- United States

- /

- Capital Markets

- /

- NYSE:GS

What Does Goldman Sachs' 34.6% Rally in 2025 Mean for Investors?

Reviewed by Bailey Pemberton

- Thinking about whether Goldman Sachs is a bargain or just riding the hype? Let’s dig into whether the numbers back up your curiosity.

- The stock has jumped 34.6% year-to-date and surged 31.0% over the past 12 months, even as it has seen a small dip of 2.1% in the last week.

- Recent headlines have been buzzing about the firm’s involvement in several high-profile investment deals and its push into wealth management. Both of these factors are shifting perceptions about its growth prospects. At the same time, shifts in the broader financial sector have added both excitement and uncertainty to Goldman Sachs’ recent share price performance.

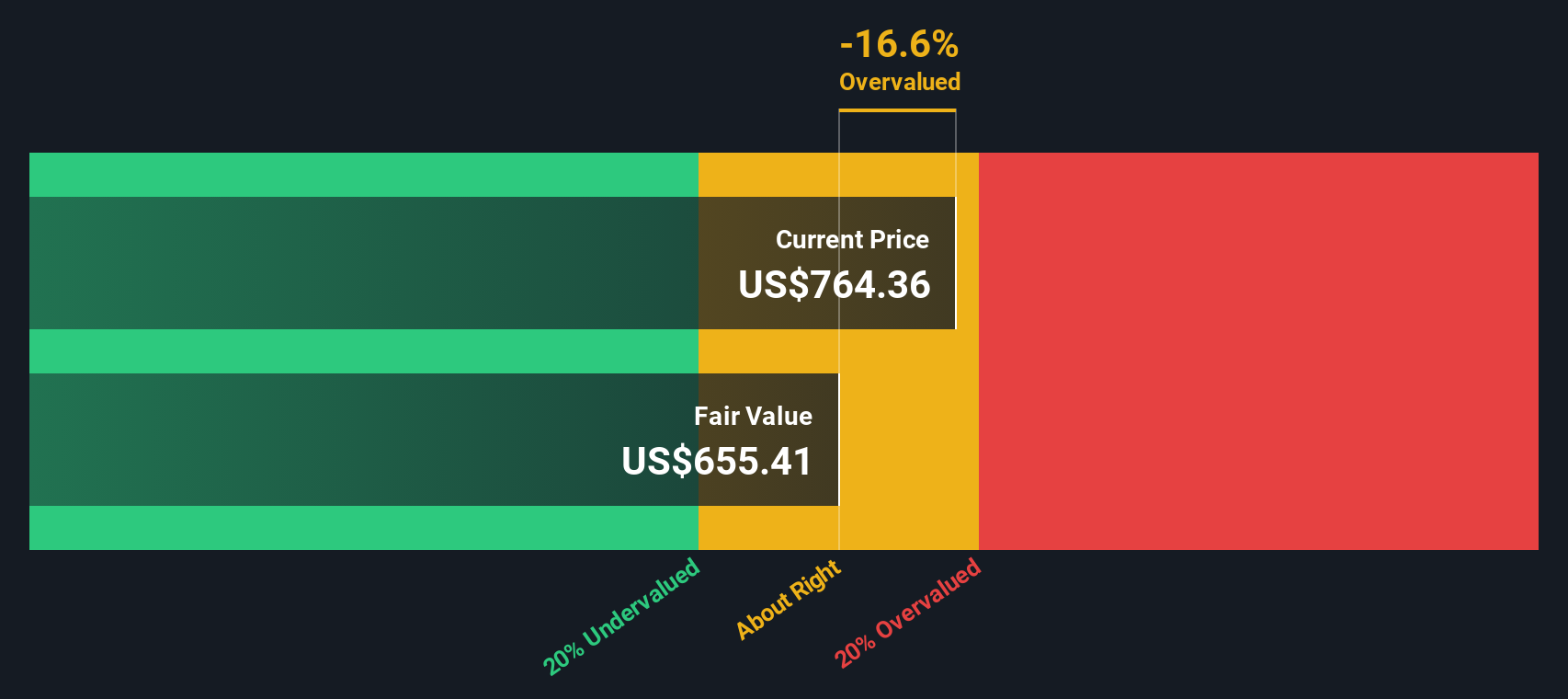

- When it comes to valuation, Goldman Sachs scores a 3 out of 6 based on key pricing checks. This means it clears the bar on three different undervalued measures. We’ll break down what these valuation approaches capture, but stick around to find out a smarter way to see if this stock is genuinely great value.

Approach 1: Goldman Sachs Group Excess Returns Analysis

The Excess Returns valuation model examines how efficiently Goldman Sachs Group earns returns above its cost of equity. This makes it a valuable tool for assessing profitability and long-term value creation. The core idea is to determine whether the company generates profits in excess of what shareholders could expect elsewhere with similar risk.

For Goldman Sachs, analysts estimate a stable return on equity averaging 15.20%, with a stable book value per share of $385.48. The stable earnings per share are estimated at $58.61, while the cost of equity is $48.19 per share. This means the firm is expected to deliver an excess return of $10.43 for each share, highlighting its ability to generate value above the minimum required return.

However, when you compare these fundamentals to the market price, the Excess Returns model suggests that the stock is about 55.3% overvalued relative to its intrinsic value. While the business efficiently generates excess profit, the current share price has surged beyond what these long-term returns justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Goldman Sachs Group may be overvalued by 55.3%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Goldman Sachs Group Price vs Earnings

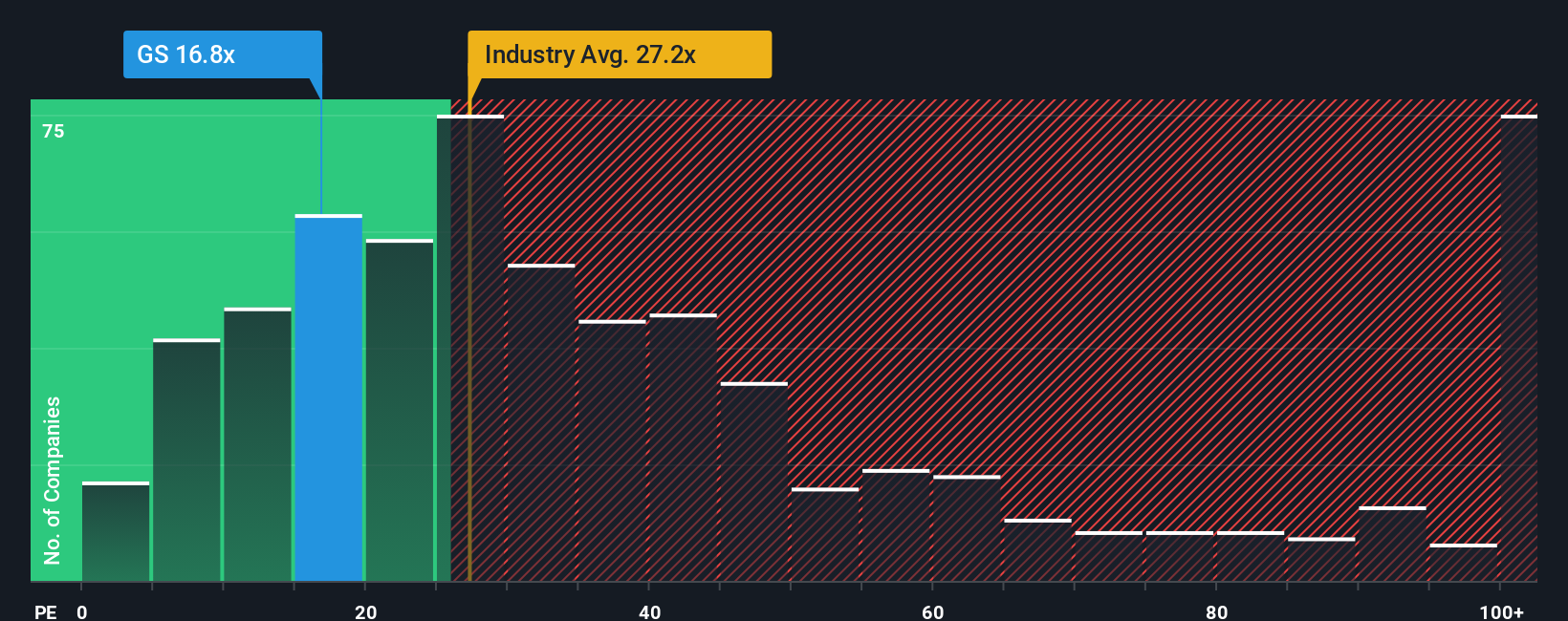

For profitable companies like Goldman Sachs Group, the price-to-earnings (PE) ratio is a widely used valuation tool because it directly reflects how much investors are willing to pay for each dollar of current earnings. This makes the PE ratio particularly useful in assessing whether a stock is priced attractively relative to its profitability.

Growth expectations and risk are key drivers of what counts as a "fair" PE ratio. Higher expected earnings growth or lower risk typically justify a higher multiple, while lower growth or greater uncertainty push the fair value lower. In essence, investors are usually willing to pay more for companies with strong and reliable earnings growth prospects.

Goldman Sachs currently trades at a PE ratio of 15.38x. By comparison, the average PE for its industry is 23.59x, and the average among its peers is 27.62x. However, simply stacking up these averages can be misleading because peer companies may have different growth profiles, margins, or risk factors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Goldman Sachs stands at 18.90x. It is a tailored benchmark, factoring in specifics like Goldman’s earnings growth, industry environment, profit margins, market cap, and overall risk. Unlike raw peer or industry averages, the Fair Ratio aims to set a more appropriate expectation for what investors should pay. This makes it a more suitable yardstick.

With Goldman Sachs trading at a PE ratio of 15.38x versus its Fair Ratio of 18.90x, the stock appears undervalued based on these fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Goldman Sachs Group Narrative

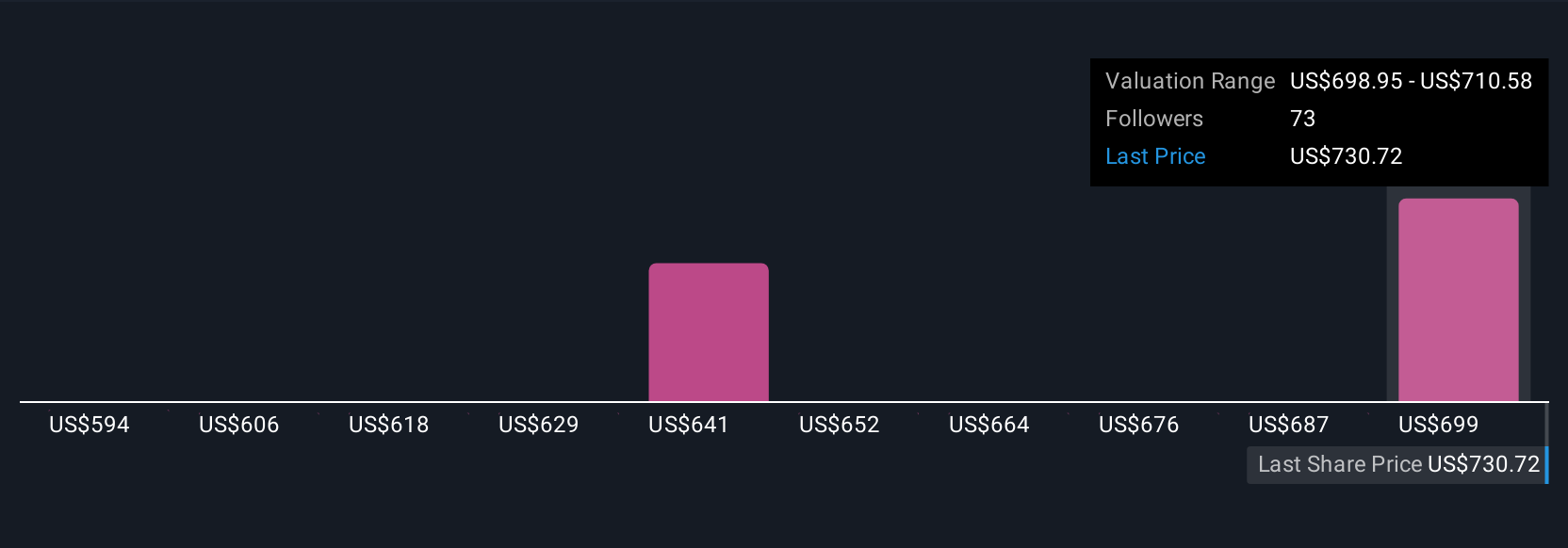

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a smarter and more dynamic approach to making investment decisions. A Narrative is your story about a company, built around your assumptions for fair value, future revenue, earnings, and margins; it goes beyond raw numbers by connecting your unique perspective and expectations to a real-world financial forecast and resulting valuation.

With Narratives, available for anyone to use directly on Simply Wall St's Community page, you can quickly craft and update your own outlook for Goldman Sachs Group and see how it compares to the current market price. This tool helps investors make more informed decisions by revealing gaps between their fair value estimate and the actual price, and it automatically updates as new news, earnings, or company events unfold, ensuring your view stays current.

For example, looking at Goldman Sachs Group right now, one investor might believe future acquisitions will deliver higher earnings growth and set their fair value near $815.0 per share, while another may be more cautious about risk and assign a much lower value, around $538.0 per share. This reveals how Narratives give every investor the power to back their thesis and act with confidence.

Do you think there's more to the story for Goldman Sachs Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives