- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Does Shift4’s (FOUR) Preferred Dividend Reveal Evolving Priorities for Growth and Capital Allocation?

Reviewed by Sasha Jovanovic

- Shift4 Payments announced its Board of Directors has declared a US$1.50 per share cash dividend on its Series A Mandatory Convertible Preferred Stock, payable November 3, 2025, to holders of record as of October 15, 2025, following the issuance of 10,000,000 shares earlier this year.

- This dividend announcement highlights Shift4 Payments' ongoing focus on shareholder returns while reinforcing its financial stability after recent capital structure adjustments.

- We’ll explore how the expanded credit agreement with Citizens Bank could impact Shift4’s ability to pursue international growth initiatives.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Shift4 Payments Investment Narrative Recap

To hold Shift4 Payments shares today, investors need to believe that international expansion and successful integration of recent acquisitions will drive sustained growth, despite mounting financial leverage. The recent preferred stock dividend signals continued attention to shareholder returns, but does not materially alter the biggest short-term catalyst, accelerating cross-sell opportunities through the Global Blue and Smartpay acquisitions, or the major risk: higher debt and dilution pressures from complex capital structure changes.

Among the latest company developments, Shift4’s amended credit agreement with Citizens Bank stands out. Increasing its credit line to US$125 million could directly support the capital needed for integrating and scaling recent acquisitions, tying in with the company’s efforts to boost growth momentum beyond its core hospitality and restaurant sectors.

Yet, against this positive backdrop, investors should also be aware of the increased risk of future dilution and limited flexibility in a downturn if leverage rises further…

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments is projected to reach $7.0 billion in revenue and $613.9 million in earnings by 2028. This outlook assumes a 24.8% annual revenue growth rate and an increase in earnings of about $406 million from the current $207.7 million.

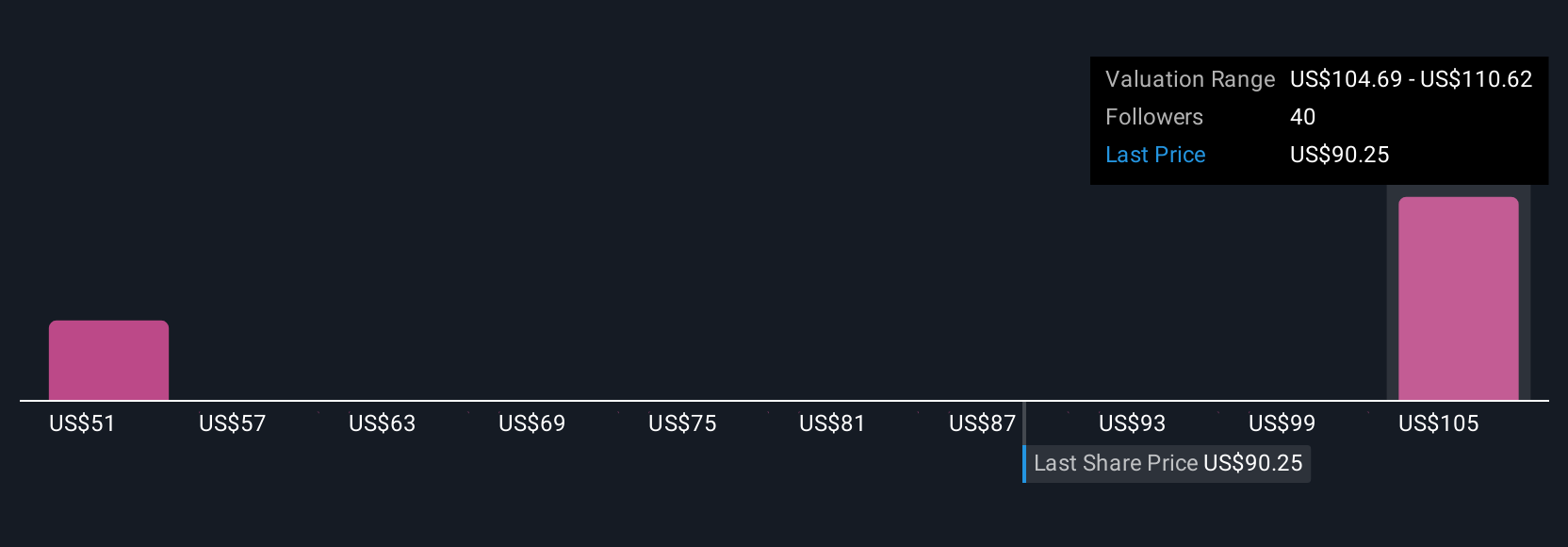

Uncover how Shift4 Payments' forecasts yield a $110.62 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Fair value estimates from five members of the Simply Wall St Community span from US$50.68 to US$110.62 per share, highlighting considerable differences in outlook. With opinions varying widely, especially in light of Shift4’s growing debt and preferred stock issuance, make sure to review multiple viewpoints before making your own decision.

Explore 5 other fair value estimates on Shift4 Payments - why the stock might be worth 34% less than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives