- United States

- /

- Capital Markets

- /

- NYSE:FDS

Does FactSet’s Margin Compression Signal a Trade-Off Between Growth and Profitability for FDS Investors?

Reviewed by Sasha Jovanovic

- FactSet Research Systems recently posted mixed quarterly results, with revenue rising 6.2% year-over-year to surpass estimates, but adjusted operating margin slipped and adjusted EPS fell short of analyst forecasts.

- Despite revenue growth, margin pressure and earnings misses have contributed to more cautious analyst sentiment, reflected in a consensus Hold rating and only modest expectations for the coming year.

- We’ll examine how FactSet’s declining operating margins impact its investment narrative given ongoing efforts to expand its platform and product offerings.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

FactSet Research Systems Investment Narrative Recap

To be a FactSet shareholder right now, you have to believe the company's efforts to expand its platform and launch new AI-powered products will outweigh pressures on operating margins and earnings. The latest mixed results highlight a tension for investors: while revenue is still climbing, profit margins are slipping, which could weigh on the short-term outlook. For now, these factors reinforce that persistent cost increases and sector-specific headwinds remain the main risks, while the success of platform enhancements is the key catalyst to watch.

Among recent announcements, FactSet's integration with Macrobond is especially relevant, broadening access to FactSet datasets for institutional users. This move underscores the company's focus on expanding product offerings and capturing more enterprise clients, which is directly related to the catalyst of increasing market adoption and incremental revenue growth.

But while product advances generate optimism, investors should also be alert to the risk of sustained margin pressure from...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' outlook anticipates $2.7 billion in revenue and $730.7 million in earnings by 2028. This projection is based on a 5.7% annual revenue growth rate and a $197.8 million increase in earnings from the current $532.9 million.

Uncover how FactSet Research Systems' forecasts yield a $335.94 fair value, a 21% upside to its current price.

Exploring Other Perspectives

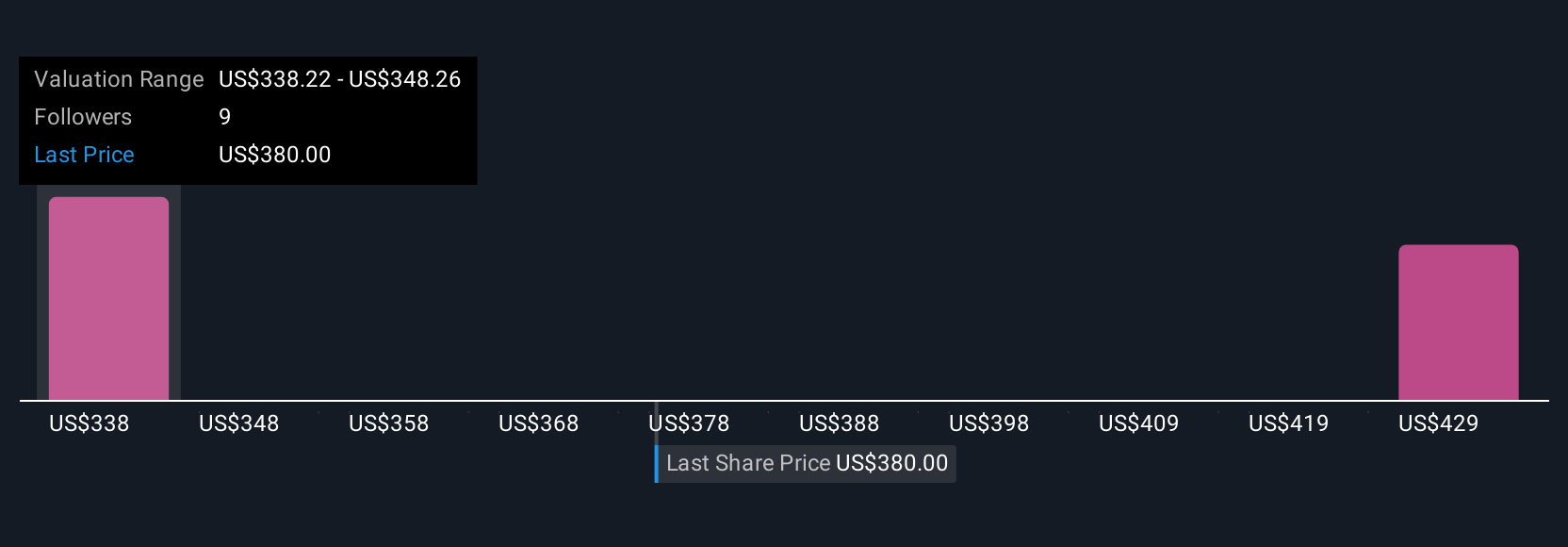

Three different fair value estimates from the Simply Wall St Community range between US$276.99 and US$336.68, underscoring differing user expectations for FactSet’s upside. With rising technology costs putting pressure on margins, broader market opinions highlight why it pays to compare multiple viewpoints before making a call.

Explore 3 other fair value estimates on FactSet Research Systems - why the stock might be worth just $276.99!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success