- United States

- /

- Capital Markets

- /

- NYSE:EVR

Will Evercore’s (EVR) New Transportation Hires Reshape Its Competitive Position in Investment Banking?

Reviewed by Sasha Jovanovic

- Earlier this month, Evercore announced the addition of Keith Prusek and Hugh Rabb as senior managing directors in its transportation investment banking group, coinciding with the opening of a new office in Richmond, Virginia.

- This move highlights Evercore’s intent to deepen its capabilities in transportation and logistics advisory by bringing aboard leadership with significant sector experience and expanding its national footprint.

- We'll explore how expanding Evercore's senior talent base in transportation could influence its broader investment banking growth narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Evercore Investment Narrative Recap

To believe in Evercore as a shareholder today, you need confidence that ongoing investments in new talent and a broader US footprint will support long-term advisory growth, even if short-term M&A market cycles are unpredictable. The recent addition of experienced transportation bankers in Richmond enhances sector expertise, but is unlikely to materially shift the most immediate catalyst, robust deal volume, or address the main risk of rising non-compensation and compensation costs outpacing revenue if M&A activity slows.

Among recent announcements, the planned acquisition of Robey Warshaw stands out, as it broadens Evercore’s European reach and client base. This aligns directly with the ongoing catalyst of international expansion, which, together with increased US sector coverage, offers greater revenue diversity to help balance cyclical volatility.

In contrast, investors should also keep in mind the risk that fixed costs from ongoing expansions and high compensation ratios may pressure margins if revenue growth loses momentum...

Read the full narrative on Evercore (it's free!)

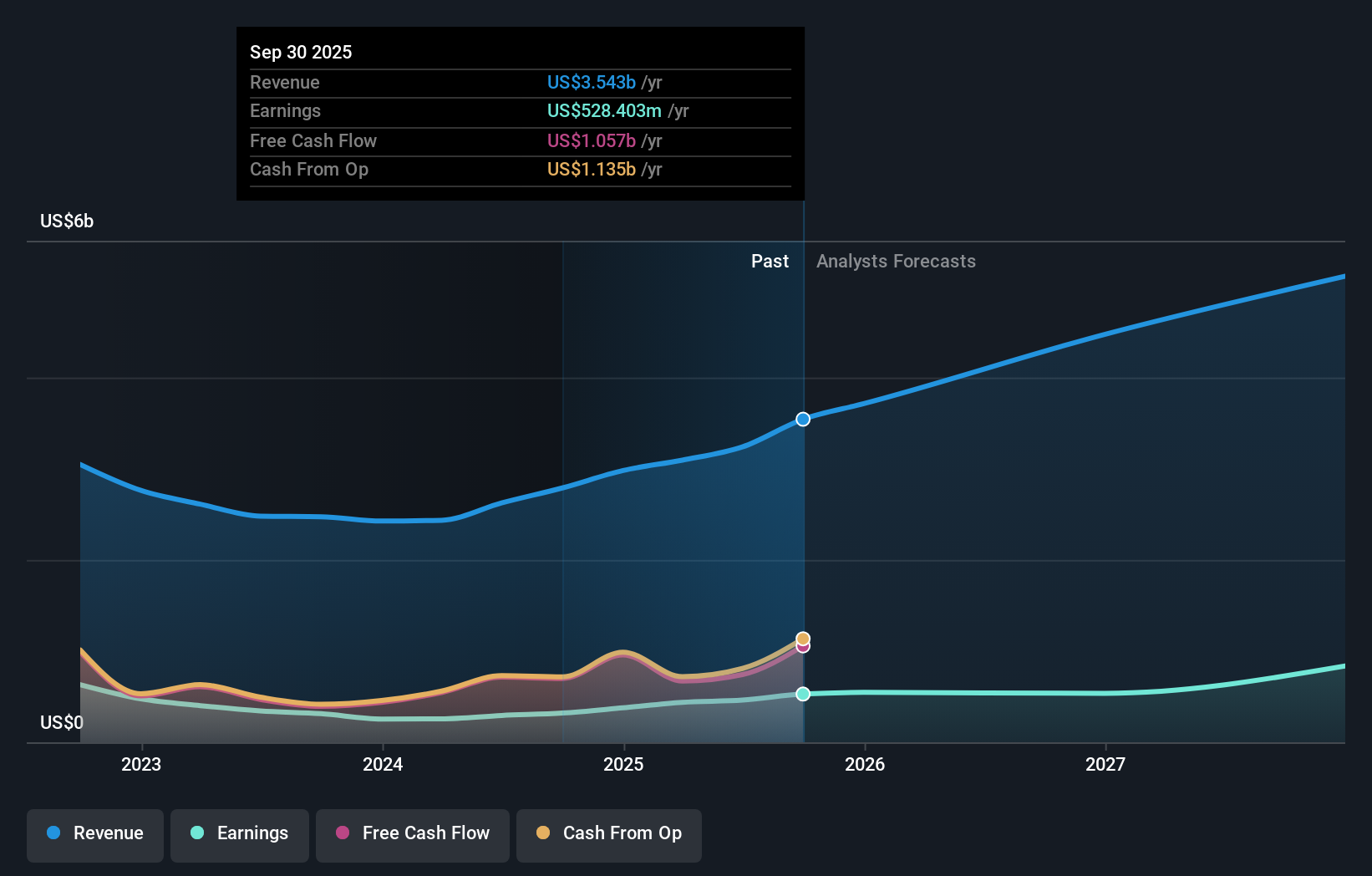

Evercore's outlook projects $5.4 billion in revenue and $953.1 million in earnings by 2028. This requires 18.7% yearly revenue growth and a $490.9 million increase in earnings from the current $462.2 million.

Uncover how Evercore's forecasts yield a $355.88 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community see Evercore's fair value between US$229.73 and US$365 per share, revealing significant divergences amid only a handful of opinions. This wide range comes as continued investment in global expansion and sector expertise may provide new avenues for growth, but also raises questions on sustained margin strength, explore what other investors are projecting and why these outlooks differ.

Explore 3 other fair value estimates on Evercore - why the stock might be worth 25% less than the current price!

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives