- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (ICE): Assessing Valuation After Strong Q3 Results and Dividend Increase

Reviewed by Simply Wall St

Intercontinental Exchange (ICE) delivered higher revenue and net income in its third quarter compared to last year, helped by better-than-expected results in its core Exchanges segment. The company also announced an increased quarterly dividend, which signals growing confidence.

See our latest analysis for Intercontinental Exchange.

Intercontinental Exchange has been busy, completing two sizable fixed-income offerings and announcing a 7% dividend increase, all on the heels of a strong earnings beat. Although the most recent quarter showcased higher revenues and upbeat profit growth, momentum in the share price has faded. After a modest bounce from earnings, the 90-day share price return is down 15.7%, and total shareholder return over the past year is essentially flat. However, the company’s longer-term trajectory remains compelling, with a 54% total return over three years and 65% over five years. This pattern suggests that short-term volatility is less important than the robust longer-term creation of value.

If you’re curious where strong performance could show up next, now might be the perfect opportunity to broaden your investing radar and discover fast growing stocks with high insider ownership

With shares still trading nearly 25% below consensus analyst price targets, investors now face a familiar question: Is Intercontinental Exchange undervalued after a lackluster year, or has the market already priced in the company’s growth potential?

Most Popular Narrative: 19.9% Undervalued

Intercontinental Exchange’s most popular narrative sets a fair value considerably higher than the last close, based on sizable profit and recurring revenue projections. While the market lags behind, the narrative’s framework presumes robust, technology-driven expansion still lies ahead. Here is a key point shaping this outlook:

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification, which are likely to drive sustained double-digit growth in transaction revenues and operating leverage.

Curious about which aggressive growth assumptions make this valuation tick? The narrative leans on rising profits, margin upgrades, and a future earnings multiple typically reserved for the biggest disruptors in finance. Find out what makes this prediction so bold. Discover the numbers behind the headline.

Result: Fair Value of $192.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory shifts and rising tech infrastructure costs could challenge ICE’s margin expansion and potentially disrupt its otherwise optimistic growth trajectory.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: What Does the SWS DCF Model Say?

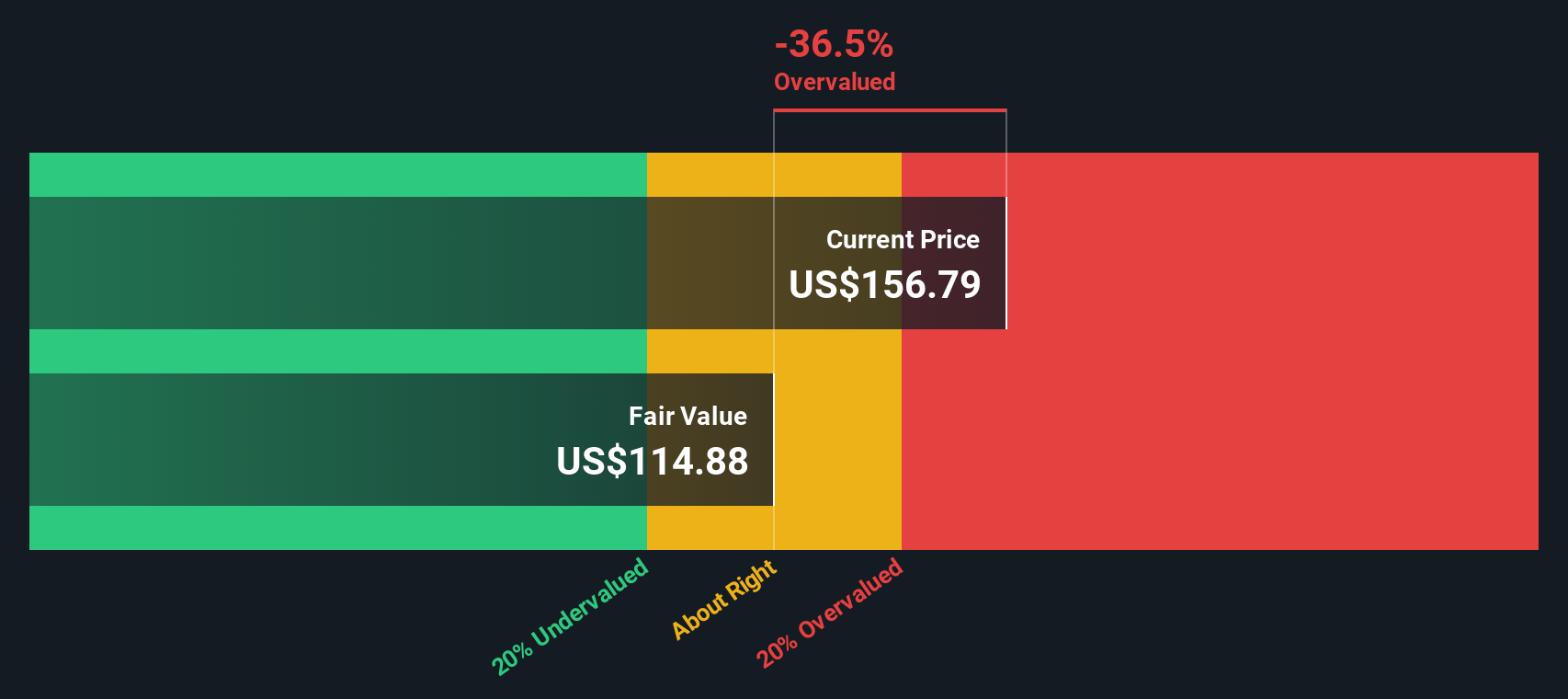

While analysts see Intercontinental Exchange as undervalued, our DCF model paints a different picture. According to this method, ICE trades above its fair value estimate of $115.76. This suggests the market may be factoring in more optimism than the fundamentals support at the moment. Does this mean upside is limited, or could reality outpace projections?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intercontinental Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intercontinental Exchange Narrative

If you want to challenge the consensus or follow your own intuition, you can build your narrative from scratch in just a few minutes. Do it your way

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors act before the crowd by uncovering promising ideas early. Sharpen your edge and avoid missing what could be the next winning theme with these three handpicked ways to supercharge your portfolio research using Simply Wall Street’s powerful screeners.

- Catch tomorrow’s leaders by checking out these 882 undervalued stocks based on cash flows, where companies trading below their intrinsic worth could deliver significant upside.

- Maximize steady income potential as you scan these 14 dividend stocks with yields > 3% for businesses offering robust yields above 3% and reliable payout histories.

- Grab your place at the forefront of tech with these 27 AI penny stocks that are poised to disrupt industries and shape the future of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives