- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Shift4 Payments (FOUR): Evaluating Valuation Following Preferred Dividend Announcement and Analyst Caution

Reviewed by Kshitija Bhandaru

Shift4 Payments (FOUR) has moved into the spotlight after announcing a $1.50 per share dividend for its Series A Mandatory Convertible Preferred Stock. This comes alongside recent cautious scoffs from analysts, which has sparked fresh debate on the company’s direction.

See our latest analysis for Shift4 Payments.

Despite the spotlight from the new preferred dividend and a recent credit line expansion, Shift4 Payments’ share price has slipped in recent months, reflecting a mix of caution after lowered analyst targets and investor uncertainty about short-term growth. While the past year’s total shareholder return is slightly negative, momentum appears to be cooling. At the same time, longer-term performance remains positive, hinting at a company in transition with potential for renewed interest if execution improves.

If you’re curious about where the next big opportunity might emerge, this is a great time to branch out and discover fast growing stocks with high insider ownership

With shares now trading well below the average analyst price target and analysts divided on the outlook, the question for investors becomes clear: is Shift4 Payments undervalued at current levels, or is the market already factoring in future growth?

Most Popular Narrative: 30% Undervalued

Compared to Shift4 Payments' last close price of $76.86, the most popular narrative sets a far higher fair value, pointing to major upside if its projections play out. The focus is on transformative growth from international acquisitions and new-market expansion, which could mark a turning point for the company.

The cross-sell opportunity across the combined customer bases of newly acquired companies (for example, bringing Shift4's payment products into Global Blue's luxury retail clients, or introducing Global Blue's DCC product to Shift4 hotels and restaurants) creates a substantial embedded pipeline for incremental revenue and sustained organic growth over multiple years.

Curious what bold financial forecasts push the consensus to such a bullish fair value? Discover the powerful mix of revenue, margin, and cross-selling assumptions behind this optimistic scenario, and find out why some believe the stage is set for explosive, profitable growth. Which numbers unlock that $110 fair value? The full story awaits.

Result: Fair Value of $110.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hurdles from integrating recent acquisitions, as well as growing competitive pressures abroad, could quickly challenge this bullish outlook and alter growth expectations.

Find out about the key risks to this Shift4 Payments narrative.

Another View: Reality Check via Multiples

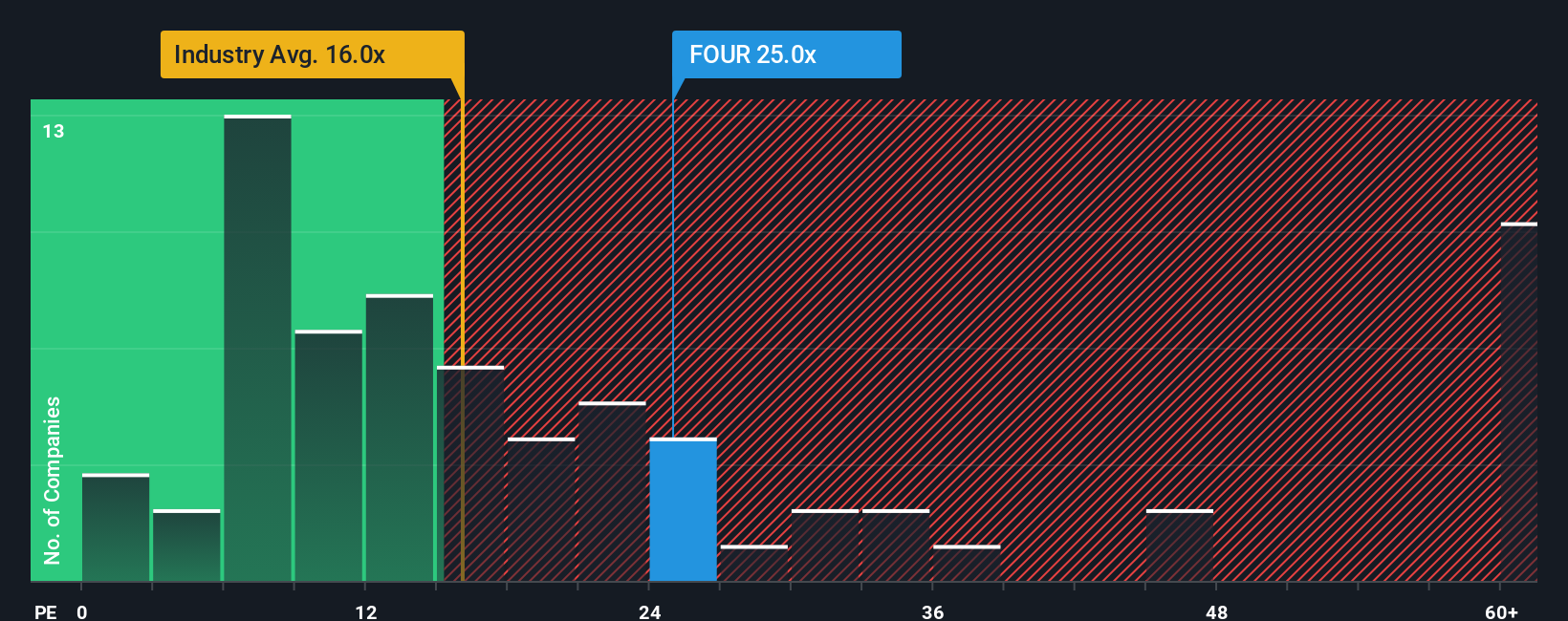

While analysts see Shift4 Payments as undervalued based on future earnings growth, the company currently trades at a price-to-earnings ratio of 25.4x. This is well above the US industry average of 16.5x and its own fair ratio of 24x. This suggests investors are already pricing in significant optimism, raising the risk that even solid results may not be rewarded by the market. Can Shift4’s growth keep pace with these lofty expectations, or is valuation risk starting to build?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shift4 Payments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shift4 Payments Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way.

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let potential winners pass you by. Use these tailored stock ideas to sharpen your edge and take your investing strategy to the next level.

- Tap into high-yield options for steady passive income by reviewing these 19 dividend stocks with yields > 3% offering strong yields above 3%.

- Uncover the future of cloud, algorithms, and automation by browsing these 24 AI penny stocks transforming every industry with artificial intelligence.

- Catch undervalued gems before they’re widely recognized by scanning these 886 undervalued stocks based on cash flows identified as trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives