- United States

- /

- Mortgage REITs

- /

- NYSE:GPMT

Would Shareholders Who Purchased Granite Point Mortgage Trust's(NYSE:GPMT) Stock Year Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the Granite Point Mortgage Trust Inc. (NYSE:GPMT) share price has gained 27% in the last three months. But that doesn't change the fact that the returns over the last year have been disappointing. During that time the share price has sank like a stone, descending 67%. So the bounce should be viewed in that context. Of course, it could be that the fall was overdone.

Check out our latest analysis for Granite Point Mortgage Trust

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

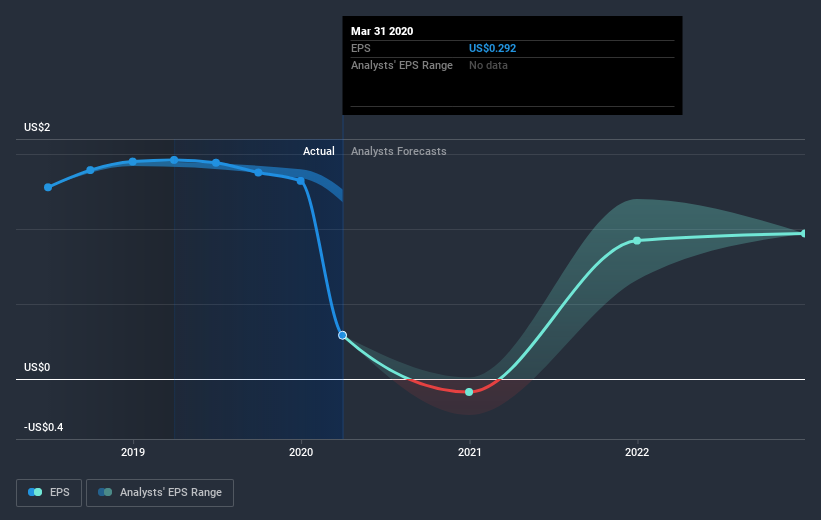

Unfortunately Granite Point Mortgage Trust reported an EPS drop of 80% for the last year. This proportional reduction in earnings per share isn't far from the 67% decrease in the share price. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered Granite Point Mortgage Trust's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Granite Point Mortgage Trust's TSR of was a loss of 65% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Over the last year, Granite Point Mortgage Trust shareholders took a loss of 65%. In contrast the market gained about 7.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 17% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Granite Point Mortgage Trust (of which 1 makes us a bit uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Granite Point Mortgage Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:GPMT

Granite Point Mortgage Trust

A real estate investment trust, originates, invests in, and manages senior floating-rate commercial mortgage loans, and other debt and debt-like commercial real estate investments in the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives