion and successful integration of acquisitions.

Conversely, investors should be mindful that growing investment in data and technology infrastructure may become a drag if...

Read the full narrative on Intercontinental Exchange (it's free!)

Intercontinental Exchange's outlook forecasts $11.4 billion in revenue and $4.1 billion in earnings by 2028, driven by a 5.7% annual revenue growth rate and a $1.1 billion increase in earnings from the current $3.0 billion.

Uncover how Intercontinental Exchange's forecasts yield a $199.25 fair value, a 25% upside to its current price.

Exploring Other Perspectives

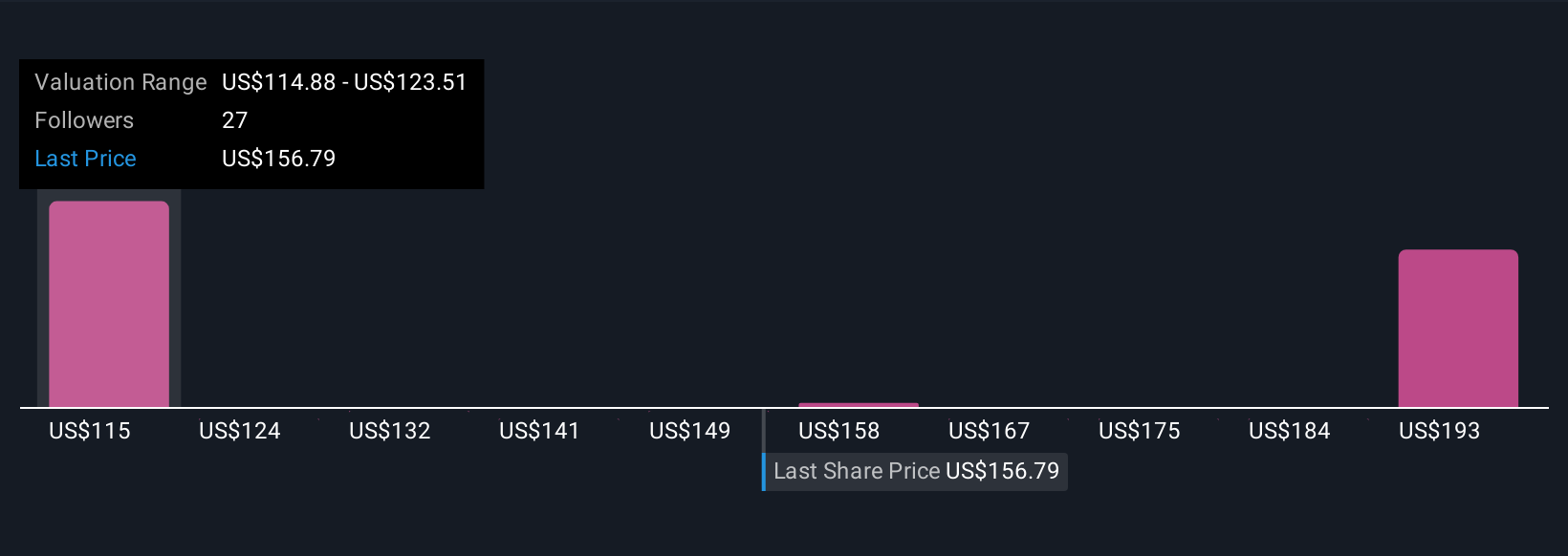

Six fair value estimates from the Simply Wall St Community range between US$114.87 and US$199.25 per share. While community sentiment varies, continued reliance on trading volume growth highlights the broad implications of successful product expansion and integration for ICE’s future performance.

Explore 6 other fair value estimates on Intercontinental Exchange - why the stock might be worth 28% less than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intercontinental Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercontinental Exchange's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives