- United States

- /

- Capital Markets

- /

- NYSE:GAM

General American Investors (GAM): Evaluating Valuation Following Chairman’s Stock Buy and Board Appointment

Reviewed by Simply Wall St

General American Investors Company (GAM) is making headlines after Chairman Spencer Davidson bought nearly $20,000 in preferred stock. Additionally, Sarah M. Ward was named to the Board of Directors, bringing valuable legal and financial insights.

See our latest analysis for General American Investors Company.

Momentum has picked up for General American Investors Company, with a 23.6% year-to-date share price return and a robust 1-year total shareholder return of 27.4%. These gains come amid new leadership additions and insider buying, both signaling confidence in the company’s long-term direction.

If you’re curious what else insiders may be betting on, this could be the right moment to discover fast growing stocks with high insider ownership

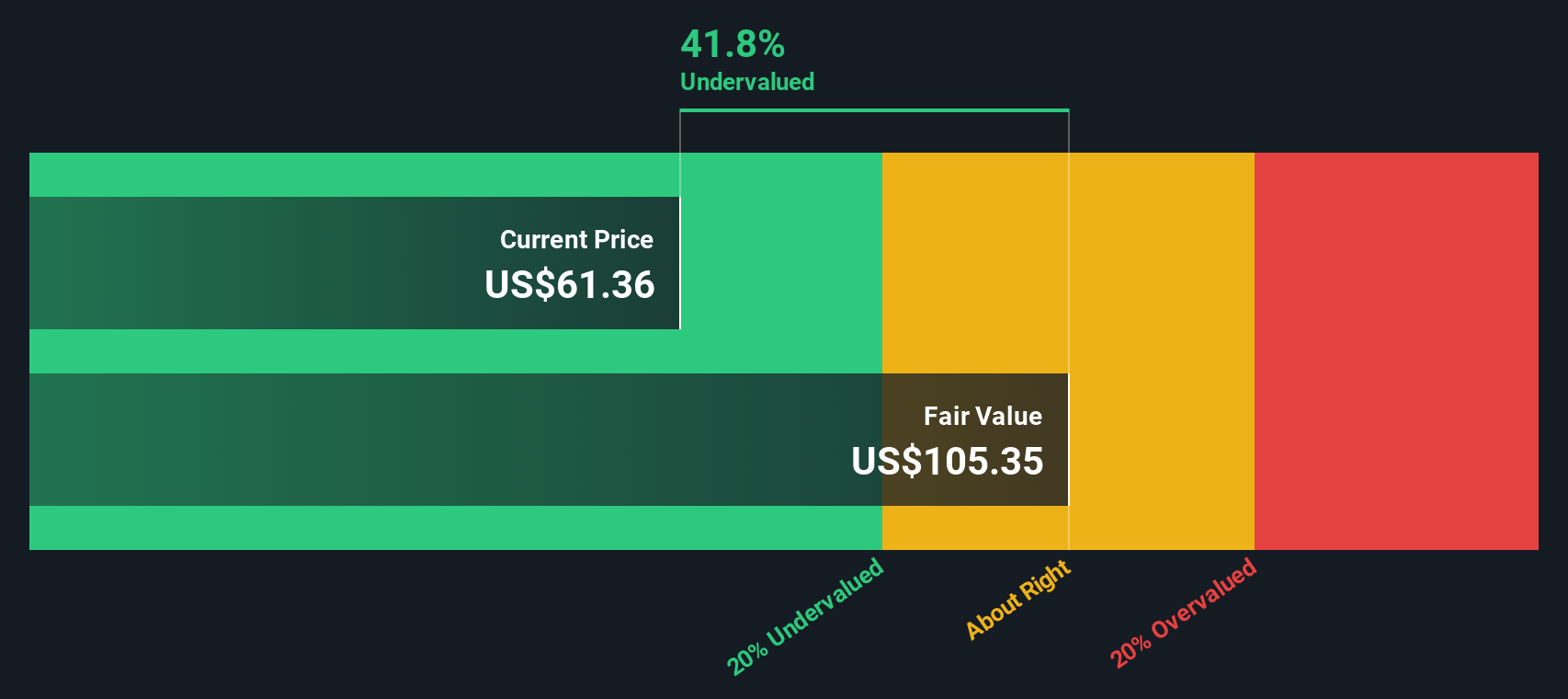

With shares trading at a notable discount to intrinsic value, the crucial question is whether General American Investors Company remains undervalued or if the current price already reflects all its future growth potential.

Price-to-Earnings of 7.6x: Is it justified?

At a price-to-earnings ratio of just 7.6x, General American Investors Company stands out as a clear value play versus both its peers and the broader industry. The last close was $62.60, sharply below multiples seen elsewhere, suggesting the market may be discounting its earnings strength.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings. A lower value indicates potential undervaluation, while a higher value signals premium growth expectations. For a company in the capital markets sector, this ratio is a direct window into how the market views its earnings reliability and profit sustainability.

With General American Investors Company's P/E sitting at 7.6x, compared to a peer average of 34.4x and an industry average of 25.7x, the discount is undeniable. These steep differences raise the question of whether investors have overlooked strengths or are pricing in risks others might not see.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 7.6x (UNDERVALUED)

However, risks remain, including uncertain revenue growth and potential shifts in sector sentiment. These factors could challenge the current undervalued thesis.

Find out about the key risks to this General American Investors Company narrative.

Another View: Discounted Cash Flow Perspective

Looking at General American Investors Company through the lens of our DCF model reveals a notable valuation gap. The SWS DCF model puts fair value at $105.49, while the current price is $62.60, which is about 41% below fair value. Is the market overlooking hidden strength, or are there risks the model fails to capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General American Investors Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General American Investors Company Narrative

If you want to reach your own conclusions or think there’s more to uncover, our platform gives you the tools to examine the data and shape your own perspective. Get started in just a few minutes with Do it your way.

A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Stay ahead of the market and spot your next big winner. Unique opportunities are just a few clicks away when you use the Simply Wall St Screener to find companies with strong fundamentals, income potential, and emerging tech advantage.

- Tap into powerful yield opportunities and strengthen your income strategy with these 17 dividend stocks with yields > 3% offering reliable returns above 3%.

- Fuel your portfolio with the explosive potential of these 25 AI penny stocks as artificial intelligence shapes tomorrow’s industries and market leaders.

- Access tomorrow’s growth stories at today's lower valuations with these 879 undervalued stocks based on cash flows and lock in promising companies priced below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives