- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Will Fed Rate Cut Hopes and Analyst Optimism Shift HA Sustainable Infrastructure Capital's (HASI) Growth Story?

Reviewed by Simply Wall St

- In the past week, HA Sustainable Infrastructure Capital drew investor attention as Federal Reserve Chair Jerome Powell's dovish remarks at the Jackson Hole symposium signaled possible interest rate cuts, easing concerns for rate-sensitive sectors.

- Analyst confidence remained strong following the company's Q2 2025 earnings, with multiple firms reiterating positive ratings despite some operational challenges and a robust business pipeline exceeding US$6 billion.

- We'll explore how expectations of lower interest rates might influence HASI's access to capital and its ongoing growth opportunities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

To be a shareholder in HA Sustainable Infrastructure Capital, you have to believe in the value of reliable capital access for sustainable projects and the company's ability to execute on a robust, growing pipeline now exceeding US$6 billion. The recent rally after the Fed Chair’s dovish Jackson Hole comments could prove a real short-term catalyst by softening capital costs for rate-sensitive firms like HASI, potentially easing one of the key restraints called out in earlier analysis. If expectations for lower rates hold, this shift may ease funding pressures and inject confidence into the company’s outlook, despite challenges such as reduced transaction activity and persistently high debt relative to operating cash flow. Investors should still weigh the risk of prolonged volatility in liquidity conditions should rate cuts not materialize or market optimism fade as quickly as it emerged.

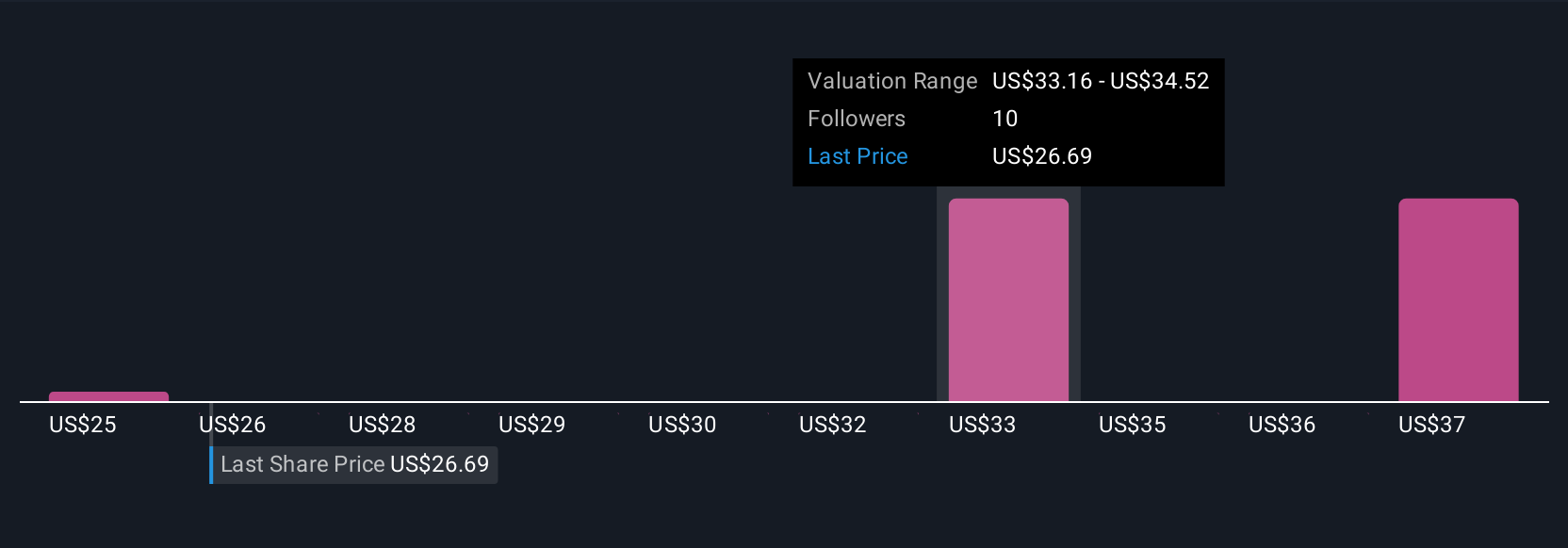

But, lower interest rates may not address all the company’s capital and profitability hurdles. HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth as much as 34% more than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives