- United States

- /

- Capital Markets

- /

- NYSE:HLI

Is Houlihan Lokey’s Recent 9.6% Drop a Signal or a Short-Term Setback?

Reviewed by Bailey Pemberton

- Curious if Houlihan Lokey's stock is a hidden gem or already fully priced? You're not alone, as investors across the board are keen to understand where value still exists in today's market.

- Despite a stellar track record over the past 3 and 5 years (up 106.0% and 204.2%, respectively), the stock is currently down 9.6% over the last week and 8.9% in the past month, prompting fresh conversations about growth potential and shifting risk perceptions.

- Recent news has highlighted the company's evolving strategy as it navigates a changing financial landscape, with commentators spotlighting management's efforts to maintain market relevance amid industry shifts. This has provided extra context to recent price movements, showing the stock is reacting to both sector trends and company-specific headlines.

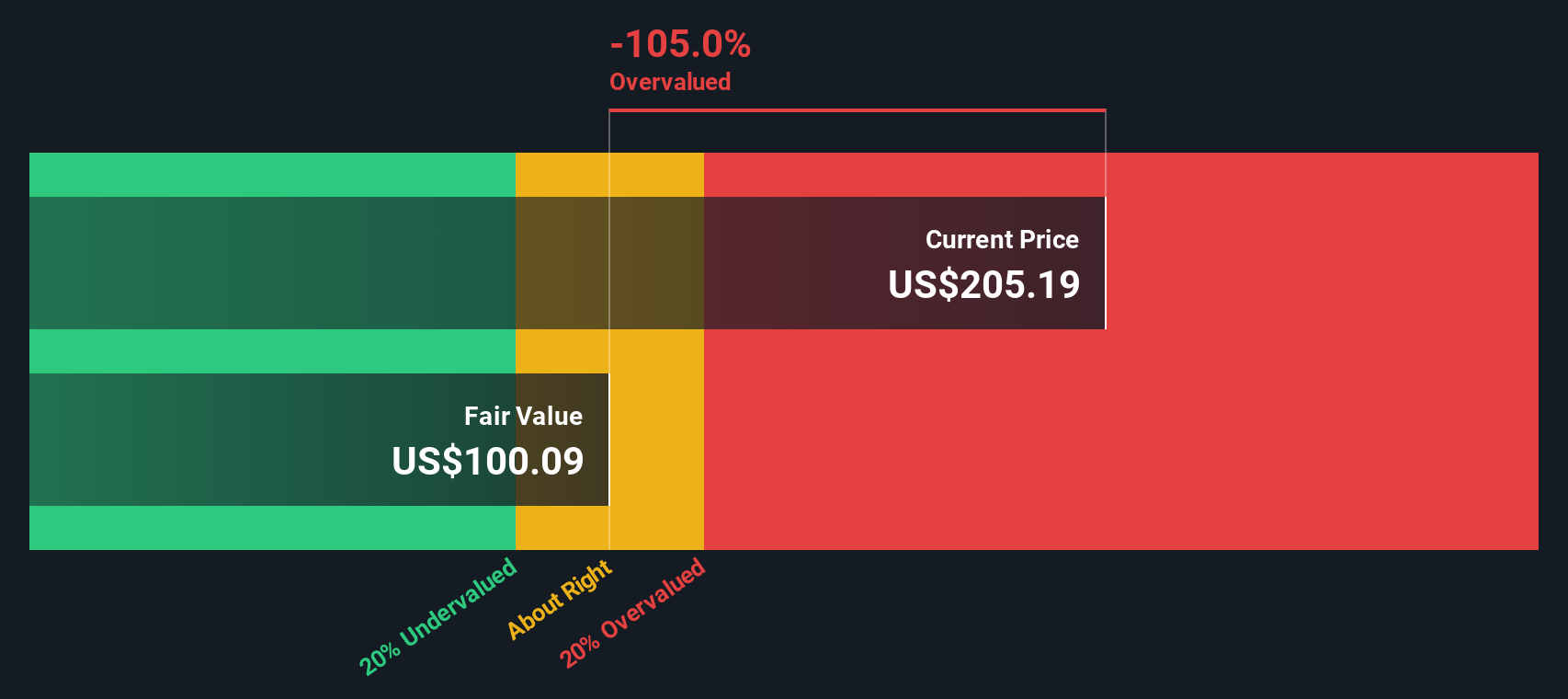

- On our valuation checks, Houlihan Lokey scores 0 out of 6 for undervaluation, meaning none of our standard methods show it as cheap right now. However, there are several ways to approach the concept of "value" so make sure to stick around for an even more insightful perspective on valuation at the end of this article.

Houlihan Lokey scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Houlihan Lokey Excess Returns Analysis

The Excess Returns valuation approach measures how much profit a company generates above the cost of its equity, using this figure to estimate intrinsic value per share. For Houlihan Lokey, this model highlights whether the company is creating genuine shareholder value through its returns relative to the capital invested.

Key figures for Houlihan Lokey include a Book Value of $32.04 per share and a Stable Earnings Per Share (EPS) of $5.97, calculated from the median Return on Equity over the past five years. The company's Cost of Equity stands at $2.86 per share, with an Excess Return of $3.11 per share, reflecting the earnings power the business generates above the required investor return. Over the same period, Houlihan Lokey’s average Return on Equity has been a robust 16.83%. Additionally, analysts estimate a future Stable Book Value of $35.48 per share.

According to this method, the current intrinsic value is significantly lower than the prevailing share price. This points to the stock being 82.9% overvalued based on excess returns. This suggests that the market has already priced in much of Houlihan Lokey’s growth prospects.

Result: OVERVALUED

Our Excess Returns analysis suggests Houlihan Lokey may be overvalued by 82.9%. Discover 841 undervalued stocks or create your own screener to find better value opportunities.

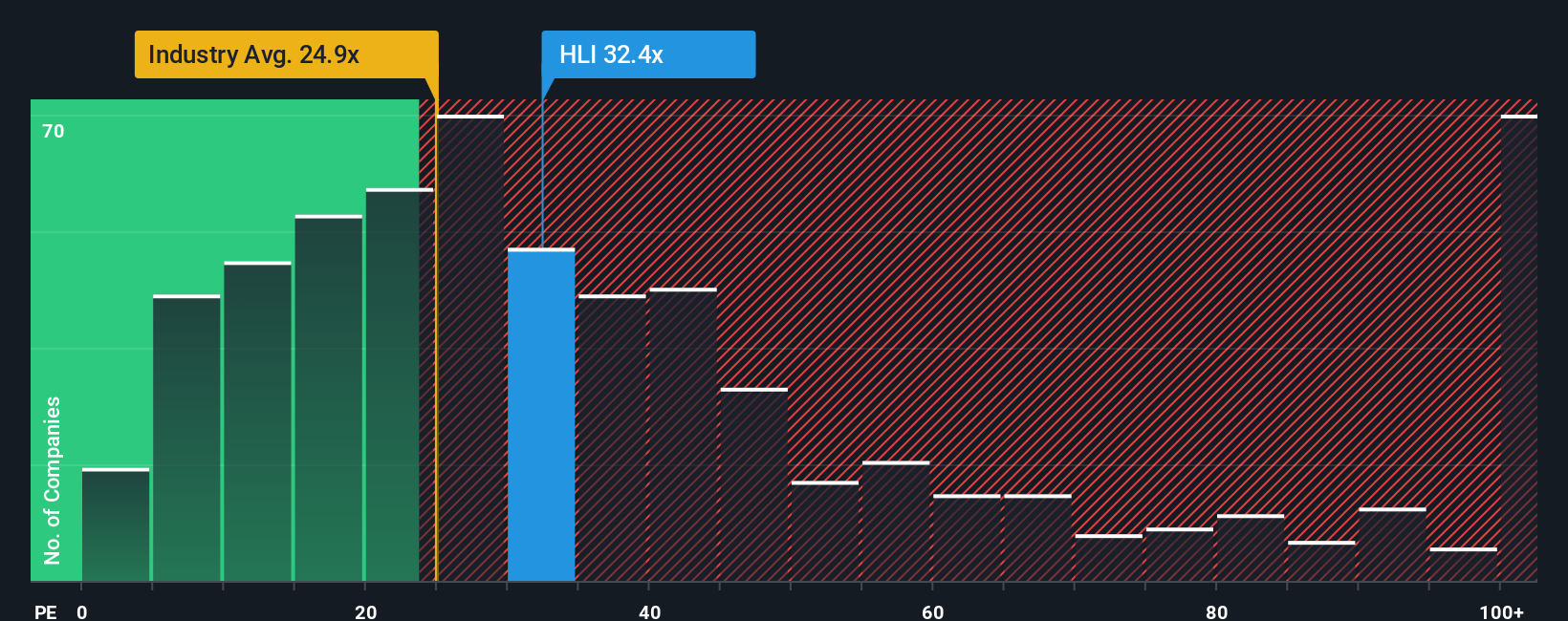

Approach 2: Houlihan Lokey Price vs Earnings

The price-to-earnings (PE) ratio is a go-to valuation metric for profitable companies like Houlihan Lokey because it connects a company's share price directly to its earnings. For investors, the PE ratio quickly answers the question: how much are you paying for each dollar of earnings? A higher PE might signal strong growth expectations, while a lower one could reflect risk or slower prospects. In other words, the “right” PE ratio isn’t one-size-fits-all; it depends on how much future growth and stability investors anticipate.

Current data shows Houlihan Lokey trading at a PE of 29.5x, compared to the Capital Markets industry average of 23.8x and a peer average of 17.4x. At first glance, this premium might seem high. That’s where Simply Wall St's “Fair Ratio” provides more context. The Fair Ratio for Houlihan Lokey stands at 16.4x, a figure determined using a proprietary model that weighs factors such as the company’s earnings growth, risks, profit margins, market cap, and industry characteristics. Unlike a simple industry or peer comparison, the Fair Ratio is personalized, helping spot situations where a premium or discount is justified.

Since the company’s current PE of 29.5x is substantially above the Fair Ratio of 16.4x, this approach suggests Houlihan Lokey is trading well above levels supported by its fundamentals. Investors may want to wait for a more attractive entry point or look for catalysts justifying the premium valuation.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Houlihan Lokey Narrative

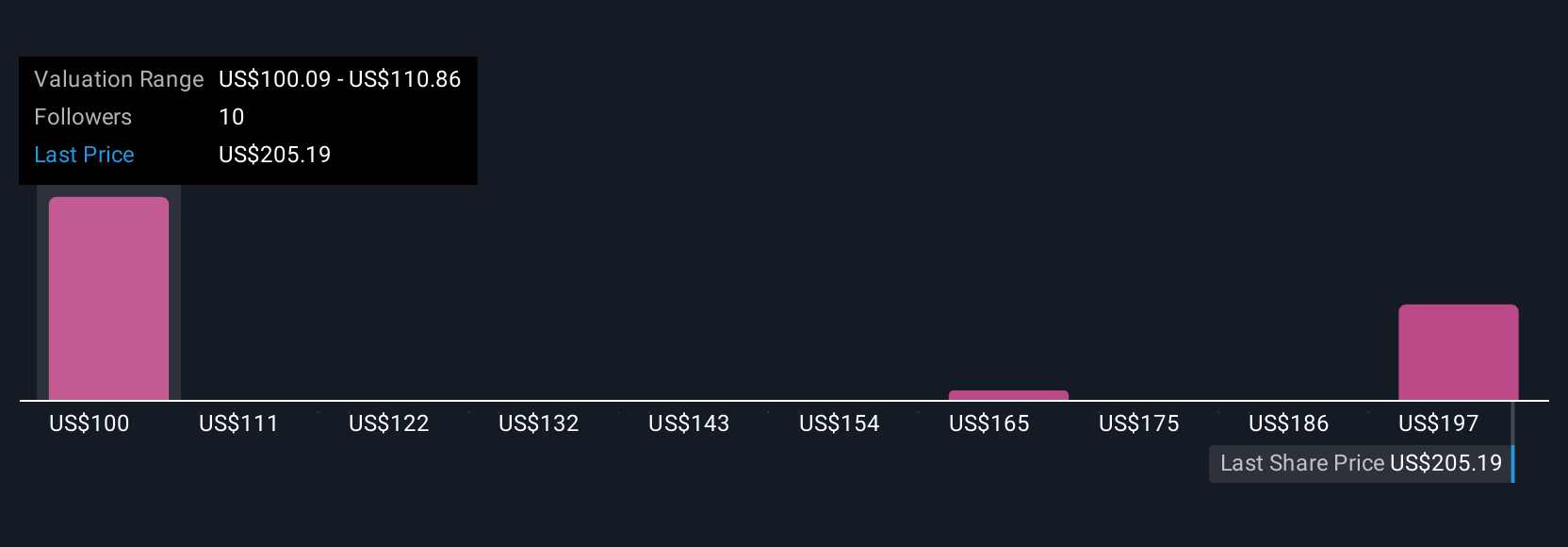

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives—a smarter, more dynamic way to guide your investment decisions. A Narrative is simply your own story about a company. It connects your beliefs about the business and future trends with numbers like fair value, revenue, earnings, and profit margins, turning hard data into an actionable outlook. On the Simply Wall St Community page, Narratives are easy for anyone to create or explore, making top-down investing accessible to millions.

With Narratives, you see how your outlook links directly to a financial forecast and fair value. When new information emerges, whether it is breaking news, quarterly results, or market shifts, Narratives automatically recalculate, keeping your view up to date. This means you can instantly compare your Fair Value with the current share price to decide if it is time to buy, hold, or sell.

For example, some investors are bullish, seeing Houlihan Lokey’s ongoing expansion and margin improvement as a catalyst for a future price as high as $232.00 per share, while more cautious voices worry about U.S. concentration and rising costs, resulting in a lower fair value of around $166.00. Narratives help you weigh up these different perspectives and make smarter, more confident decisions based on your personal thesis.

Do you think there's more to the story for Houlihan Lokey? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives