- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Fidelity National Information Services (FIS): Evaluating Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

Fidelity National Information Services (FIS) shares have quietly edged higher this month, rising about 6%. The stock remains well below its three-year highs. This has prompted some investors to reexamine its current valuation and future prospects.

See our latest analysis for Fidelity National Information Services.

While Fidelity National Information Services has rebounded with a 5.5% share price return over the past month, the momentum comes after a tough stretch, as its one-year total shareholder return still sits at -23.9%. The stock’s recent lift suggests that investors may be testing the waters again after a prolonged decline. However, its long-term performance indicates that meaningful improvement will take time.

If you’re open to finding dynamic opportunities beyond large financials, now is a good time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares lingering well below prior peaks despite a recent uptick, the big question emerges: Is Fidelity National Information Services trading at an attractive discount, or is the market already factoring in any turnaround potential?

Most Popular Narrative: 19.7% Undervalued

With Fidelity National Information Services closing at $67.79, the most widely followed narrative sets fair value at $84.39, reflecting a notable premium to the latest trading price. Investors are taking notice as analyst consensus suggests the potential for meaningful upside, dependent on key financial catalysts coming to fruition.

Execution of operational simplification (for example, Worldpay divestiture, focused acquisitions like Everlink and Global Payments Issuer), strong cost reduction programs, and improved working capital management are expected to lower operating expenses and drive EBITDA margin expansion, supporting higher future earnings.

What game-changing assumptions power this bullish target? There is a bold earnings growth trajectory and a margin leap that could rewrite the company's profit story. Which expectations really drive the gap between share price and fair value? If you're curious how these forecasts stack up, you'll want to see the specifics driving this valuation.

Result: Fair Value of $84.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fintech competition and integration challenges from recent deals could still act as headwinds. These factors may potentially disrupt FIS’s improving outlook.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Multiples Send a Different Signal

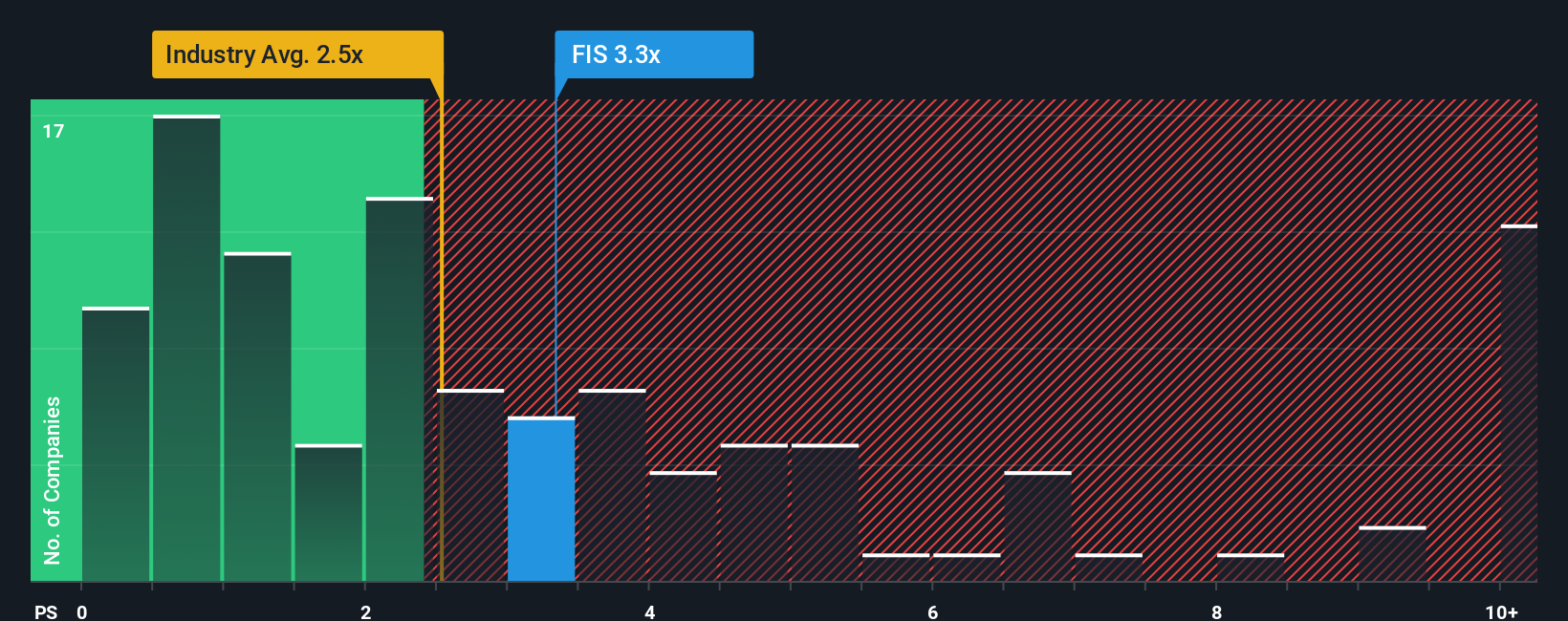

Not all valuation models point in the same direction. Based on the price-to-sales ratio, Fidelity National Information Services trades at 3.4x, which is higher than the Diversified Financial industry average of 2.5x and above its peer average of 2.8x. Even our research suggests a fair ratio of 3.2x, meaning the stock currently commands a premium. This signals caution, as the market might already be pricing in much of the turnaround story. Could this premium make upside harder to capture, or does it show lasting confidence in FIS?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If the current perspective doesn’t quite fit your own, or you’d rather dig into the numbers and build your own story, you’re free to shape a custom view in under three minutes with Do it your way

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting on the sidelines when game-changing stocks are just a click away. Uncover investment trends that could shape your next winning move. Be first, not last.

- Fuel your portfolio with high potential by tapping into these 873 undervalued stocks based on cash flows that have impressive cash flow metrics and could be poised for a breakout.

- Capture steady income streams when you access these 17 dividend stocks with yields > 3%, featuring companies offering consistent yields greater than 3%.

- Tap into innovation’s hottest corner as you follow these 27 AI penny stocks transforming industries and setting new performance standards with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives