- United States

- /

- Consumer Finance

- /

- NYSE:FINV

FinVolution Group (FINV) Is Down 8.0% After Surging International Revenues and New 2025 Guidance – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- FinVolution Group recently reported its third quarter 2025 earnings, with revenue rising to CNY 3.49 billion and net income at CNY 624 million, alongside updated full-year revenue guidance in the range of CNY 13.1–13.7 billion.

- A key highlight is the company’s sustained international expansion, where international revenues now make up a quarter of total revenue and transaction volumes surged by a very large percentage year-over-year.

- We’ll examine how FinVolution’s strong international growth shapes its investment narrative amid shifting guidance and diversification efforts.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

FinVolution Group Investment Narrative Recap

To own FinVolution Group as a shareholder, you need to believe in its ability to deliver sustained international growth and diversify beyond China’s shifting regulatory environment. The recent Q3 results, with international revenues now 25% of the total and updated guidance signaling moderate full-year growth, reinforce the short-term catalyst of international expansion, while the biggest risk, exposure to ongoing regulatory changes in China, remains present but unchanged by this announcement.

The most relevant recent announcement is the company’s revised full-year revenue guidance to CNY 13.1 billion–13.7 billion, reflecting a more conservative growth outlook than previous quarters. This aligns closely with the Q3 update, reinforcing that near-term results are being shaped by both successful international momentum and a more cautious approach to domestic growth amid regulatory pressures.

However, investors should be aware that China’s regulatory environment could still quickly shift and ...

Read the full narrative on FinVolution Group (it's free!)

FinVolution Group's outlook anticipates CN¥18.1 billion in revenue and CN¥3.7 billion in earnings by 2028. This is based on a 9.5% annual revenue growth rate and a CN¥0.9 billion increase in earnings from the current CN¥2.8 billion.

Uncover how FinVolution Group's forecasts yield a $11.34 fair value, a 105% upside to its current price.

Exploring Other Perspectives

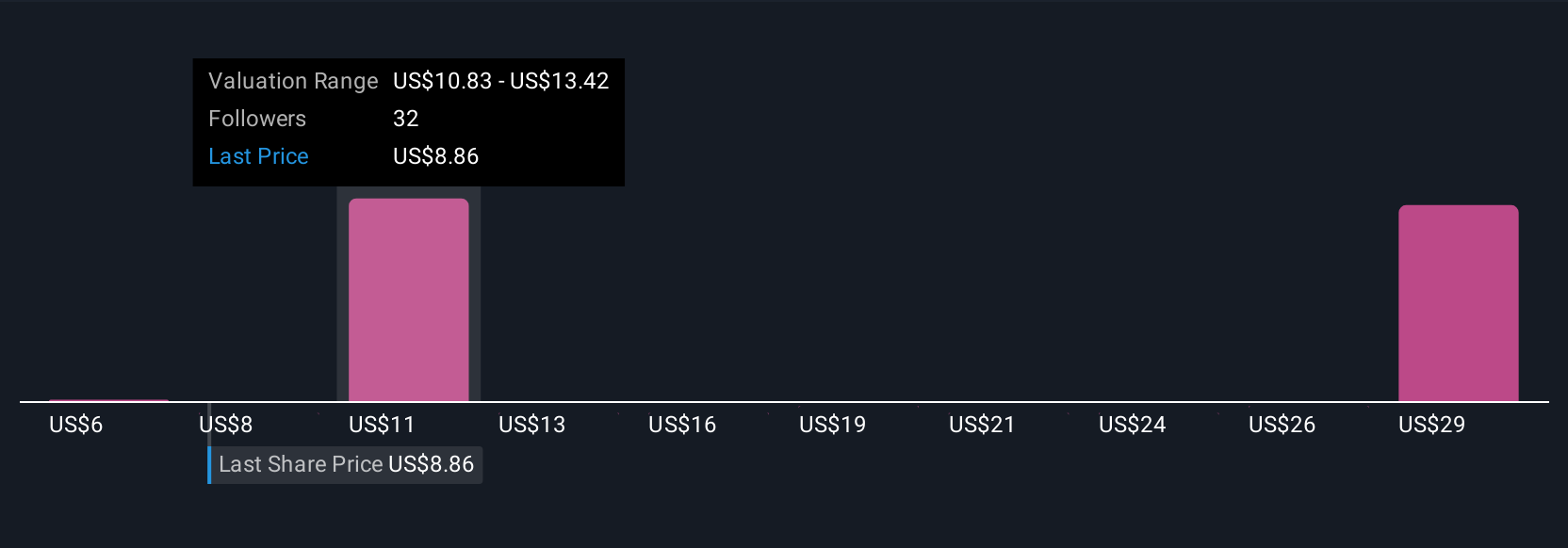

Simply Wall St Community members offered a wide range of fair value estimates for FinVolution, from CNY 8.91 to CNY 26.92, across 12 perspectives. While many see deep undervaluation, the company’s reliance on robust international momentum will shape near-term results and could affect future outcomes if market conditions shift unexpectedly.

Explore 12 other fair value estimates on FinVolution Group - why the stock might be worth over 4x more than the current price!

Build Your Own FinVolution Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FinVolution Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FinVolution Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FinVolution Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FINV

FinVolution Group

An investment holding company, operates in the online consumer finance industry in the People’s Republic of China, Indonesia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives