- United States

- /

- Capital Markets

- /

- NYSE:HLI

Houlihan Lokey (HLI) Valuation: Is There More Upside After Recent Share Price Stability?

Reviewed by Simply Wall St

Houlihan Lokey (HLI) shares have traded sideways over the past week, providing investors an opportunity to take a closer look at where the company stands. Recent performance trends could offer some useful clues for assessing its prospects.

See our latest analysis for Houlihan Lokey.

Zooming out, Houlihan Lokey’s share price is up 12.5% so far this year, supporting its strong 1-year total shareholder return of 15.3%. A remarkable 3-year total return of 153% shows the firm’s longer-term momentum is firmly intact. While shares have lost a bit of ground this month, the overall trend suggests investors remain confident in both growth potential and management’s ability to deliver results.

If strong long-term performance has you thinking about other leadership stories in the market, consider broadening your scope to discover fast growing stocks with high insider ownership

The question now is whether Houlihan Lokey’s strong run has left shares undervalued compared with their fundamentals, or if the market is already fully reflecting its future growth potential in the current price.

Most Popular Narrative: 8.6% Undervalued

Houlihan Lokey’s most widely followed narrative currently estimates a fair value that stands noticeably above the last close at $193. This setup suggests some analysts still see meaningful upside if growth expectations are realized.

Ongoing global expansion, sector diversification, and talent recruitment position Houlihan Lokey for sustained revenue growth and increased market share. Strong pipelines from succession planning, resilient restructuring activity, and enhanced client engagement are stabilizing fee income and supporting earnings despite macroeconomic shifts.

How do a global strategy, deal pipeline, and margin boost all add up for Houlihan Lokey's future? The secret sauce behind this valuation lies in bold growth bets and confidence in management’s next moves. Discover the powerful mix of assumptions that drive this attractive upside.

Result: Fair Value of $211.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high costs and slower international deal growth could limit Houlihan Lokey’s upside if global M&A trends fail to accelerate.

Find out about the key risks to this Houlihan Lokey narrative.

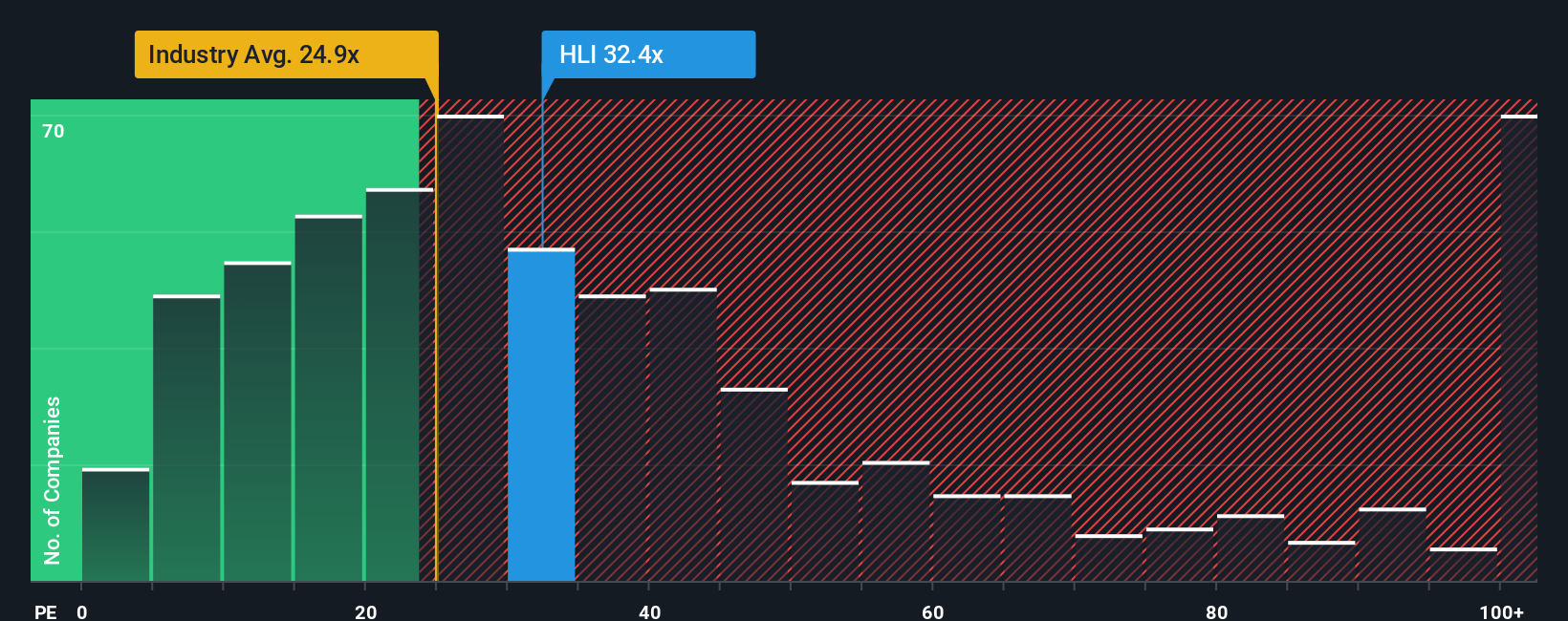

Another View: Expensive on Earnings Ratio

While the fair value estimate points to upside for Houlihan Lokey, a closer look at its price-to-earnings ratio tells a less optimistic story. Shares trade at 33.2 times earnings, well above both industry peers at 25.7x and the calculated fair ratio of 18x. That gap suggests the market is factoring in significant optimism, which may increase the risk if growth does not deliver as expected. Will investor confidence stand up to scrutiny if future results fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Houlihan Lokey Narrative

If you want to follow a different thread or dig deeper into your own research, you can easily build your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for More Investment Ideas?

Sharpen your next move and outpace the crowd by targeting opportunities others might miss. Let these smart screeners help you uncover your next winning investment.

- Capture market potential with these 877 undervalued stocks based on cash flows, offering strong cash flow and overlooked value in today’s fast-changing landscape.

- Tap into tomorrow’s technology boom by using these 24 AI penny stocks to spot innovative companies shaping artificial intelligence breakthroughs.

- Reap consistent returns by finding these 17 dividend stocks with yields > 3%, delivering healthy yields well above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives