- United States

- /

- Diversified Financial

- /

- NYSE:FI

Should Fiserv’s (FI) Stablecoin Ambitions and Analyst Shifts Change Investors’ Approach?

Reviewed by Sasha Jovanovic

- In recent days, prominent analysts adjusted their ratings and outlooks on Fiserv, while the company announced new plans to launch its own stablecoins and further integrate digital currencies into its payment infrastructure.

- This move signals Fiserv's commitment to financial technology innovation and reflects shifting industry sentiment as traditional payments increasingly converge with digital assets.

- We'll explore how Fiserv's digital currency initiatives and evolving analyst sentiment could influence its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Fiserv Investment Narrative Recap

To be a Fiserv shareholder today, you need confidence in the company’s ability to adapt quickly as digital payments rapidly evolve, while managing risks from execution delays and intensified competition. The recent wave of analyst rating adjustments, which featured several price target reductions, does not materially affect the company’s primary short-term catalyst, growing adoption of its next-generation platforms, but it does highlight lingering concerns about Fiserv’s capacity to launch new products on time, which remains the biggest risk.

Among the recent headlines, the announcement of Fiserv’s upcoming stablecoin launches, Roughrider coin and FIUSD, stands out as most relevant, reflecting the company's continued push to modernize financial infrastructure and capture growth in digital asset payments. These developments are poised to support the company’s broader integration efforts and could enhance its appeal as a partner for both traditional financial institutions and newer players, aligning with key growth catalysts such as Clover’s international expansion and the company’s broadening fintech ecosystem.

But against these digital advances, investors should also be aware of the challenges posed by execution delays and what that means for...

Read the full narrative on Fiserv (it's free!)

Fiserv's outlook anticipates $24.7 billion in revenue and $5.9 billion in earnings by 2028. This calls for 5.4% annual revenue growth and a $2.5 billion increase in earnings from the current $3.4 billion.

Uncover how Fiserv's forecasts yield a $178.38 fair value, a 43% upside to its current price.

Exploring Other Perspectives

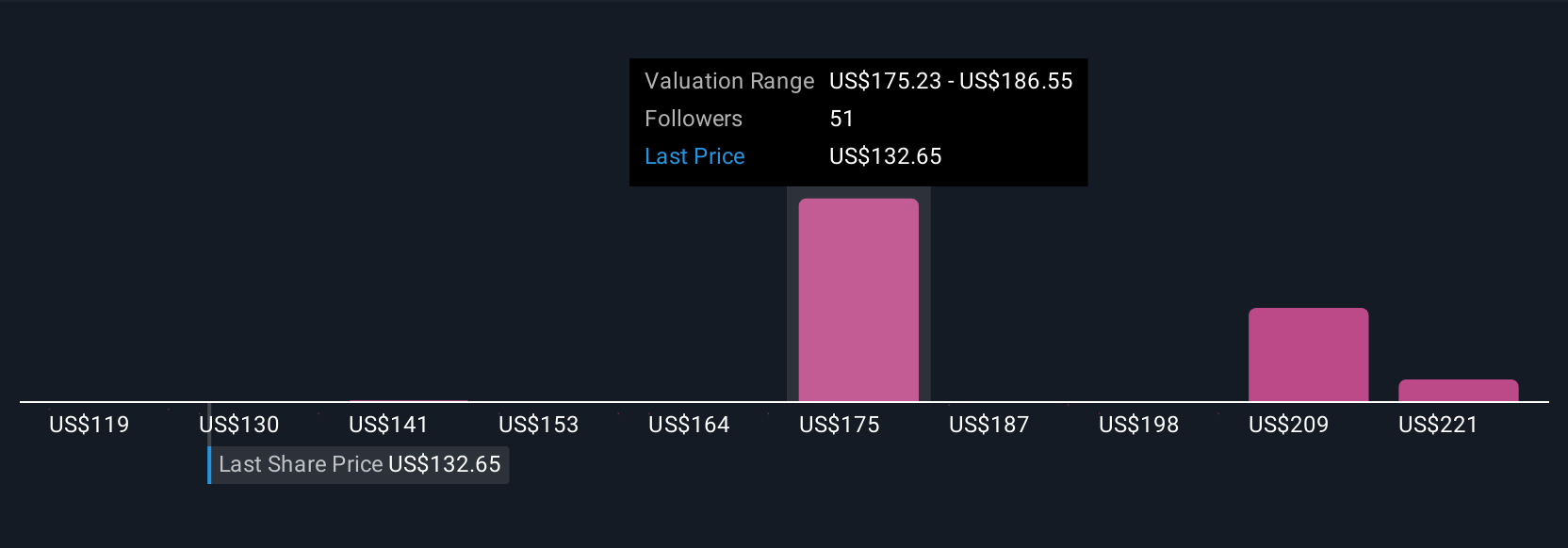

Fourteen individual estimates from the Simply Wall St Community see Fiserv's fair value range from US$135.23 to US$231.84. With new stablecoin moves and analyst revisions in play, it is clear that market participants view the company's future very differently, explore these diverse viewpoints before deciding your next step.

Explore 14 other fair value estimates on Fiserv - why the stock might be worth just $135.23!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives