- United States

- /

- Diversified Financial

- /

- NYSE:EVTC

Should EVERTEC's (EVTC) Leadership Shuffle Signal a Strategic Pivot or Reinforce Its Expansion Ambitions?

Reviewed by Sasha Jovanovic

- On September 29, 2025, EVERTEC, Inc. announced the appointment of Joaquin Castrillo as Senior Executive Vice President and COO, Karla Cruz-Jusino as CFO, Diego Viglianco as CIO, and Cruz-Jusino also as Executive Vice President and Treasurer, all effective November 1, 2025.

- This significant reshuffling assigns top leadership positions to experienced internal candidates, reflecting an emphasis on continuity and internal talent development during a period of business expansion.

- We'll examine how the appointment of a new CFO and COO could influence EVERTEC's investment outlook and operational execution.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

EVERTEC Investment Narrative Recap

Being a shareholder in EVERTEC requires confidence in the company’s ability to expand digital payments across Latin America, while managing institutional client concentration and regional risks. The leadership changes announced on September 29, 2025, bring experienced internal candidates into pivotal operational and financial roles. These appointments are not expected to materially shift the most important near-term catalyst, sustained transaction volume growth, nor do they alter the concentration risk tied to large clients like Popular, Inc.

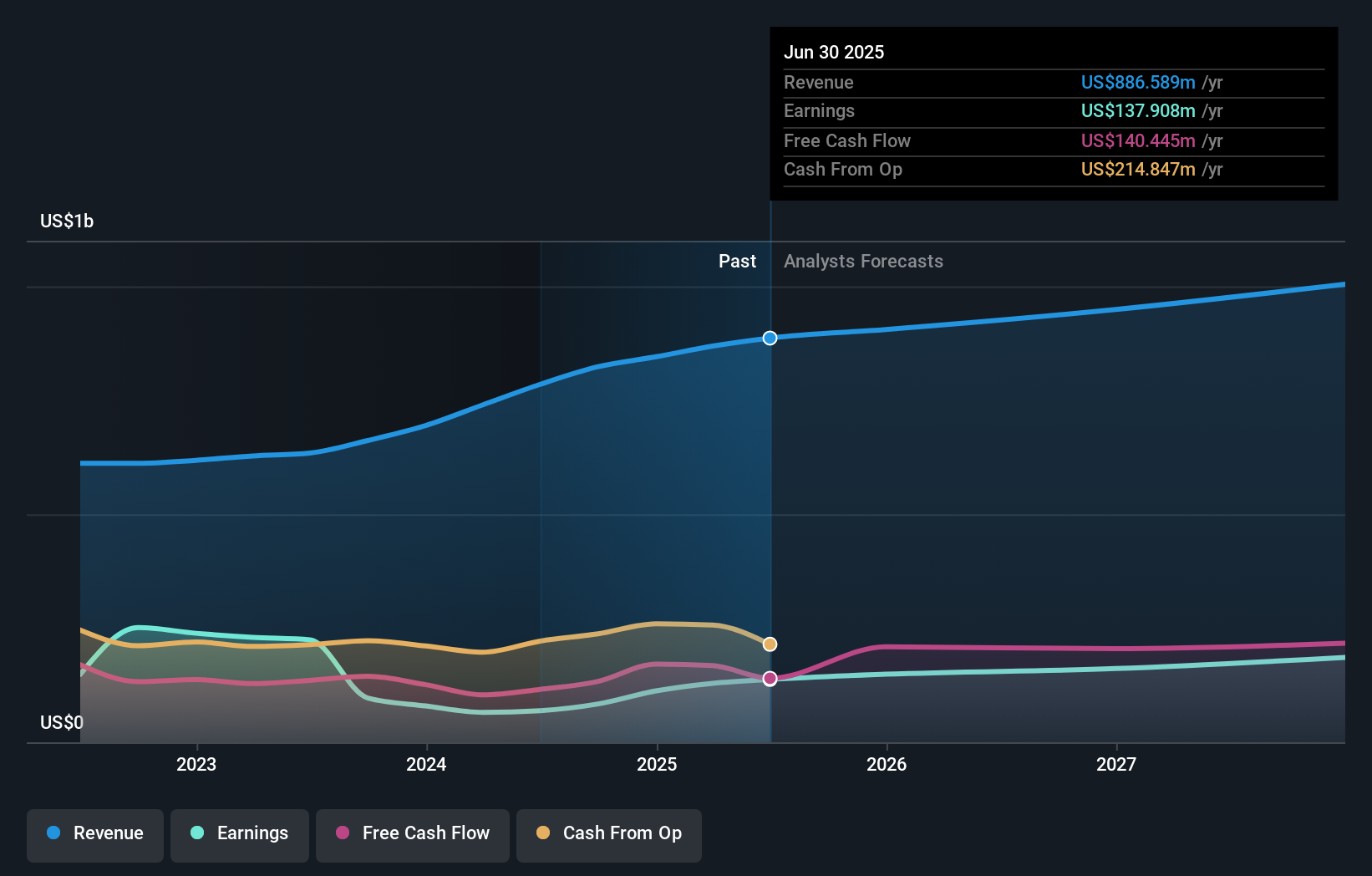

Among recent developments, EVERTEC’s raised 2025 revenue guidance to US$889 million–US$897 million stands out. This updated outlook reflects ongoing strength in digital payments and volume growth, anchoring investor focus on operational execution rather than any broad shift in strategy tied to leadership changes.

But investors should also recognize the flip side: if further contract renegotiations with large clients occur, especially Popular, it could abruptly impact revenue and earnings stability...

Read the full narrative on EVERTEC (it's free!)

EVERTEC's outlook forecasts $1.0 billion in revenue and $193.8 million in earnings by 2028. This implies 5.0% annual revenue growth and a $55.9 million increase in earnings from current earnings of $137.9 million.

Uncover how EVERTEC's forecasts yield a $38.60 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate EVERTEC’s fair value between US$33.04 and US$55.43 per share, suggesting a wide spectrum of views. While opinions differ, some participants focus on the importance of contract stability with major clients when weighing long-term performance.

Explore 3 other fair value estimates on EVERTEC - why the stock might be worth as much as 78% more than the current price!

Build Your Own EVERTEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EVERTEC research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EVERTEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EVERTEC's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVERTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVTC

EVERTEC

Provides transaction processing and financial technology services in Latin America, Puerto Rico, and the Caribbean.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026