- United States

- /

- Diversified Financial

- /

- NYSE:FIS

FIS (Fidelity National Information Services): Assessing Valuation After Strong Q3 Results, Upbeat 2025 Outlook, and Share Buyback

Reviewed by Simply Wall St

Fidelity National Information Services (FIS) is in the spotlight as the company posted higher third quarter sales and net income compared to last year. Along with raising its 2025 growth outlook, FIS has attracted attention for ongoing innovation and a completed share repurchase, prompting new discussions about its stock.

See our latest analysis for Fidelity National Information Services.

FIS has kept investors busy this year with a steady stream of product launches, upbeat guidance, and sizable share repurchases, but the market remains cautious. The stock’s 1-year total shareholder return is down 23.5%, even as management doubles down on future growth initiatives. Despite this, longer-term holders may take some comfort in the 17% three-year total return, though the five-year total return still reflects significant pressure.

If you’re interested in where the action is in financial technology and beyond, now’s a smart moment to broaden your lens and check out fast growing stocks with high insider ownership.

With encouraging results and strategic moves fueling optimism, the key question now is whether Fidelity National Information Services is truly undervalued at current prices, or if investors have already priced in all the anticipated growth. Is there a genuine buying opportunity, or is the market simply reflecting future expectations?

Most Popular Narrative: 18.3% Undervalued

With the most popular narrative pegging Fidelity National Information Services' fair value well above its last close of $66.26, the valuation case hinges on future margin expansion, recurring revenue, and international growth. This market outlook invites a closer look at the company's underlying catalysts.

Acceleration in digital payment solutions, highlighted by strong client wins in digital banking, embedded finance, and international payment processing (including new digital asset capabilities via partners like Circle), is positioning FIS to capture a growing share of global transaction volumes and capitalize on the continuing move toward cashless societies. This is likely to drive higher recurring revenue growth.

What is powering such a robust valuation jump? The narrative is built around bold growth projections, industry-shifting technology, and a financial formula that is rare outside of top tech stocks. Find out which future targets and ambitious assumptions shape this consensus narrative.

Result: Fair Value of $81.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some caution remains, as ongoing fintech competition and integration challenges could quickly shift the outlook and dampen long-term profit growth for FIS.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Looking Beyond Analyst Estimates

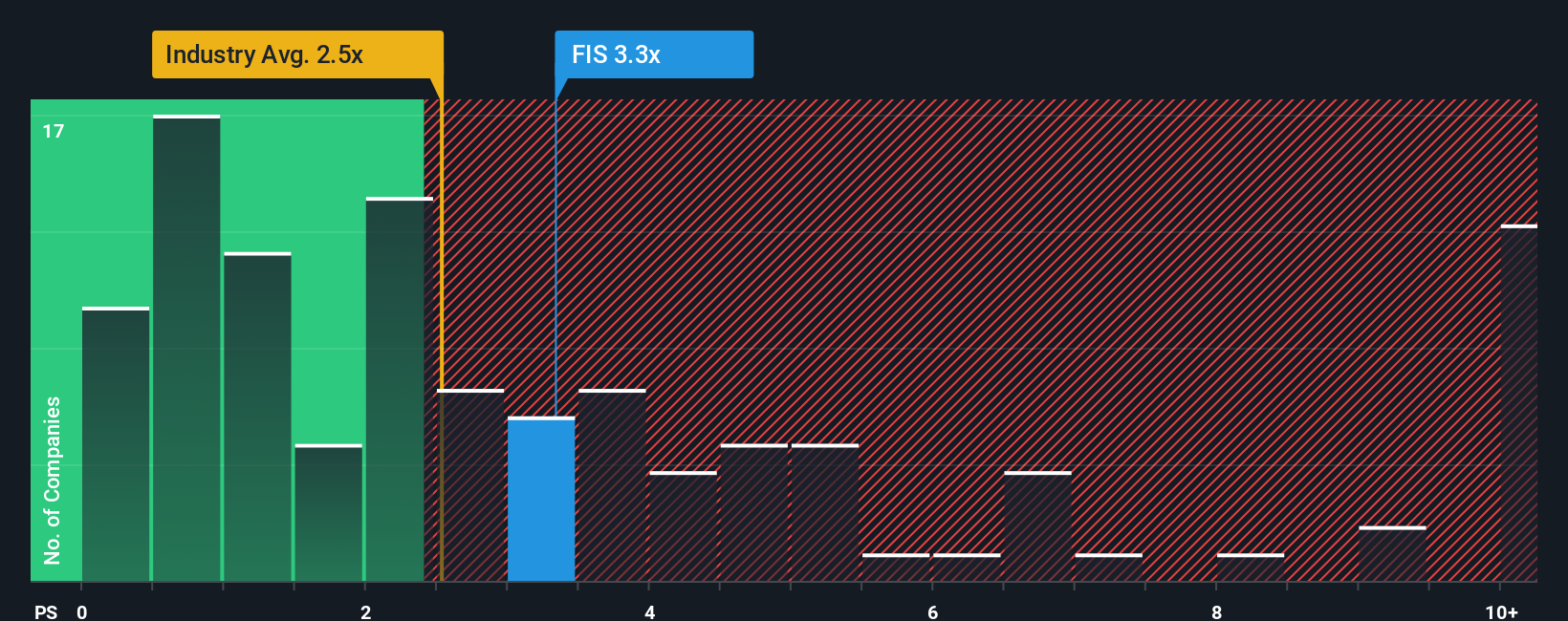

While the consensus narrative sees Fidelity National Information Services as undervalued, a look at the company's revenue-based valuation tells a different story. FIS trades at 3.3 times sales, which is higher than both peer (2.4x) and industry (2.5x) averages. This premium suggests the market is already expecting outsized growth. With the fair ratio sitting at 3x, any disappointment in future results could mean notable downside for investors. Which method paints the more accurate picture—is the premium justified, or does it flag a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If you see Fidelity National Information Services differently or want to shape your own outlook, you can easily build your own narrative in minutes, Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas? Act Now

Stay a step ahead and don’t miss market-shaping opportunities that others overlook. Use these handpicked screeners to unlock untapped potential and update your watchlist with tomorrow’s performers today:

- Capture steady income streams by selecting from these 100+ dividend stocks with yields > 3%, which offers yields above 3 percent and features strong dividend histories.

- Harness breakthroughs in artificial intelligence by targeting these 26 AI penny stocks, which are fueling major shifts across entire industries.

- Tap into value that’s under the radar by targeting these 876 undervalued stocks based on cash flows, based on rigorous cash flow analysis and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives