- United States

- /

- Capital Markets

- /

- NYSE:GS

Is Goldman Sachs Still a Good Value After Its 38% Rally and Strategic Shift?

Reviewed by Bailey Pemberton

- Wondering if Goldman Sachs Group is still good value after its latest run? You are not alone. What comes next could hold the key to whether it is worth a spot in your portfolio.

- The share price has seen impressive gains, up nearly 38% year-to-date and over 35% in the past 12 months. Even though the last month saw a slight dip of 0.5%, the upward trend has been notable.

- Some of this momentum comes as investors have responded to news about Goldman’s renewed push into wealth management and the positive reception to its strategic shift away from consumer banking. News of leadership changes and fresh deals has also attracted attention, bringing both excitement and questions about the long-term direction.

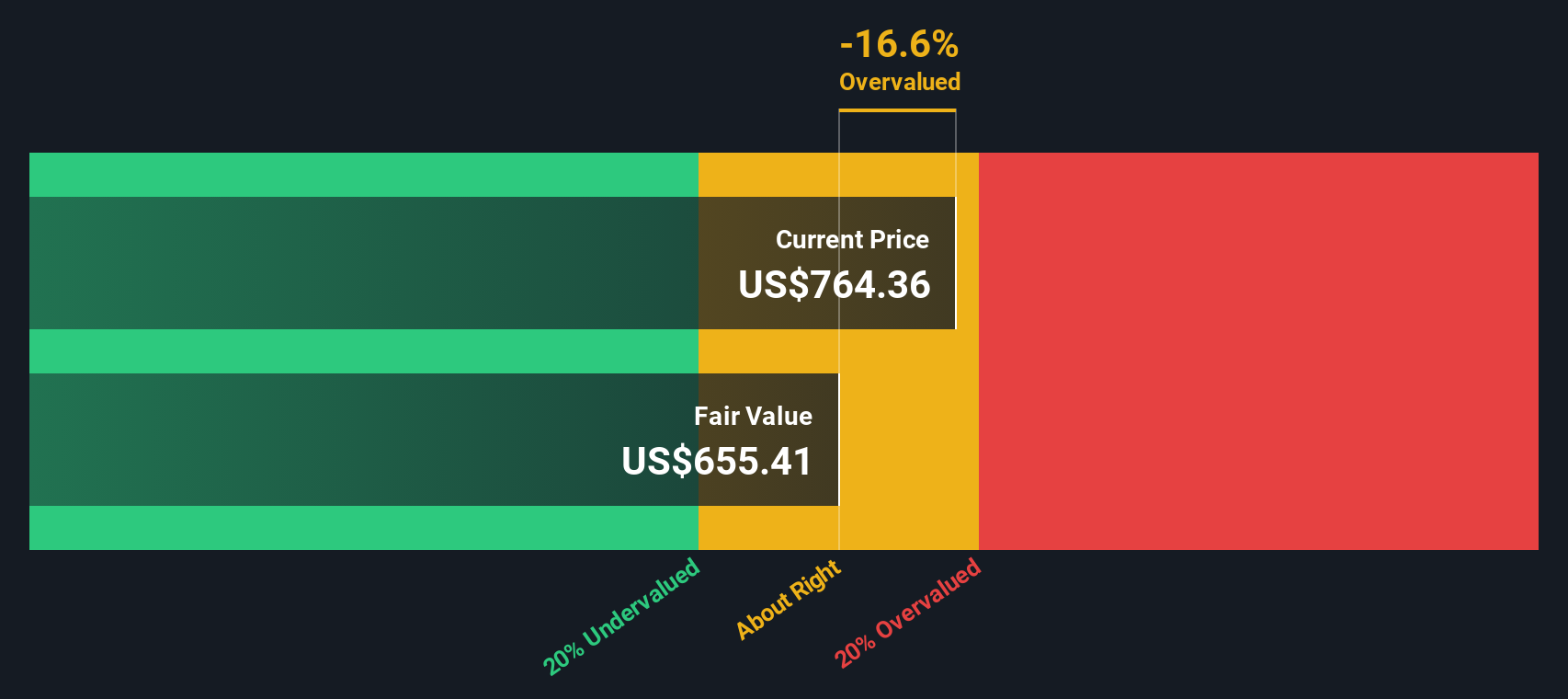

- But is all this optimism already reflected in the price? Goldman Sachs Group currently scores 3 out of 6 on our valuation checks. Let’s break down what this means using different valuation methods, and conclude with an additional perspective on assessing value, coming up at the end.

Approach 1: Goldman Sachs Group Excess Returns Analysis

The Excess Returns valuation model estimates how much value Goldman Sachs Group generates above its cost of equity. This approach focuses on the company's ability to earn more from invested capital than the minimum required return, providing insight into its long-term profitability and value creation potential.

According to this method, Goldman Sachs Group’s Book Value stands at $348.02 per share. Its Stable Earnings Per Share (EPS) is projected at $58.70. These projections are based on weighted future Return on Equity (ROE) estimates from 13 analysts. The company’s average ROE is robust at 15.21%, comfortably above its Cost of Equity of $47.55 per share, resulting in an Excess Return of $11.15 per share. Furthermore, the Stable Book Value is forecasted to rise to $385.95 per share, based on future estimates from 14 analysts.

After applying the Excess Returns model, the resulting intrinsic value suggests the stock is approximately 56.5% overvalued compared to its current market price. This indicates the optimism reflected in Goldman Sachs Group’s recent rally may have outpaced the underlying fundamentals revealed by this valuation approach.

Result: OVERVALUED

Our Excess Returns analysis suggests Goldman Sachs Group may be overvalued by 56.5%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Goldman Sachs Group Price vs Earnings

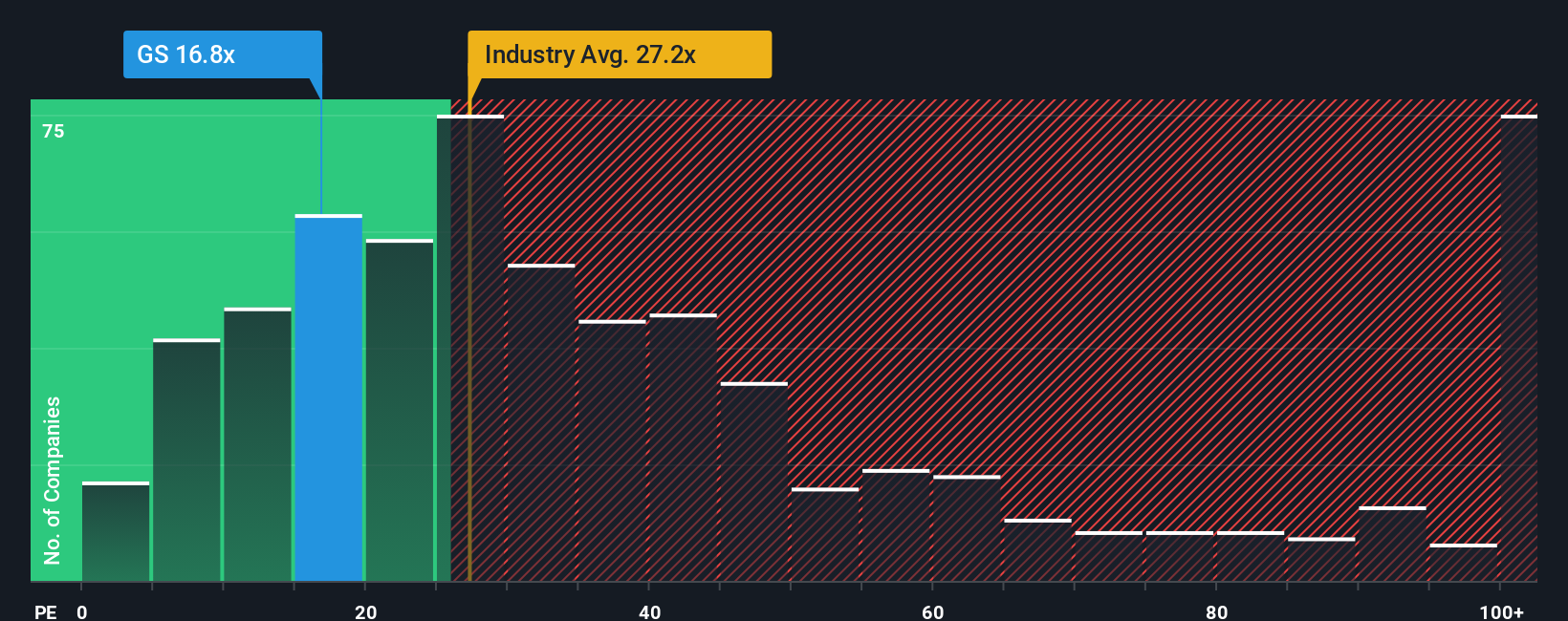

For profitable companies like Goldman Sachs Group, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it connects a company’s stock price to its actual earnings performance. The PE ratio helps investors assess how much they are paying for each dollar of a company’s earnings, making it especially useful for businesses with steady profits.

The "right" or "fair" PE ratio for any business depends on several factors, most notably its expected earnings growth and perceived risk. Higher growth prospects and lower risks tend to justify higher PE ratios, while slower growth or elevated risks call for lower ratios.

Currently, Goldman Sachs Group trades at a PE ratio of 15.8x. This compares favorably against the Capital Markets industry average of 23.8x and its peer average of 36.1x, making Goldman look relatively inexpensive at first glance. However, Simply Wall St’s proprietary “Fair Ratio” for Goldman is 18.9x, calculated using a blend of its earnings growth forecast, market cap, profit margins, and risk profile. Unlike standard industry or peer comparisons, the Fair Ratio provides a tailored benchmark that reflects what is reasonable for Goldman Sachs Group’s unique position and outlook.

The actual PE ratio of 15.8x is slightly below the Fair Ratio of 18.9x. This suggests that the stock is trading at an attractive valuation, factoring in its growth prospects and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Goldman Sachs Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company’s future—your perspective on its growth, earnings, margins, and fair value, all grounded in your research and assumptions.

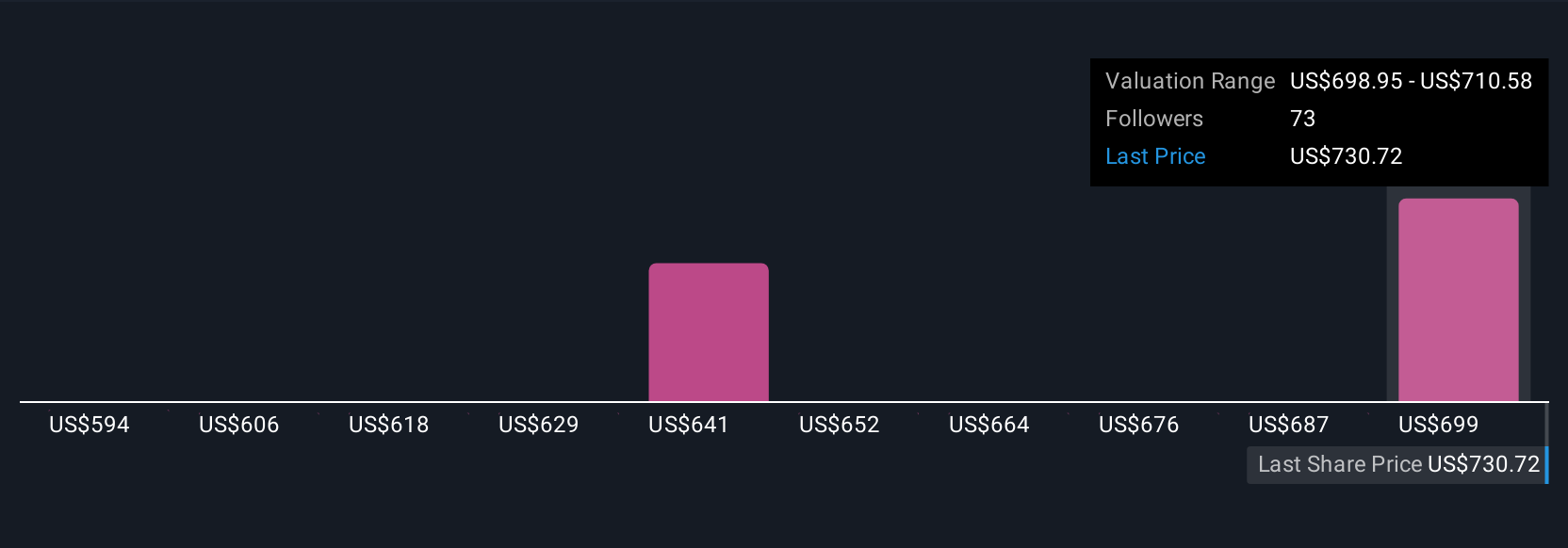

Instead of just relying on numbers alone, Narratives let you connect your view of Goldman's strategy, market trends, and risks directly to financial forecasts and a fair value estimate. This approach brings numbers and qualitative analysis together, allowing you to visualize how your outlook compares with others, and how it changes as news or earnings come in.

On Simply Wall St's Community page, millions of investors share their Narratives, making this tool accessible for everyone. Narratives make it easier to decide when to buy or sell by showing you the fair value for each perspective and how it measures up to today's price.

For example, some investors might focus on Goldman's growth in asset management and technological innovation, setting fair values as high as $815.00. Others may be more cautious about regulatory or market risks, landing as low as $538.00. Narratives help you see the full picture so you can make more informed decisions based on your own beliefs and up-to-date information.

Do you think there's more to the story for Goldman Sachs Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives