- United States

- /

- Diversified Financial

- /

- NYSE:GPN

Global Payments (GPN): Gauging Valuation After New Genius Rollouts in U.S. and U.K. Foodservice Markets

Reviewed by Simply Wall St

If you're eyeing Global Payments (GPN) right now, you probably noticed the fresh buzz around their latest move. The company just rolled out its Genius solution for enterprise customers in the U.S. and simultaneously launched Genius for quick service and fast casual restaurants in the UK. For anyone tracking the payments space, this expansion into enterprise-grade, all-in-one commerce platforms is a clear signal that Global Payments is targeting a bigger share of foodservice and hospitality. This represents a sizable and fast-evolving market.

These launches come at a time when Global Payments’ share price has been under pressure, with momentum over the past year lagging well behind expectations. While the company is showing stable revenue and net income growth, the stock's recent movements, including a small gain over the past three months compared to a longer-term slide, reflect shifting investor sentiment about future growth and risk. After a challenging year, these strategic product moves could be seen as attempts to revive optimism and potentially spark a turnaround.

So with recent performance in mind and new products hitting key markets, is Global Payments now at an attractive entry point or is the current price already factoring in any gains from its innovation push?

Most Popular Narrative: 39.9% Undervalued

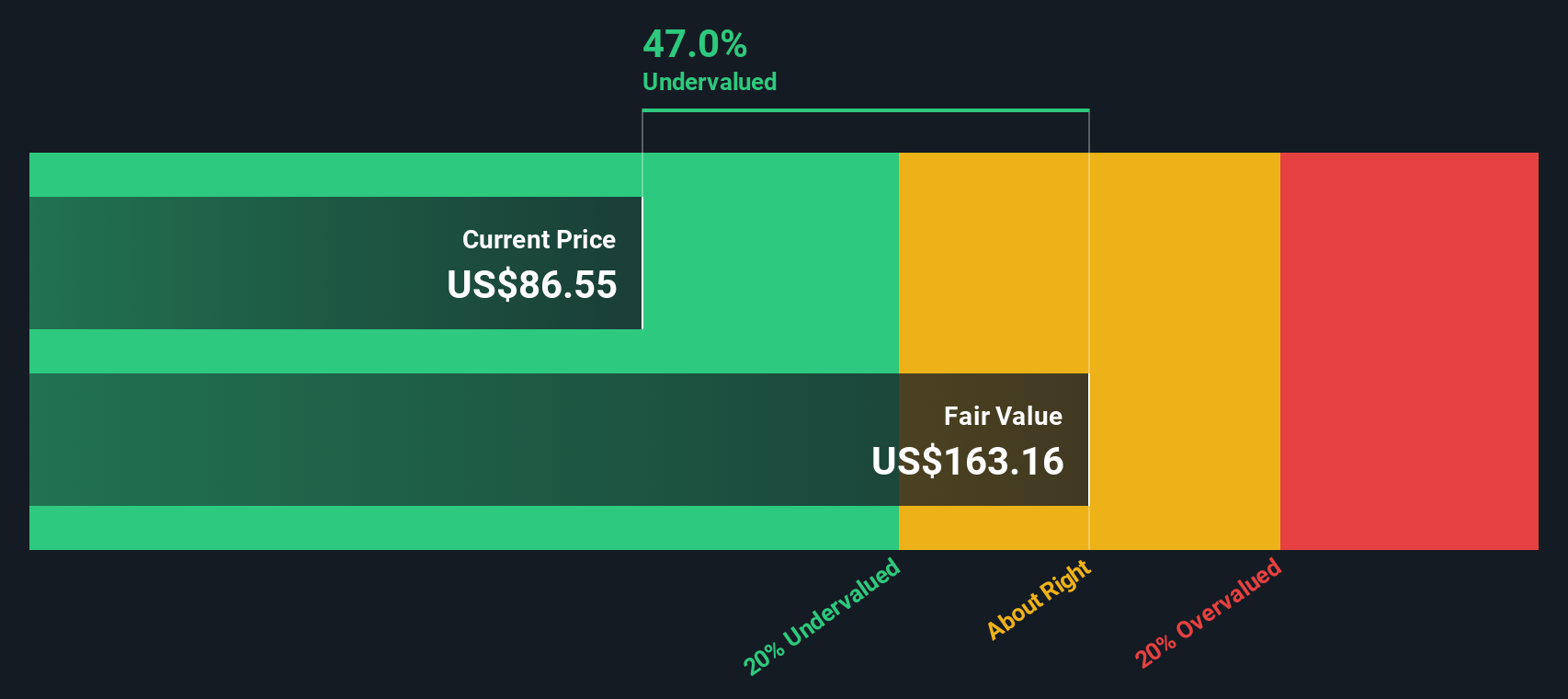

According to Maxell, Global Payments is significantly undervalued at current levels, with the narrative projecting a large discount to its estimated fair value.

Global Payments (GPN) presents a compelling investment opportunity at current levels, with three key catalysts driving potential outperformance in 2025: Q4 2024 momentum in Merchant Solutions with strong POS adoption (added approximately 3,000 new locations), strategic sale of AdvancedMD for $1.125 billion at attractive multiple with $700 million earmarked for shareholder returns, and successful integration of EVO Payments enhancing B2B capabilities and geographic reach.

Ready to unravel this bold valuation call? There is a confident bet hidden in the growth runway, margin strength, and forecasted returns behind Global Payments' fair value. What future profit drivers power this narrative leap? Is there one crucial growth assumption that changes everything? Maxell’s projections might just challenge everything you thought you knew about GPN’s upside.

Result: Fair Value of $142 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, near-term pressure on margins from increased tech spending and potential integration hiccups may quickly challenge this bullish outlook for Global Payments.

Find out about the key risks to this Global Payments narrative.Another View: The SWS DCF Model Perspective

Looking at Global Payments from another angle, our DCF model also points to the shares trading at a significant discount to what the business could be worth. While the math supports a value gap, an important question remains: can these forward-looking assumptions truly hold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Global Payments Narrative

If you think there’s more to the story or want to dive into the data for yourself, you can shape your own Global Payments narrative in just a few minutes. Do it your way

A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give your portfolio a jolt by taking the next step today. The smartest investors keep their edge by acting before the crowd. These tailored screeners put high-potential opportunities right at your fingertips.

- Spot high-yield opportunities and strengthen your cash flow by checking out stocks with robust returns like dividend stocks with yields > 3%.

- Back tomorrow’s game-changers by examining companies harnessing breakthroughs in artificial intelligence through AI penny stocks.

- Stay ahead of undervalued gems and invest where the upside looks promising by leveraging undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPN

Global Payments

Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives