- United States

- /

- Capital Markets

- /

- NYSE:GAM

Does Management’s Insider Commitment Shape the Leadership Narrative for General American Investors (GAM)?

Reviewed by Sasha Jovanovic

- On October 20, 2025, Spencer Davidson, Chairman of General American Investors Company, purchased US$19,701 worth of 5.95% Preferred Stock, while the company announced the addition of Sarah M. Ward to its Board of Directors.

- This combination of insider investment and board-level expertise highlights the company's focus on strengthening its governance and leadership structure.

- With the Chairman's preferred stock purchase underscoring management confidence, we'll look at how these steps inform the company's broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is General American Investors Company's Investment Narrative?

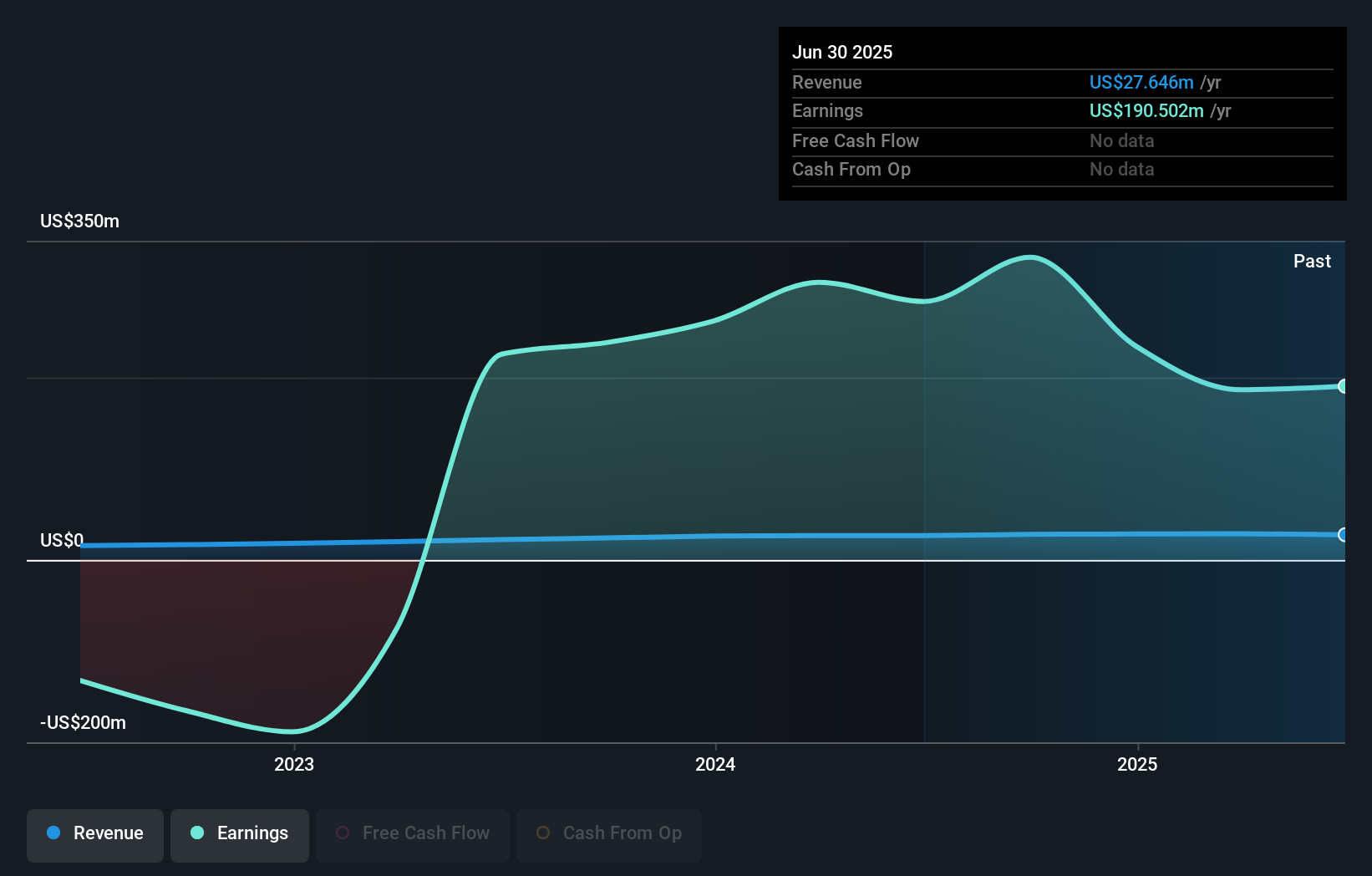

The investment case for General American Investors Company centers on its longstanding approach to capital markets, offering access to a portfolio managed by an experienced team and overseen by a seasoned, mostly independent board. The recent insider purchase by Chairman Spencer Davidson and the appointment of Sarah M. Ward bring fresh attention to the importance of governance at a time when the company’s short-term catalysts and risks are finely balanced. While the additional board expertise might shore up confidence in future strategies, the direct financial impact from these changes is unlikely to materially shift core risks such as unpredictable earnings from large one-off gains or the challenge of improving returns on equity, which remains low compared to benchmarks. The share price’s recent moderate gains, even after the news, suggest that investors may already be factoring in the current pace of management and board renewal.

But while leadership is evolving, unstable dividends remain a risk investors should be aware of. Despite retreating, General American Investors Company's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on General American Investors Company - why the stock might be worth as much as 69% more than the current price!

Build Your Own General American Investors Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free General American Investors Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General American Investors Company's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives