- United States

- /

- Diversified Financial

- /

- NYSE:FIS

A Look at Fidelity National Information Services (FIS) Valuation Following Smart Basket Product Launch and Earnings Optimism

Reviewed by Kshitija Bhandaru

Fidelity National Information Services (FIS) is making headlines after introducing its upcoming Smart Basket solution. The solution aims to overhaul the checkout experience with real-time analytics and personalized rewards for shoppers. Investors are watching closely as new earnings approach.

See our latest analysis for Fidelity National Information Services.

The launch of Smart Basket is the latest in a line of strategic moves by FIS, following upbeat earnings and persistent analyst optimism. Despite these efforts, the company’s share price has struggled. After a tough year with a 1-year total shareholder return of -24.73% and a pronounced year-to-date share price drop, momentum remains weak. Still, new product innovation and recent insider buying hint that the market may be watching for a longer-term turnaround.

If you’re scanning the market for companies with the potential to surprise, now's a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets and Smart Basket positioned to potentially reshape FIS’s outlook, the question remains: is now the time to buy before the next growth phase, or has the market already factored it in?

Most Popular Narrative: 20.8% Undervalued

With a fair value estimate sitting at $84.39, well above the last close of $66.85, the leading narrative suggests meaningful upside remains. The latest forecast points to strong future growth expectations driving this target.

Increasing client demand for cloud-based and AI-powered fintech solutions, such as the launch of TreasuryGPT and Banker Assist, is allowing FIS to upsell higher-value, "stickier" products to financial institutions modernizing their operations. This should support long-term revenue expansion and improved net margins.

Want to know what’s really fueling that bullish outlook? This valuation hangs on aggressive margin improvements and an earnings leap tied to rapid tech adoption. Curious what number-crunching and scenarios push fair value this high? Find out which bold projections are driving the narrative.

Result: Fair Value of $84.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges and rising fintech competition could still threaten FIS’s expected margin gains and long-term growth outlook.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Multiples Tell a Different Story

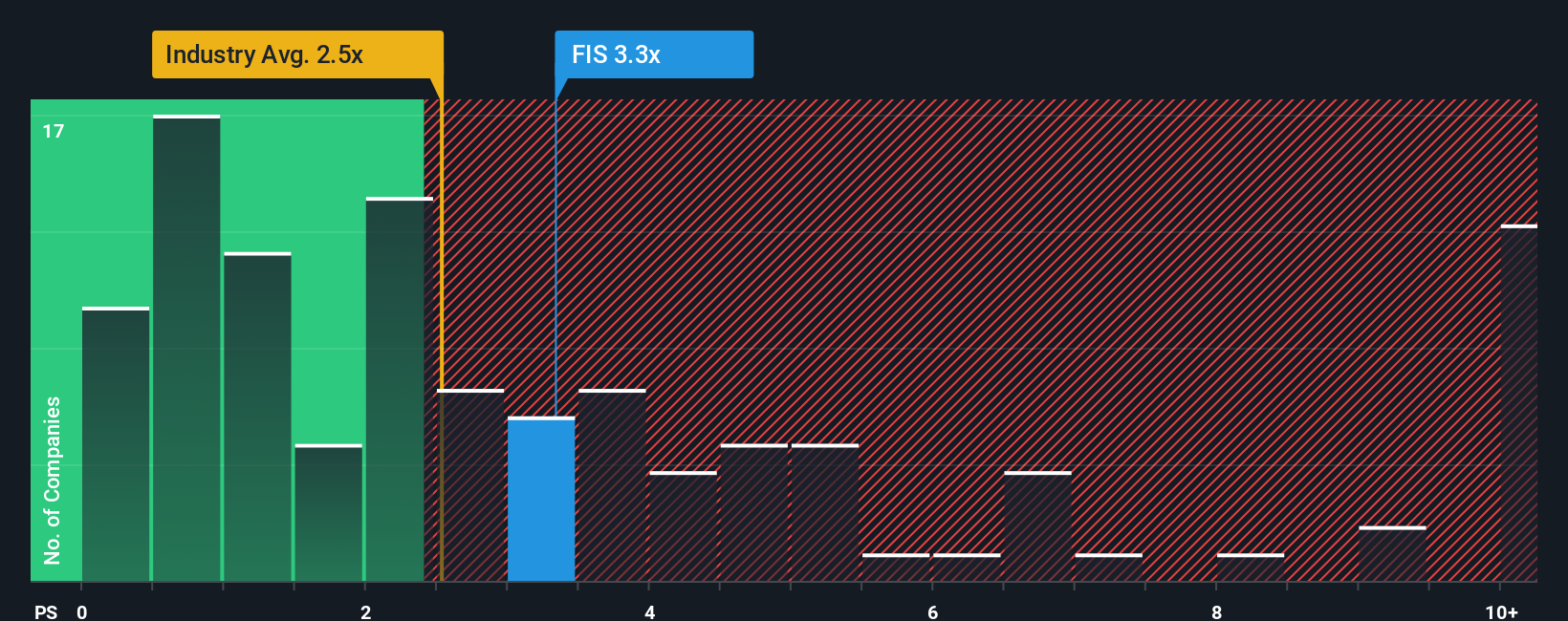

Looking through the lens of price-to-sales, Fidelity National Information Services trades at 3.4x, noticeably above both its industry average of 2.5x and its peer average of 2.7x. Even compared to the fair ratio of 3.2x, the gap hints at richer pricing and leaves less margin for error in buyer expectations. Is this premium justified or a warning to pause?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If you have a different take on what the numbers mean or want to dig into the details on your own terms, you can craft a fresh perspective in just minutes. Do it your way

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t stop at just one opportunity. Expand your approach and get ahead of market trends with hand-picked stock ideas you can act on right now.

- Capture the next wave of artificial intelligence breakthroughs by checking out these 24 AI penny stocks poised for explosive growth.

- Maximize your upside in today’s market with these 871 undervalued stocks based on cash flows that offer strong fundamentals and attractive pricing.

- Start building wealth with consistent payouts by targeting these 18 dividend stocks with yields > 3% that deliver reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives