- United States

- /

- Capital Markets

- /

- NYSE:GS

Should Goldman Sachs's (GS) First Interbank Crypto Options Trade Shape Investor Views on Long-Term Innovation?

Reviewed by Sasha Jovanovic

- In October 2025, Goldman Sachs and DBS Bank completed the first-ever over-the-counter cryptocurrency options trade between banks, involving cash-settled Bitcoin and Ether options to hedge exposures tied to crypto-linked products.

- This pioneering transaction signals growing institutional acceptance of digital assets and sets the stage for further integration of crypto derivatives within mainstream finance.

- We'll examine how this groundbreaking move toward interbank crypto derivatives could influence Goldman Sachs's long-term growth mix and innovation profile.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Goldman Sachs Group Investment Narrative Recap

For investors to have conviction in Goldman Sachs Group, they must believe in the firm's ability to capitalize on large-scale M&A activity and institutional adoption of digital assets, while efficiently managing regulatory and market risks. The recent breakthrough in interbank crypto derivatives underscores Goldman’s efforts to expand its innovation profile, but the most important short-term catalyst remains the firm’s ability to sustain elevated advisory revenue through robust deal flow. The largest near-term risk, the impact of ongoing regulatory uncertainty and capital requirements, remains largely unchanged following this news.

Among the recent announcements, the potential acquisition of a majority stake in Excel Sports Management stands out, aligning with Goldman’s focus on strengthening its asset management and private markets strategy. While not directly linked to digital asset innovation, this move could support growth in durable, fee-based revenue streams, complementing catalysts related to asset and wealth management expansion.

However, investors should be aware that shifting capital requirements could suddenly alter Goldman's margin outlook and ...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's outlook anticipates $61.4 billion in revenue and $17.0 billion in earnings by 2028. This is based on a projected 3.9% annual revenue growth rate and calls for a $2.3 billion increase in earnings from the current $14.7 billion.

Uncover how Goldman Sachs Group's forecasts yield a $801.58 fair value, in line with its current price.

Exploring Other Perspectives

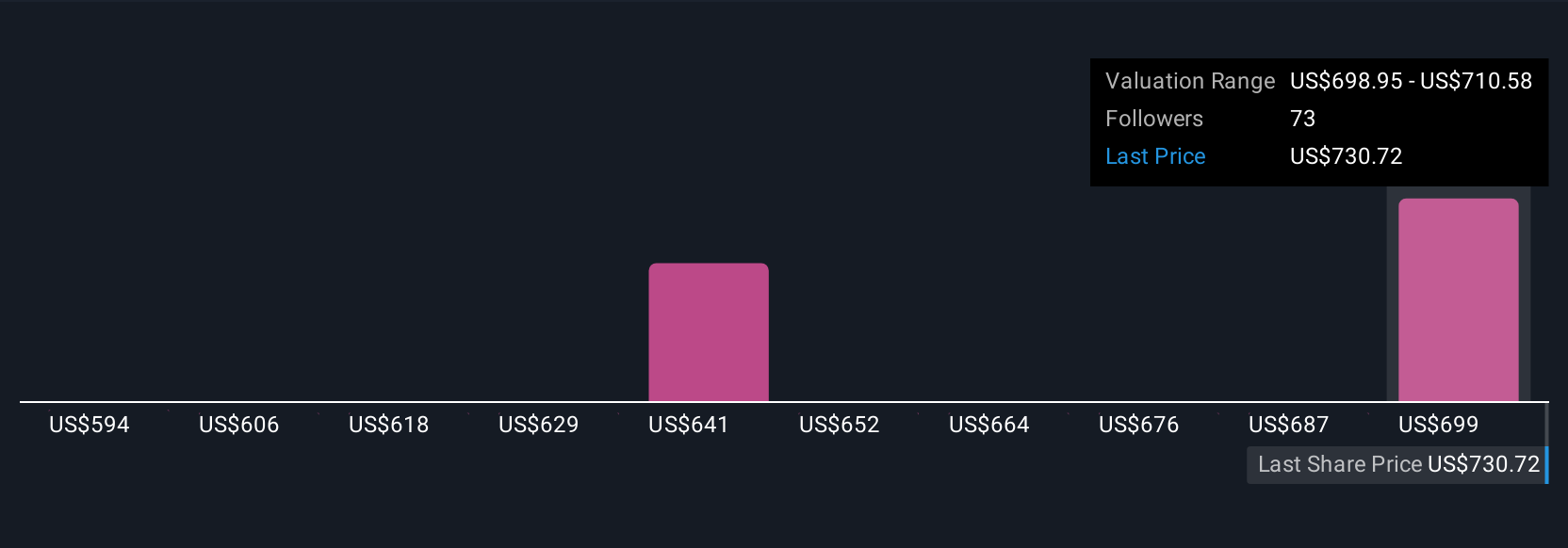

Seven members of the Simply Wall St Community provided fair values for Goldman Sachs ranging from US$610 to US$815 per share. As regulatory uncertainty persists, consider how evolving capital needs may influence these outcomes, explore these varied perspectives to assess your own view.

Explore 7 other fair value estimates on Goldman Sachs Group - why the stock might be worth 23% less than the current price!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives