- United States

- /

- Capital Markets

- /

- NYSE:EVR

Should You Reconsider Evercore After Shares Rally 350% in Five Years?

Reviewed by Bailey Pemberton

Thinking about what to do with Evercore stock right now? You’re definitely not alone. With shares closing at $324.24, many investors are looking for reasons to either hold, buy more, or lock in some impressive long-term gains. It’s been a bit of a rollercoaster: the last week brought a 2.9% bump, clawing back after a tougher 30 days that saw a dip of 5.3%. Take a step back, though, and Evercore’s long-term trajectory is hard to ignore, rocketing over 350% in the past five years and posting a strong 17.4% gain year-to-date. In short, anyone who committed early has seen major rewards, and even recent shareholders are ahead by 26% over the past year.

Recent headlines hint at why the stock has maintained its upward momentum. Evercore’s growing influence in high-profile M&A deals, along with its reputation for boutique expertise, have helped fuel investor optimism about its growth strategy. While the news cycle hasn’t highlighted any one event driving short-term price moves, an overall uptick in dealmaking activity and recurring mentions of Evercore as an industry leader seem to reinforce faith in the company’s long-term potential, even as market sentiment wavers.

But here is the number everyone’s waiting for: Evercore scores a 0 on a composite valuation check, indicating it isn’t deemed undervalued by any of the standard metrics right now. So, is that the whole story? Not even close. Let’s break down what goes into that valuation score, and explore the strengths and limitations of the usual approaches. Stick around, because there’s an even sharper lens for understanding what Evercore’s price really means for investors.

Evercore scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Evercore Excess Returns Analysis

The Excess Returns model evaluates a stock's intrinsic value by looking beyond basic accounting profits and instead focusing on how much return the company generates above its true cost of equity. In Evercore’s case, this approach centers on measuring whether the company is consistently producing profits that outpace the minimum required return. This offers insight into its ability to create shareholder value over time.

For Evercore, the metrics are notable. The company’s Book Value is $42.88 per share, while its Stable EPS stands at $13.39, derived from a median return on equity of 24.20% over the past five years. The estimated Cost of Equity is $4.56 per share, meaning Evercore delivers an Excess Return of $8.83 per share. Analyst projections see the Stable Book Value rising to $55.33 per share in the future, which bolsters confidence that Evercore's competitive advantages and disciplined capital allocation could be sustainable.

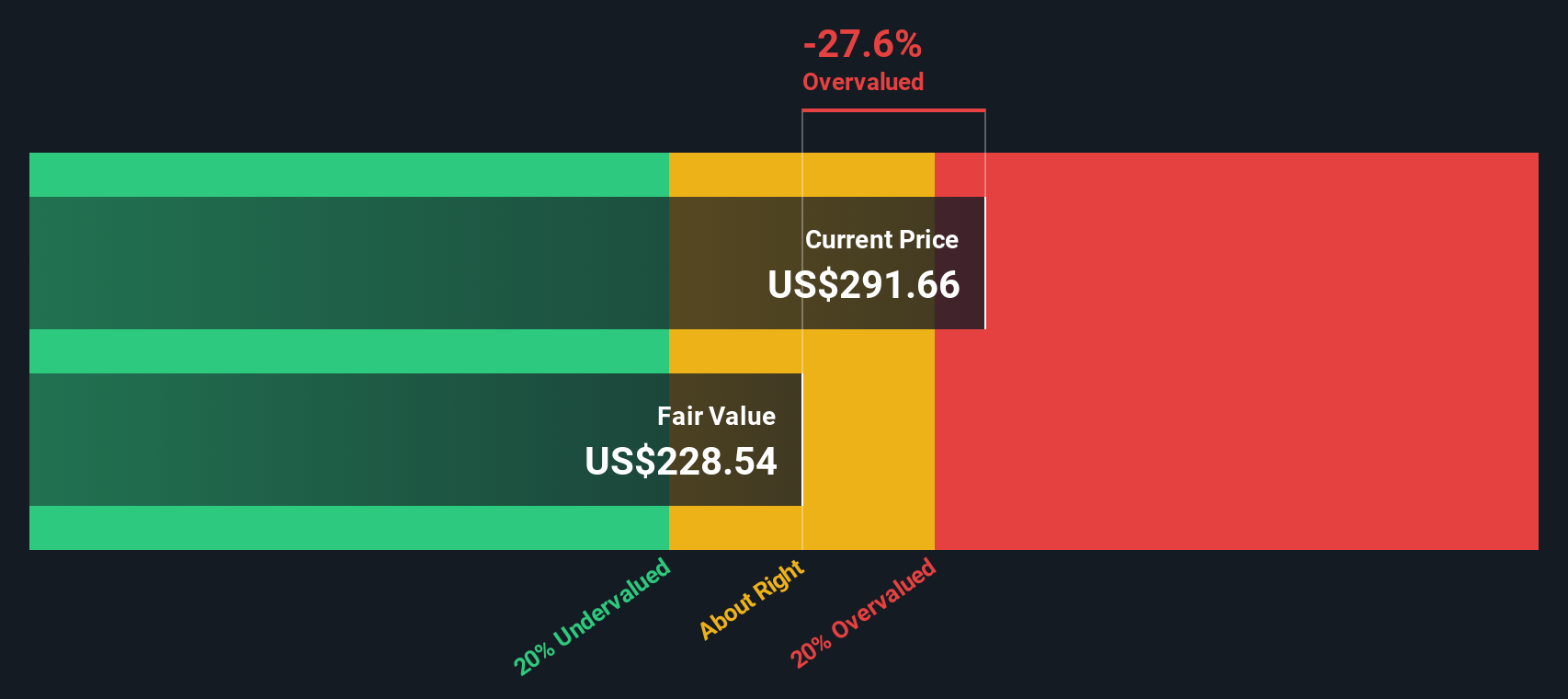

However, the model’s math leads to a caution sign: the estimated intrinsic value based on Excess Returns is 43.1% below the current share price. This suggests Evercore stock is strongly overvalued using this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Evercore may be overvalued by 43.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Evercore Price vs Earnings

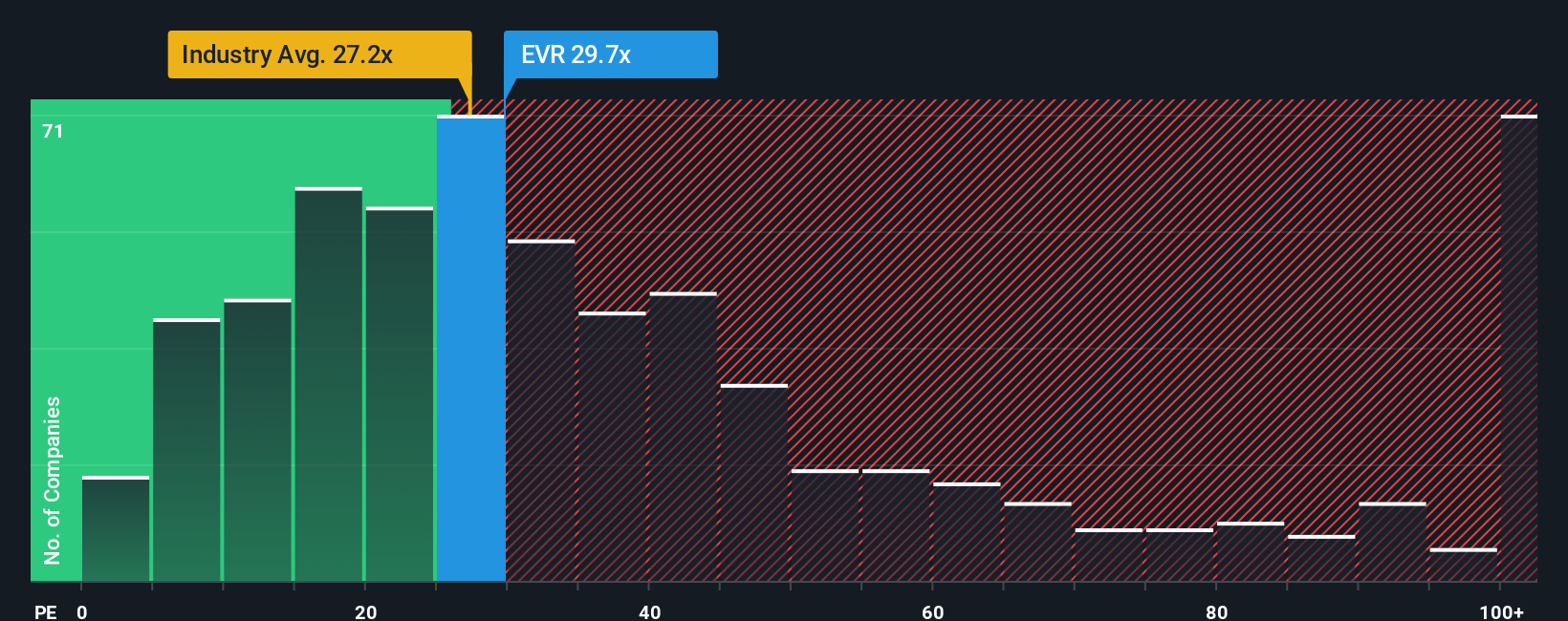

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like Evercore, as it directly relates the price investors are willing to pay for each dollar of company earnings. Profitable businesses are typically valued on this basis because it efficiently reflects both the company’s ability to generate profit and investor sentiment about its future prospects.

What constitutes a “normal” or “fair” PE ratio can shift depending on expectations for earnings growth and the risks tied to a company’s business. Higher growth tends to justify a higher PE, while increased risk might push the fair value ratio downward. In Evercore’s case, the current PE ratio sits at 27.08x. For comparison, this is just above the Capital Markets industry average of 26.56x and notably above the peer average of 20.47x, signaling the market recognizes Evercore’s strong earnings power but may also be factoring in higher growth expectations or quality.

Simply Wall St uses a proprietary “Fair Ratio” to go beyond basic peer or industry comparison. This metric considers not only earnings growth and risks, but also factors like the company’s profit margin, market cap, and competitive position. In Evercore’s instance, the Fair Ratio is 17.41x. This offers a more holistic, tailored benchmark that better reflects what multiple Evercore would realistically deserve relative to its peers and the broader industry.

With Evercore’s current PE at 27.08x and the Fair Ratio at 17.41x, the stock appears to be priced well above the level justified by its fundamentals and prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Evercore Narrative

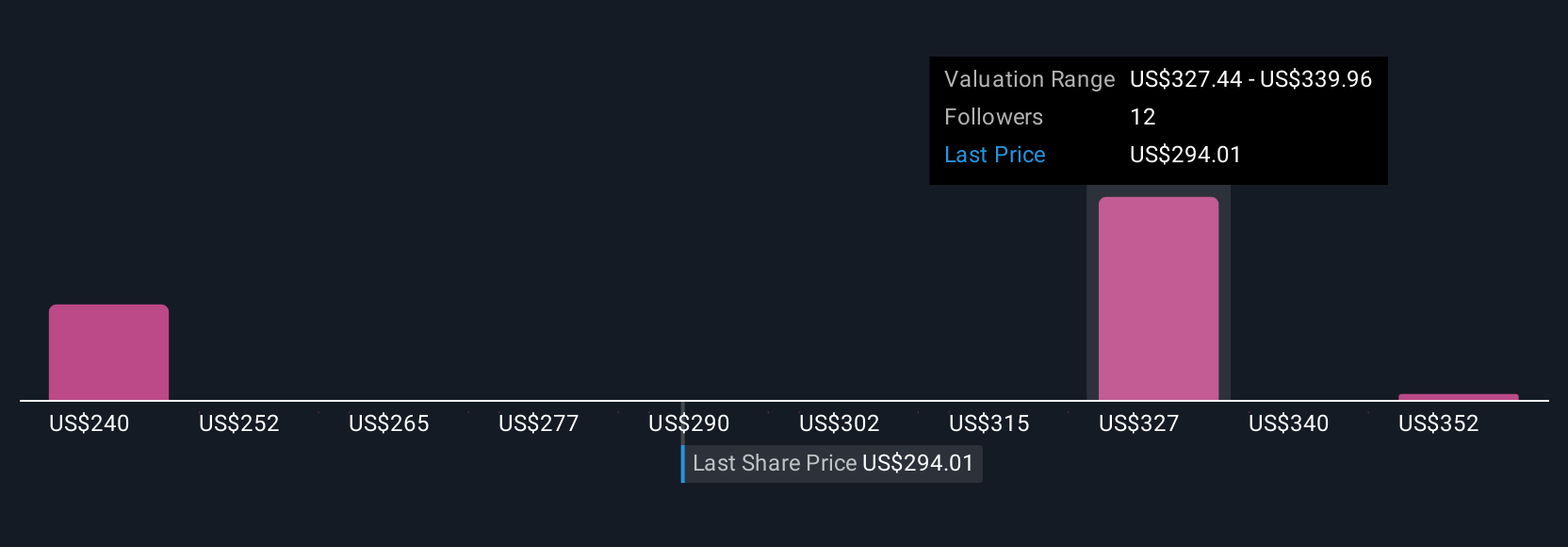

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your own story about a company. It connects what you believe about Evercore’s future (like revenue and profit growth, business strengths, and risks) with actual financial forecasts to arrive at a fair value that matches your outlook.

Narratives let you move beyond static numbers and formulas, combining your perspective with real-world events and forward-looking estimates. As you update your view, whether because of a major deal, news, or new earnings, your Narrative automatically refreshes to reflect the latest facts.

On Simply Wall St’s Community page, millions of investors are already sharing and debating Narratives every day, using this tool to sense-check their predictions and compare with others. Narratives are practical and accessible for all investors; you just choose your assumptions and get an instant fair value, which you can weigh against the current market price to help guide your buy or sell decision.

For example, some investors see Evercore capitalizing on its new international acquisitions, projecting a fair value above $378 per share. Those more cautious about competition and costs enter more conservative forecasts, resulting in a lower estimate. Narratives make your investment decision personal, dynamic, and better informed.

Do you think there's more to the story for Evercore? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives