- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Shift4 Payments (FOUR): Exploring Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Shift4 Payments (FOUR) is drawing interest among investors after its recent decline, with shares slipping roughly 15% over the past month. The dip has some watching closely to see how fundamentals measure up compared to sentiment right now.

See our latest analysis for Shift4 Payments.

Shift4 Payments’ share price has experienced a sharp pullback lately, contributing to a wider trend of fading momentum this year. While the stock’s 30-day share price return is down 14.9% and its total shareholder return over the past year sits at -22.8%, long-term investors have still seen a three-year total shareholder return of 62.8%. This combination of near-term weakness alongside solid multi-year gains has some investors reconsidering the opportunity, especially with current valuations coming under the spotlight.

If you’re interested in finding fresh opportunities beyond the headlines, it’s a perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With Shift4's shares off their highs, while longer-term gains remain intact, the key question now is whether the pullback presents an undervalued entry point or if the market already reflects all foreseeable growth potential.

Most Popular Narrative: 31.8% Undervalued

The current narrative places Shift4’s fair value well above the last close of $73.88, creating a disconnect between price and potential. This gap has drawn increasing attention to the numbers powering the narrative’s bullish stance and what might be fueling expectations for upside.

The broad adoption and integration of value-added services (such as unified software and POS solutions like SkyTab) is driving higher merchant adoption internationally and domestically, supporting an increase in net spreads and boosting recurring, higher-margin revenue streams.

Curious how aggressive revenue growth and margin expansion turn into a price target well above today’s market price? The most popular narrative hinges on financial projections and valuation multiples that would surprise many onlookers. Wondering what makes analysts so confident despite recent volatility? Dive into the full breakdown to discover the bold, market-pushing assumptions behind this striking value estimate.

Result: Fair Value of $108.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges from international acquisitions and tighter margins could quickly undermine the bullish case if not carefully managed in the future.

Find out about the key risks to this Shift4 Payments narrative.

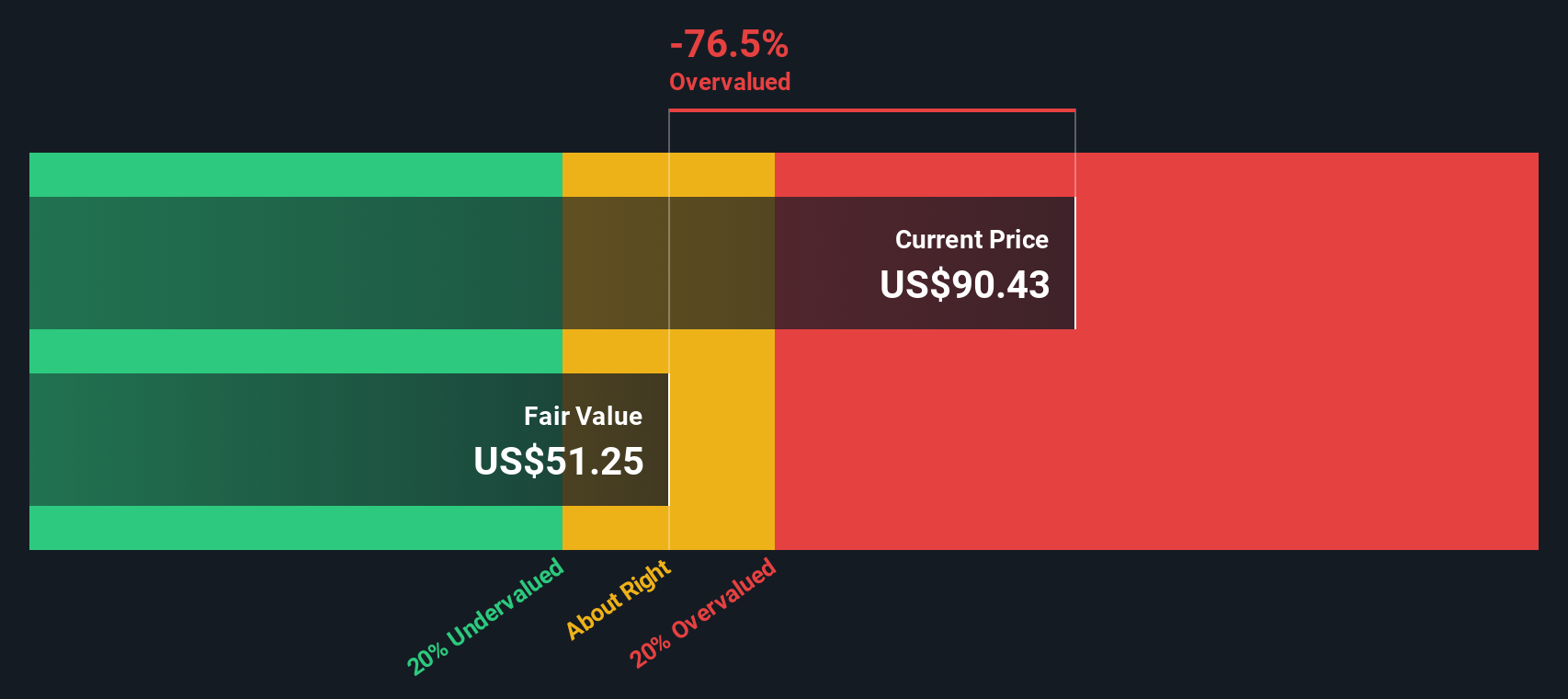

Another View: SWS DCF Model Weighs In

Looking beyond valuation multiples, our SWS DCF model tells a different story. According to this cash flow analysis, Shift4 Payments’ shares appear overvalued, with the current price sitting significantly above the DCF-derived fair value. This difference highlights the risks associated with assuming aggressive growth will continue. Which perspective will prove accurate as fundamentals change?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Shift4 Payments Narrative

If you’re curious, skeptical, or simply want to follow a different path, you can review all the data and shape your own view in just a few minutes. Do it your way

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to a single stock. Widen your options and act on trends you care about using these powerful stock searches before opportunity passes you by.

- Generate steady passive income for your portfolio by checking out these 18 dividend stocks with yields > 3%, which highlights reliable yields above 3%.

- Get ahead of the AI revolution and access real innovation with these 24 AI penny stocks, giving you insight into companies shaping the future of machine learning and automation.

- Spot undervalued opportunities others might miss when you review these 877 undervalued stocks based on cash flows, featuring stocks with strong cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives