- United States

- /

- Diversified Financial

- /

- NYSE:GPN

How Global Payments' (GPN) Leadership Appointments May Reshape Its Investment Story Amid Worldpay Acquisition

Reviewed by Sasha Jovanovic

- In recent days, Global Payments Inc. announced the appointment of Nathan Rozof, CFA, as head of Investor Relations, and named Patricia “Patty” Watson and Archana “Archie” Deskus as independent Board directors in collaboration with Elliott Investment Management.

- These moves highlight Global Payments’ renewed commitment to governance, transparency, and technology-focused leadership during a pivotal period that includes the pending Worldpay acquisition and operational transformation.

- As Global Payments strengthens its board with industry technology expertise, we'll evaluate how these leadership changes may influence the company's investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Global Payments Investment Narrative Recap

To own shares of Global Payments today, you need to believe the company can successfully integrate Worldpay, deliver operational efficiencies, and capitalize on technology-enabled payments growth, all while managing shifting competitive and regulatory headwinds. The recent addition of technology-focused directors and a new head of Investor Relations represents a positive but not material change to the investment case near term, as the most important short-term catalyst, the Worldpay integration, still carries significant execution risk.

The formation of an Integration Committee directly relates to the pending Worldpay acquisition and stands out among recent company actions. This committee aims to oversee and maximize the value of the transaction, addressing the company’s most immediate catalyst while also taking steps to mitigate potential operational and integration challenges on the horizon.

But against these promising developments, investors should be focused on the risk that if the integration runs into major challenges, it could...

Read the full narrative on Global Payments (it's free!)

Global Payments' projections point to $12.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes a 7.0% annual revenue growth and a $0.2 billion increase in earnings from the current level of $1.5 billion.

Uncover how Global Payments' forecasts yield a $103.18 fair value, a 17% upside to its current price.

Exploring Other Perspectives

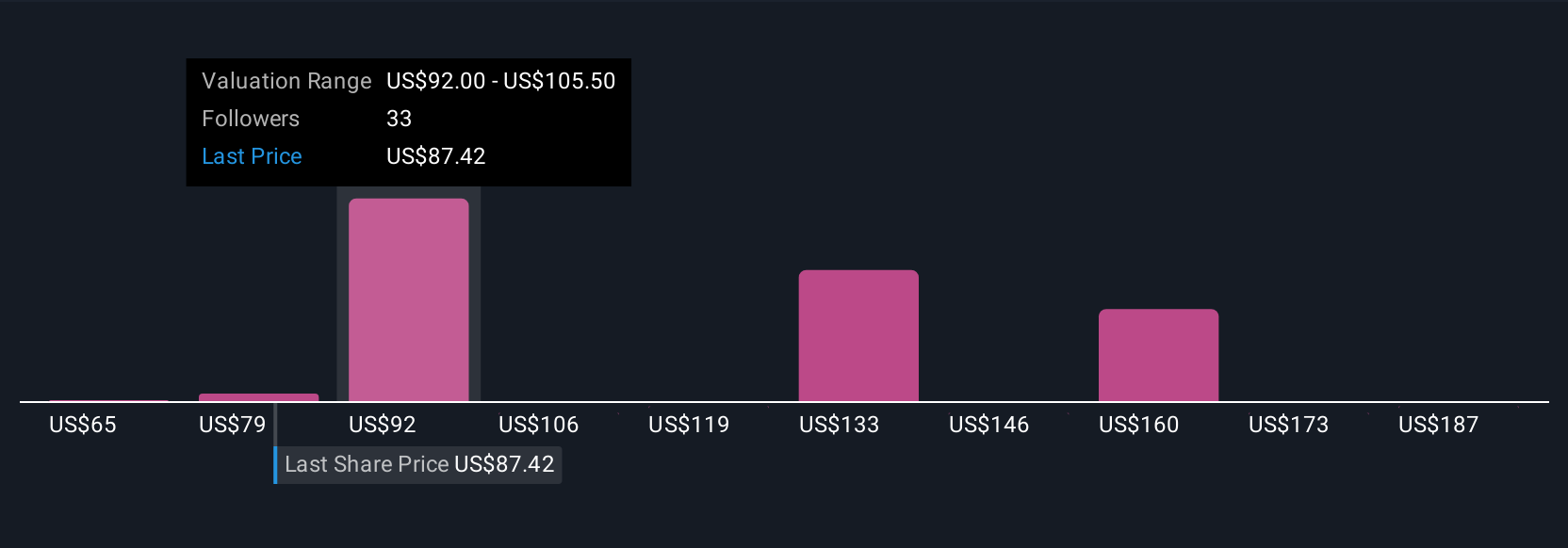

Simply Wall St Community members submitted 11 fair value estimates for Global Payments, ranging from US$65 to US$200 per share. With such a spread of expectations, think about how the success or failure of integrating Worldpay could have widespread effects on future earnings.

Explore 11 other fair value estimates on Global Payments - why the stock might be worth over 2x more than the current price!

Build Your Own Global Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Global Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Payments' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPN

Global Payments

Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives